Reaching SMBs Through SMB Communities

It’s a well-established fact that social media is every bit as – if not more – influential for business decision-makers (B2B) as it is for consumers (B2C); Forrester clients can read more here. And SMBs are the most prolific of all business-size segments in utilizing social media and online communities to inform their technology purchase decisions. So where are SMBs turning to for that information? Where can you check the pulse of SMBs’ thinking?

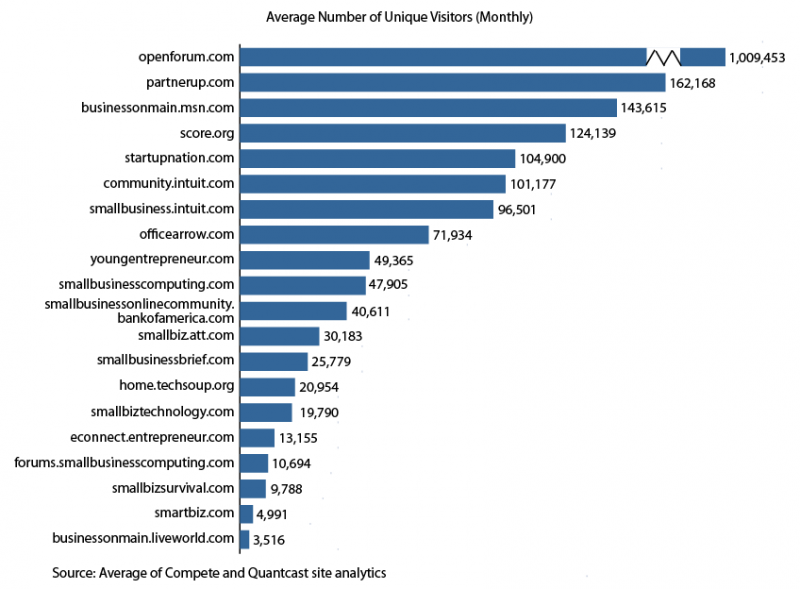

Using a couple of free Web tools, you can derive the relative popularity, if not the absolute Web site traffic volume, of various SMB-oriented online communities. Although their methodologies (and their numbers!) differ, Compete and Quantcast turn up the same results in terms of relative traffic volume. Here we use an average of the two, which indicates that, while community sites like Deluxe Corporations’s PartnerUp, Sprint’s and Microsoft’s Business on Main, StartupNation, OfficeArrow, and YoungEntrepreneur.com are important sites for monitoring and participating in technology and business discussions, American Express’ Open Forum is the granddaddy of them all:

Moreover, many of these communities have technology-specific discussion forums (e.g., Open Forum, PartnerUp, Small Business Brief).

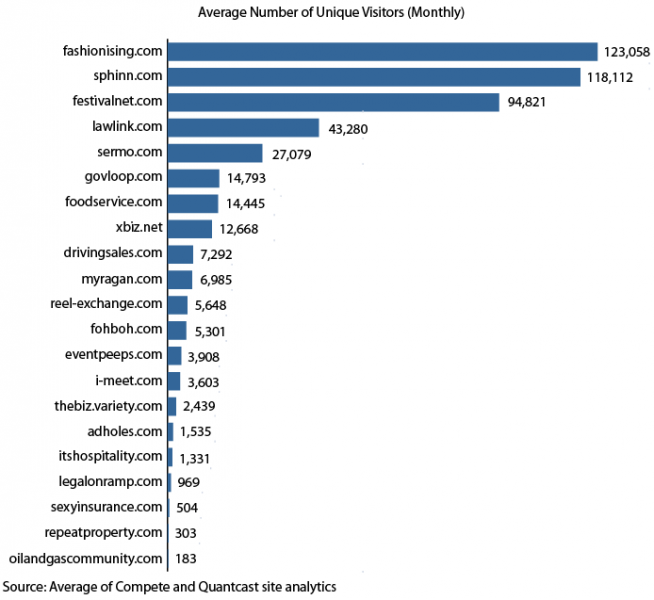

There is debate, though, as to whether SMBs think of themselves in terms of an SMB or in terms of their vertical industry. The correct answer, of course, is both. As it applies to technology, SMBs will often identify with the SMB priority attributes of low cost, anti-complexity, and ease of sourcing. When it comes to functionality, they add their vertical industry relevancy into the decision process mix. So vertical communities need to be factored into the SMB marketing strategy as well:

These are representative examples. Let me know if you have other SMB-oriented online communities of interest that are bearing lead or insight fruit.