GXS Acquires RollStream

GXS announced today that is has acquired RollStream, a SaaS vendor that offers solutions for supplier discovery/sourcing, master data management, compliance and risk management, and supplier performance. RollStream has a healthy customer base in healthcare distribution and grocery retail with marquee customers like TESCO, Sainsbury’s, and Owens and Minor.

The key functionality that RollStream offers that really stands out is its ability to track all supplier information, communications, and credentials in a single, shared repository. Reading the press release from GXS, this was in part why it made the acquisition — “The acquisition deepens GXS’s long-term commitment to the Social Supply Chain, a vision that brings together information flows and information workers to break down barriers hampering supply chain efficiency.”

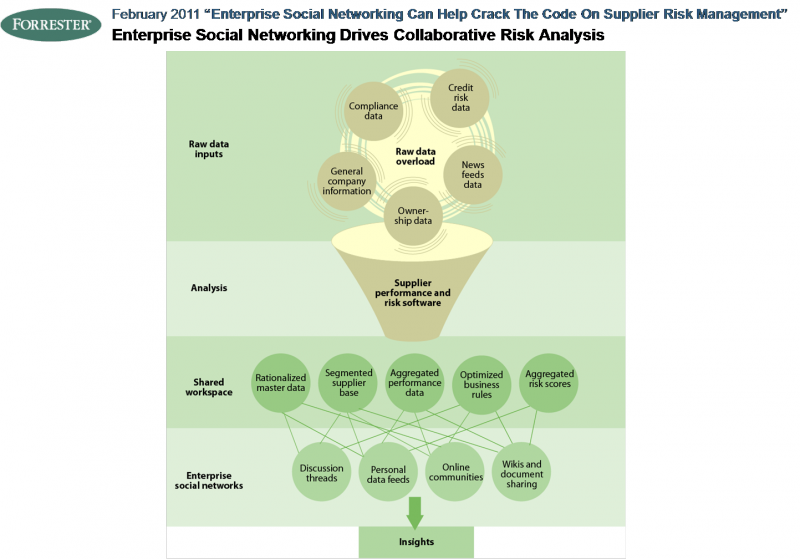

We’ve been writing about this concept for some time and see tremendous potential in the concept of applying the social networking paradigm to supplier management. In my February, 2011 report, “Enterprise Social Networking Can Help Crack The Code On Supplier Risk Management,” I explore this very concept — that through virtual communities of stakeholders, both internal and external to a company, executives can share common supplier data and insights on risk-related events.

This report explores how enterprise social networking can help build communication across siloes, create smart feeds to help aggregate and refine the noise, and encourage adoption through more familiar UIs.

What does this acquisition mean for existing and future clients of RollStream? Given that the two vendors have been partners since 2009, GXS is already a reseller of the solution, and the solution has already been integrated with GXS Trading Grid, there are not any major immediate impacts to consider — a lot of the heavy lifting from a technology stand point is already in place. Over time, look for RollStream to bolster R&D and build out its international capabilities.

Stay tuned, this category of software that Forrester refers to as Supplier Risk and Performance Management has been growing rapidly. We expect additional consolidation in the market with the other standalone vendors to be bought up by larger software companies in the next 12 to 24 months.