Where volatility goes, risk often follows.

In today’s increasingly volatile business environment, risk is everywhere. From AI-enabled cyber attackers to increased impacts of climate change and unforeseen geopolitical threats, today’s business leaders have to be ready for anything and everything — and the ongoing volatility shows no signs of slowing. According to Forrester’s most recent Business Risk Survey, 80% of enterprise risk management (ERM) decision-makers say volatility is either increasing (44%) or staying the same (36%). The majority also say that the number of discrete, critical risk events their organization has experienced has either increased (28%) or stayed the same (46%).

It has perhaps never been more important to truly understand risk management and maintain a comprehensive risk management strategy.

What Is Risk Management?

At the highest level, risk management can be defined as a structured process of identifying, assessing, and addressing potential risks that could impact an organization’s strategic objectives and business performance. Not all risk is bad, so effective risk management ensures that organizations can proactively identify potential loss events, seize opportunities, and maintain resilience in a dynamic business environment.

To help businesses navigate volatility and risk with confidence, Forrester has developed the Three E’s Framework to identify and prioritize the three primary sources of risk based on level of control:

1. Enterprise Risk. Enterprise risks are internal risks fully within the organization’s control, such as cybersecurity, financial risks, and internal policies. They arise from the company’s strategy, investments, business model, products, policies, and internal controls, and they are affected by the maturity of its enterprise risk management program. Examples of enterprise risks include data privacy risk, information security risk, financial risk, operational risk, business continuity risk, or insider risk. Because organizations have full control over enterprise risks, they can choose to accept risks within their risk appetite, mitigate risks partially or fully, transfer risks through insurance or contractual means, or reconsider strategic direction to reduce risk.

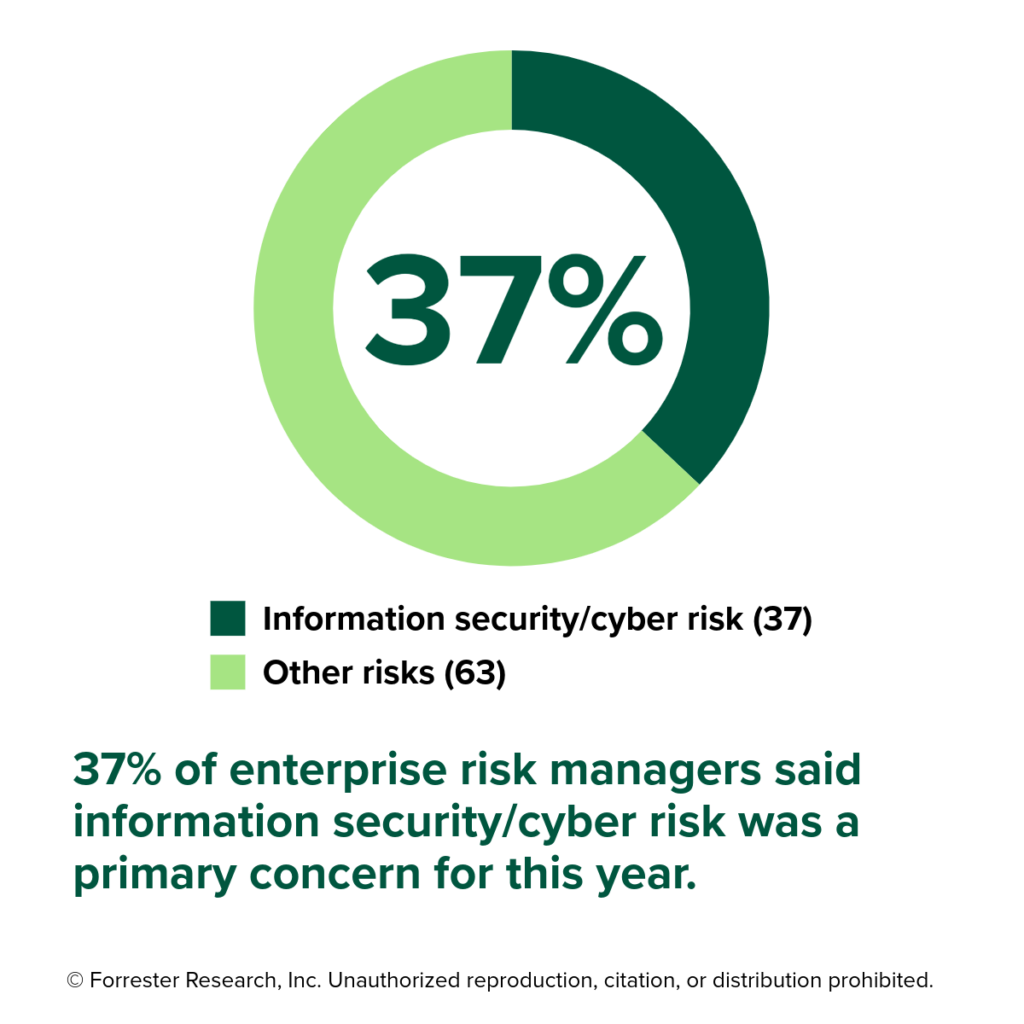

What Are The Top Five Enterprise Risks?

