The Data Digest: Who Adopts Tablets Next?

In the current time of digital disruption, market insights professionals need to know the market their organization plays in well enough to identify the “adjacent possible” but also to understand how receptive their customers are to new offerings. With that in mind, I’ve taken a fresh look at Forrester’s Technographics® segmentation. This segmentation is built on three main components: motivation, income, and technology optimism/pessimism using a proprietary algorithm and is created in 1997 when we first began collecting our Technographics® data to help companies understand and predict changes in the consumer technology landscape. In 1999, Forrester published a book, called 'Now or Never', that covered how companies should use the model.

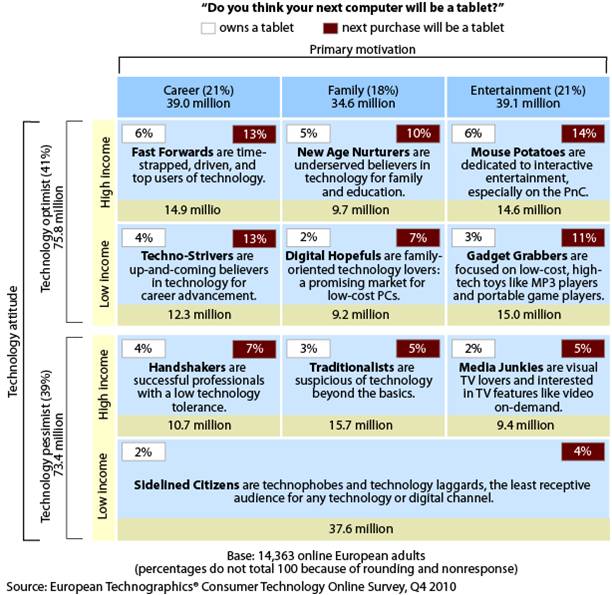

Recently I was wondering: does the segmentation still hold for current technologies like tablets and can it still help companies understand and predict technology behaviors? For this, I analyzed tablet uptake as well as buying intention of tablet from one of our European surveys by segment:

Our Technographics segmentation shows that the highest uptake of tablets is currently with the high-income technology optimists like the Fast Forwards, New Age Nurturers, and Mouse Potatoes. The adoption of tablets by low-income optimists (Techno Strivers, Digital Hopefuls, and Gadget Grabbers) is at the same level as that of high-income technology pessimists (Handshakers, Traditionalists, and Media Junkies). For the first group, it’s mainly lack of funding that keeps them from owning a tablet; for the latter, it’s lack of interest. This is illustrated by the fact that when you look at buying intention, the percentages are about twice as high for the low-income technology optimists.

Additionally, the segmentation also shows that uptake and interest are higher for consumers who are career- or entertainment-driven than for segments that are family-driven. This means that despite all the stories about kids using tablets, this isn’t a driver for buying the device (yet).

I’m pleased to see our Technographics segmentation still works, even after all these years, and can give clients insight in adoption patterns as well as the drivers for adoption. If you’re interested in understanding how this could help you undersand your customers better, please reach out.