Bridge the Financial Divide with Netbooks

[Posted by Jennifer Bélissent]

[Posted by Jennifer Bélissent]

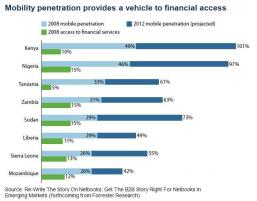

There was a great mobile banking article in the Economist last week. It reminded me of a report written by GSMA on its Mobile Money for the Unbanked initiative that came out a few months back. The GSMA report points out that mobility penetr ation is much higher in emerging markets than is access to financial services — an opportunity for mobile operators and banks to work together to bridge the financial divide. So, I began mulling the opportunity that these trends provide for netbook adoption: why don’t netbook vendors partner with local banks to deliver financial services via 3G-enabled netbooks.

ation is much higher in emerging markets than is access to financial services — an opportunity for mobile operators and banks to work together to bridge the financial divide. So, I began mulling the opportunity that these trends provide for netbook adoption: why don’t netbook vendors partner with local banks to deliver financial services via 3G-enabled netbooks.

Mobile banking has taken off through cell phone access, particularly in Africa and the Philippines. Smart Communications in the Philippines launched its SMART Money initiative in 2000. In 2004 and 2005 some of the first innovative deployments of mobile banking in Africa were launched in South Africa— by WIZZIT and MTN Standard Bank respectively. Safaricom and Vodafone launched M-PESA in Kenya in 2007, with growth of up to 10,000 new users a day, and now over 5 million customers. More recently, MTN announced expansion of its Mobile Money service to its over 80 million subscribers in 21 countries. And, Vodafone will soon replicate M-PESA scale in Tanzania, Zain launched ‘Zap’ in Kenya and Uganda with plans for a broader rollout. Orange is also piloting a deployment of Orange Money in Cote D’Ivoire.

Combining the momentum of mobile banking and the lively SMB segment, banks in emerging market have an opportunity to equip small businesses with netbooks. Again, recalling my previous post, for many in emerging markets a netbook is a step up as an internet access and business device. Sounds like a win-win all around.

[Cross posted from B2B Beyond Borders]