Forrester’s most recent Business Risk Survey found that ERM decision-makers ranked these as the top five enterprise risks they face today:

- Information security/cyber risk

- Financial risk

- AI risk

- Data governance risk

- Operational risk

Source: Forrester’s Business Risk Survey, 2025

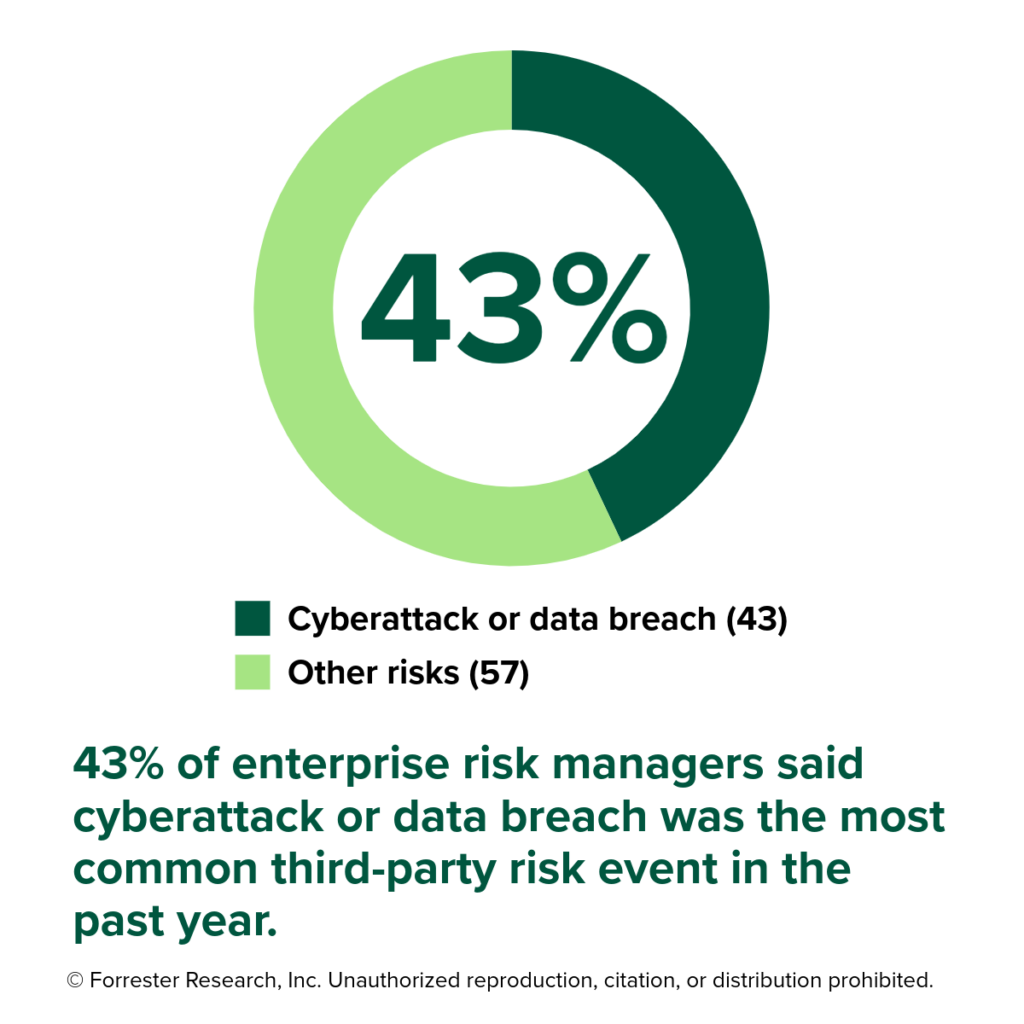

2. Ecosystem Risk. Ecosystem risks are external risks that the organization has partial control over, including third-party relationships, supply chain dynamics, and partnerships. They can stem from suppliers, distributors, technology partners, and other interconnected business relationships. Examples of these risks could include supply chain vulnerabilities, operational disruptions of partners, or technology partner risks. While the organization is fully responsible for these risks, it typically has limited ability to manage them.

