Sales Enablement And The Future Of Selling

Highlights

- Looking back on the past 10 years puts the changes taking place today in the technology industry in context.

- Over this period, SGA has grown faster than revenues – a major contributor to margin erosion.

- Buyers are stratifying their suppliers into a caste system, increasingly delineating strategic vendors from commodity providers.

- In order to achieve profitable growth objectives, technology vendors must rethink how they go to market.

- Forrester’s Sales Enablement Forum February 14-15 will provide sales enablement leaders the concepts and approaches to compete in the new emerging “outcome economy.”

Where Have We Been?

Shakespeare once wrote, “the past is prologue,” and that is a wonderful way to start a conversation about the tectonic forces at work that are fundamentally changing how vendors go to market.

As you try to remember to sign your checks 2011 instead of 2010, take pause and think a little bit about the changes that have taken place in our industry over the past decade.

- In 2000, times were great for the technology industry. Businesses were making huge investments in their corporate web sites and supply chains. Software providers were at work webifying their applications, and consulting firms experienced a boom by helping clients extend their brick-and-mortar-only business models to embrace eCommerce. The big winners were, of course, the ones who saw where things were heading and got there first.

- By 2003, the tech depression had hit – radically changing the heavy promotion- and marketing-driven model many software and hardware companies were following as firms retrenched into survival mode. It wasn’t all bad. Services companies enjoyed a lot of growth during this time, offering outsourcing services to help their client re-engineer their balance sheets given their overinvestment in technology. Their value proposition was simple: “We’ll manage your mess for less.” The ones who got there first benefited the most.

- By the middle of the decade, the explosion of consumer spending brought back demand for technology as a business enabler. Coming off a mild recession, businesses expanded their operations and pushed to maximize their reach. Large companies hired new employees, all of whom needed technology to help them perform their duties as knowledge workers in an information-driven economy. Everyone benefited. New hardware was needed to add to the computing and bandwidth capacity, new software was needed to support all of these new employees, consulting firms benefitted by helping companies streamline operations to maximize their throughput. The ones who shifted to growth strategies first, benefited the most.

- The end of the decade saw the largest economic downturn the technology industry has ever seen. Businesses, for the most part, have weathered the storm with severe cost-cutting measures and by holding hiring to a minimum. Originally, the idea in mind of most CFOs was to rehire back to appropriate levels to keep expenses in line with revenues. However, something very different is happening. Forced to do more with less, businesses are getting creative with their use of technology and blending it with business processes, workflows, and employee production programs, and are getting amazing results. This blending of historical disparate activities coupled with changing funding models is forcing buyers to rethink how they work with suppliers.

Where Are Buyers Going?

On the buyer side, we are seeing a growing trend to push more suppliers through professional procurement functions while investing in strategic vendor programs with the select business partners that add more value to their companies. How well has the technology industry as a whole responded to these changes?

If you accept the idea that buyers pay more for perceived value (and that only they can determine what is valuable), then some financial trends make a good scoreboard. We recently analyzed 100 technology companies’ financials (hardware, software, services, telecommunications, etc.) over the past 10 years. When we normalized year-over-year growth (for example, what was the % growth of revenue from 2005 to 2006 and plotting out that % growth rate for each year from 2000-2009), we found some very interesting trends. First, in every single year, the year-over-year growth of SG&A was higher than the growth rate of revenues. Secondly, margins are clearly under pressure; in 2000 the industry average operating margin was 18.1% – by 2009 it had declined to 13.4%. In other words, the rate at which technology vendors are investing to fuel their selling engine is higher than the yield they are getting.

Where Should You Be Going?

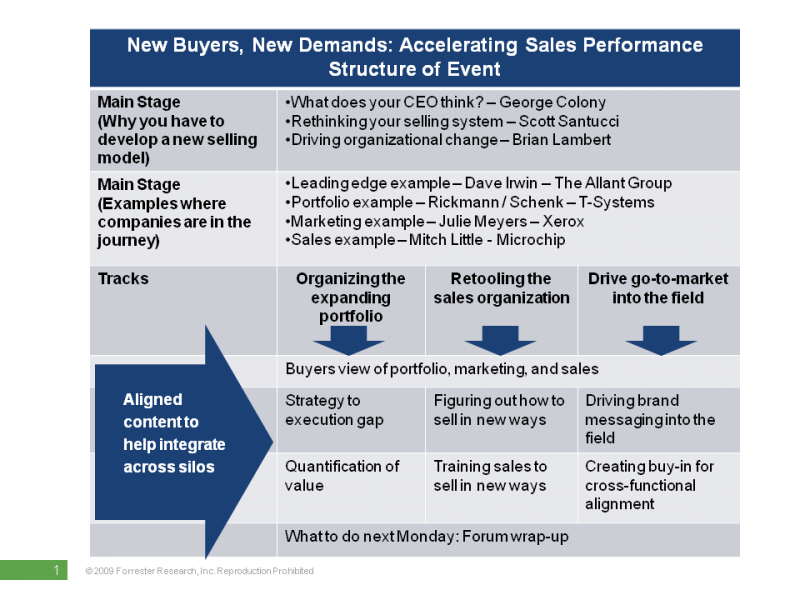

This is exactly the focus of our sales enablement research agenda at Forrester and the theme of our upcoming conference, titled: "New Buyers, New Demands: Accelerating Sales Performance" (Feb. 14-15 in San Francisco). Our lens is very simple – CEOs want their businesses to drive more profitable growth and are growing frustrated with execution. Buyers are stratifying their suppliers into a caste system of commodity and strategic partners – and vendor go-to-market models are not keeping up with the change.

To tackle this problem, vendors must find ways to communicate value (in the terms of the customer, not themselves), and that requires coordination across product, marketing, and sales organizations. We have designed our conference to provide you a layered approach to:

- Provide clarity about what is changing and what the path forward looks like.

- High-level models to help think through how to change a go-to-market approach.

- Real world examples (with measurable results) from executives from The Allant Group, T-Systems, Xerox, and Microchip Technology, representing different steps along the journey and efforts beginning from different organizations (product, marketing, sales).

- Our track sessions help people who work in different departments (product, marketing, and sales) understand the demands of customers and what that means to their groups, while providing real world examples from companies like Cisco Systems, BMC Software, Avaya, and Red Hat about specific projects they are working on.

- Finally, we will conclude each track with “what to do next Monday” sessions in which we’ve asked a handful of our sales enablement clients to interact with the audience and capture the side conversations and insights so we can wrap up the show in a meaningful way.

Information About The Forum

Link to information:

http://www.forrester.com/events/eventdetail/0,9179,2438,00.html

Where is it?

The Palace Hotel in San Francisco, California

When is it?

February 14-15, 2011

Pricing

We have group pricing available because we encourage people to come as cross-functional teams.

Contact

If you are a Forrester client, contact your account executive – your probably have some conference tickets available as part of your contract. If you are not a client, you can register for the forum using the link above.