Discussing The Forrester Wave™: Enterprise Data Quality Platforms, Q4 2010

I’ve just published my comprehensive analysis of the enterprise data quality platforms market in my Forrester Wave™ report and provided a deep-dive assessment of the technologies, strategies, and market presence of the six vendors that, in my opinion, provide the most mature, robust, and comprehensive data quality and data profiling solutions available. The evaluated vendors include DataFlux, IBM, Informatica, Harte-Hanks Trillium Software, Pitney Bowes Business Insight, and SAP BusinessObjects.

DQ Market Overview

A fair question some may ask when they see this research is “Why evaluate only six vendors?” The reason is a simple cost/benefit analysis. As any vendor that has participated in this process can confirm, the Forrester Wave™ research methodology is at minimum a 6+ month, in-depth product and vendor strategy evaluation and the more vendors that are included only adds to the effort. So when determining my inclusion criteria, I had to ask — as always — who is the target audience for this research? The answer, of course, is the data management professionals that work for Forrester’s clients, who for the most are large commercial enterprises and public sector organizations that often support global operations.

Of course dozens of vendors worldwide offer industry-agnostic data quality and data profiling capabilities, and a great deal more, as well, if you consider solutions that target specific applications, functions, or industry processes. Also, many data quality vendors specialize and provide depth of expertise in a focused part of the data quality market such as postal address verification (e.g., Experian QAS, Melissa DATA), matching or identity resolution [e.g., Infoglide Software, Netrics (acquired by TIBCO Software), and Pervasive Software], and data profiling (e.g., Ab Initio and Business Data Quality). Many others also focus just on a single-data-domain-like product [e.g., Silver Creek Systems (acquired by Oracle)] or customer.

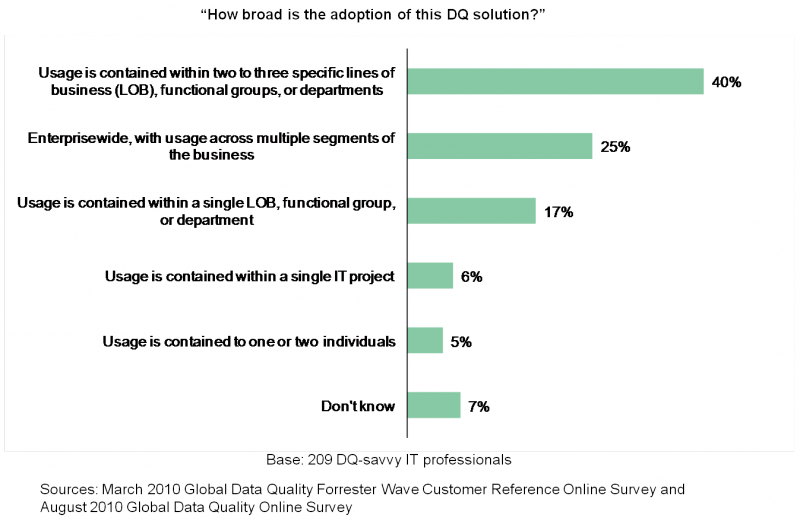

Many data management professionals focus on project-based or departmental implementations and often consider these best-of-breed data quality alternatives. But the vast majority of large enterprise companies (typically $1 billion-plus enterprises and large public sector organizations) seek mature, fully functional, and experienced data quality platforms that provide both the breadth of functionality and the depth of implementation expertise to support the complexities of their global IT and business environments. As you can see in the chart below, 65% of DQ professionals surveyed responded that their DQ solution was used to support multiple parts of their business. For this reason, this Forrester Wave evaluation focused on the shortlist of vendors most often considered by large organizations.

Further validation that this list was the right one came from Forrester’s August 2010 Global Data Quality Online Survey of 145 IT professionals familiar with their organization’s data quality initiatives. Interestingly, 23% of the respondents indicated that they were still using in-house, custom-developed solutions to manage their data quality requirements, demonstrating still significant potential growth for this market segment. But of those using packaged data quality software, 67% of respondents indicated that they were using one of the six evaluated vendors, while only 33% shared that they chose among 15 other vendors for data quality.

Customer references played a major role in scoring the Forrester Enterprise Data Quality Platforms Wave™

While customer references, interviews, and surveys are a critical part of Forrester Wave™ evaluations, I felt strongly that I wanted the vendors’ own customers to play a major role in determining how we evaluate data quality solutions. In speaking with Forrester clients about data quality and data management for almost five years now, I knew that broad functional capabilities of a product didn’t always lead to happy customers. I wanted to get the actual customer experience with the product into the scoring much more transparently, so more than 25% of each vendor’s “Strategy” score (“X” axis of the Forrester Wave™ graphic in the report) was affected by the customer reference response.

To validate product and vendor qualifications, Forrester conducted reference surveys, requesting at least 10 of each vendor’s current customers using the evaluated product. DataFlux, Informatica, Pitney Bowes, and Trillium Software all provided 10 or more customer references who responded to our survey, while IBM and SAP provided eight customer references each who responded. Using a 5-point scale, we asked these respondents to provide feedback based on overall experience with the vendor and the product. The March 2010 Global Data Quality Forrester Wave Customer Reference Online Survey included questions targeting product ease of use, pricing complexity, the overall quality of support from the vendor, and how well the DQ product met expectations on specific functional capabilities.

The responses from these vendors own reference customers were extraordinary. In a nutshell, for all the questions we asked, vendors received positive credit for scores of 4 or 5 (e.g., Agree or Strongly Agree), negative credit for scores of 1 or 2 (e.g., Strongly Disagree or Disagree) and no credit for neutral scores of 3. When aggregating a weighted final score using this method, one vendor had a score as high as 90 (out of 100) and another had a score as low as 30! And it’s quite clear from these results that the vendor with the most features d0esn’t always have the happiest customers.

The takeaway

In our 124-criteria evaluation of enterprise data quality platform vendors, we found that Informatica and DataFlux led the pack in part because of the breadth and depth of those products’ functional capabilities, including strong support for real-time data quality services, data quality monitoring, and stewardship capabilities, but even more so on the quality of the experience shared by their customers. Harte-Hanks Trillium Software — a Leader with best-in-class data profiling, robust data cleansing, standardization, and matching capabilities — also had positive feedback from its customers. SAP BusinessObjects, IBM, and Pitney Bowes Business Insight (PBBI) are Strong Performers, offering compelling data quality and data profiling solutions with specific strengths that will make them attractive considerations for many large enterprises. PBBI had good customer references but was more restricted in functional capabilities, while IBM and SAP offer strong functional capabilities but face some challenges in ensuring that they're meeting customer needs effectively based on their customer reference survey results.

My conclusion: Not all, but much of the enterprise data quality platforms market has become commoditized (especially in areas such as postal address verification, performance and scalability, multilanguage intelligence, etc), so when looking to differentiate solutions, don’t forget to evaluate the nonfunctional requirements including vendor alignment with your business objectives, quality of account management and support teams, and the vendor’s track record in delivering business results in line with what was promised during the sales cycle.

I hope you enjoy the research!