3. External Risk. External risks are typically larger, broader risks that are fully outside an organization’s control. Systemic risks are a type of external risk that may be underestimated by the organization because they build gradually over time and are interconnected with enterprise and ecosystem risks. Examples of systemic risks include geopolitical tensions, climate change, and economic uncertainties.

What Are The Top 5 Systemic Risks?

- Data integrity

- Economic uncertainty

- Geopolitical risk

- Speed of innovation

- Climate change

Source: The Top 10 Systemic Risks, 2025

Who Should Lead Risk Management Efforts?

The success of a risk management program depends on its leadership and the level of visibility it has at the top of an organization. Having a clear and empowered leader responsible for risk management can have a direct impact on your organization’s risk exposure. According to Forrester data, enterprises where ERM is not a board-level topic were 20 percentage points more likely to report experiencing six or more critical risk events in the past 12 months than the overall group of respondents. In other words, not making risk management a top priority in your organization opens your organization up to more risk.

According to Forrester data, enterprises where ERM is not a board-level topic were 20 percentage points more likely to report experiencing six or more critical risk events in the past 12 months than the overall group of respondents.

The most direct way to ensure that risk management is a C-suite topic is by creating a C-level role to oversee it. In 2023, 62% of ERM decision-makers polled by Forrester said their organization had a chief risk officer (CRO). By 2025, it was 67%, indicating that more organizations are centralizing their risk management under a C-level role.

But having a CRO is only useful if they have support and alignment with the other leaders at the top of the organization. How common is that? For one-third of organizations, the CRO reports directly to the CEO, a clear indication that the organization prioritizes risk. In other organizations the CRO may report to the CFO, CIO, or COO.

In addition to chief risk officer, the other C-level role that has gained traction is chief information security officer. As cyberattacks have become more common and more complex in recent years, it’s become much more common for organizations to have a CISO that can focus on cybersecurity and cyberattacks specifically. In fact, many more organizations have a CISO in place than a CRO, and many CISOs have a direct reporting line to the top of the org chart. According to Forrester data, 86% of ERM decision-makers said their organization has a CISO and that they most often report to the CIO (37%) or CEO (32%), and in 5% of organizations, the CRO actually reports to the CISO.

A New Approach To Risk Management: Continuous Risk Management

In today’s volatile business world, the characteristics of risk are changing. Today, risk is dynamic, shared, and continuous, making ongoing risk management more challenging. Your risk management strategy has to adapt to these changing trends. Effective risk management requires a more structured approach, to anticipate pressures across these dimensions, and clear accountability, since risk ownership lies with decision-makers (not risk managers) who maintain processes and support first-line owners.

As risks and opportunities evolve throughout projects and operations, organizations need a continuous process to assess context, adapt decisions, and monitor outcomes — because a single point-in-time assessment cannot capture reality. In today’s environment, it isn’t about avoiding all threats — it’s about deciding which risks are worth taking to achieve your objectives.

The Forrester Continuous Risk Management Model provides a good enterprise risk framework example to help formalize your program, integrate key stakeholders from the C-suite into operations, and connect risk activities directly to business value.

- Bridge the gap between risk strategy and business performance. The model connects high-level strategy with operational realities, giving leadership — including the board, CRO, and CISO — the insights to meet objectives and align with changing priorities.

- Create consistent risk management across all domains. As a domain-agnostic risk framework, it can be applied to standardize workflows for managing enterprise, ecosystem, and external risks, providing a common process and taxonomy.

- Anchor risk management to the pursuit of value. Go beyond mitigating threats. The model helps you evaluate trade-offs and support decisions that accelerate growth, innovation, and resilience.

- Enable strategic agility with clear on- and off-ramps. The model accounts for ongoing feedback and changing conditions, creating clear decision points to pivot, pause, or proceed with investments and initiatives.

Next Steps

Looking for help managing risk in your organization? Interested in learning how the Continuous Risk Management Model could apply to your business? Forrester Decisions for Security & Risk helps security and risk leaders continuously manage risk within strategic opportunities, protect business growth, and gain customer and employee trust with secure, private experiences. With a combination of actionable insights, proven risk management frameworks, and continuous guidance, Forrester helps you define and execute best practices that reinforce customers’ trust.

Build The Security Organization For The Future

To get started in building a better security team, download our guide, Building A Security Org For the Future. The comprehensive guide lays out an easy-to-follow strategy for expanding your security budget and provides a five-step plan for reducing burnout in the security organization, modeled on the NIST Cybersecurity Framework.

Contact us today.

Thank you!

Ready to learn more now? Give us a call:

Americas: +1 615.395.3401

EMEA: +44 (0) 2073 237741

Asia Pacific: +65 6426 7060