How to Financially Protect and Motivate Your Sales Team During a Pandemic

- During an economic disruption, B2B organizations must decide how to protect their sales reps’ income

- When executed properly, changes made to sales rep compensation signal business stability and commitment to the sales team

- Sales operations leaders must balance company risk with employee security to ensure an even and sensible approach

The economic uncertainty of COVID-19 has forced sales and sales operations leaders to create contingency plans for their 2020 forecast and associated compensation plans. Declining consumer confidence and changes in consumer behavior are expected to continue to affect B2B financials.

Thus, sales operations leaders must plan for various scenarios regarding pipeline health and risk. Many sales operations leaders indicate that they have planned for three scenarios: 20% of plan, 30% of plan, and 50% of plan. Although they are hoping for the best-case scenario, they are preparing for the worst-case scenario and all associated necessary adjustments to sales compensation, engagement, retention, and long-term success goals.

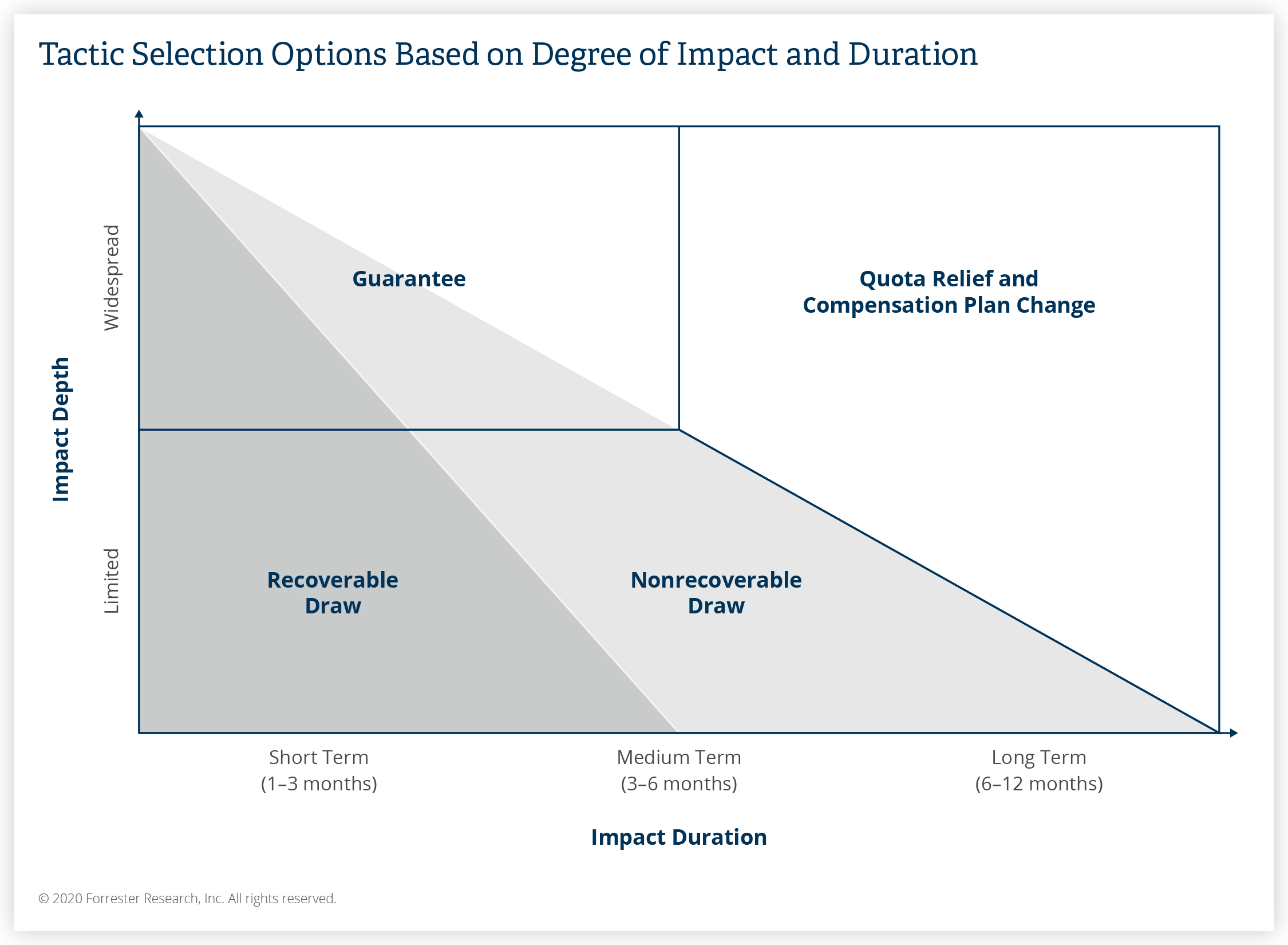

From a financial incentive perspective, organizations have four tactic selection options to choose from as they think about how to support the sales team financially and keep reps engaged during an economic downturn. Each option carries implications that may or may not be acceptable to the organization and/or the sales rep. The options are as follows:

- Guarantees. This approach offers between 50% and 100% of a rep’s target incentive for a typical period of one to three months. It allows the sales operations team to assess the economic impact of the downturn and is best used at the beginning of the disruption to signal a message of strong support to the entire sales organization.

- Recoverable draws. These are best for short-term economic disruptions and enable the sales rep to earn anticipated commissions while waiting for the economic climate to improve. Recoverable draws can be problematic, however, if the sales rep does not earn enough commissions to cover the draw after a certain time period.

- Nonrecoverable draws. This approach gives the sales rep a minimum level of income for each income period and places the majority of risk on the organization. It is usually best for disruptions lasting for three to six months.

- Quota relief from an associated compensation plan change. Sales operations leaders should only consider this approach if the economic disruption is anticipated to last for six to 12 months, as it constitutes an overhaul of the current compensation plan and requires significant time and resources.

Organizations have several financial levers to pull to address economic downturns and should use the approach that best matches the anticipated length of the downturn or crisis and the balance between their overall business goals and the culture they are seeking to foster and promote among the sales team. Proactively managing the risks and rewards enables organizations to survive the downturn and thrive during the eventual recovery.