The Data Digest: Interest In Money Management Tools

For the past decade, the number of customers using the Web to manage their bank accounts and policies and to research and buy financial products has grown steadily. For many customers, the Web has already replaced bank branches, financial advisors, and insurance agents as the heart of their relationship with their financial providers. For example, in the Netherlands and Sweden, less than one in 10 consumers go into a branch on a monthly basis — they do most of their banking activities online or, increasingly, on mobile phones..

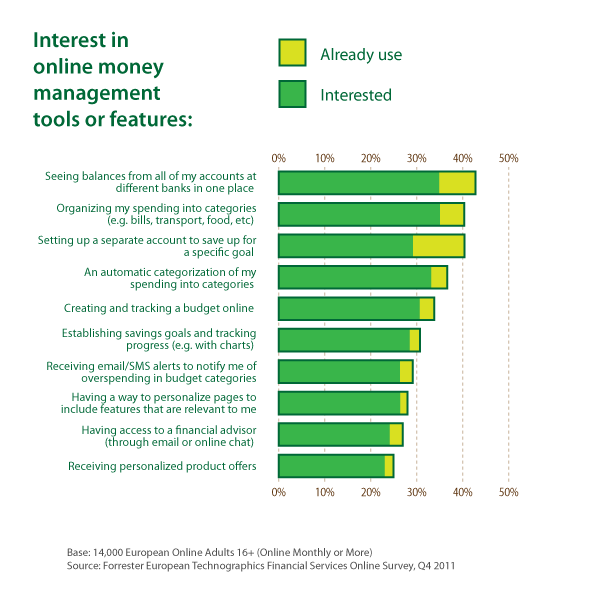

But this doesn’t mean that these consumers don’t need support. Forrester’s European Technographics® Financial Services Online Survey, Q4 2011 shows that although uptake of money management tools is still low in Europe, already one-third of online Europeans are interested in tools that will give them more insight into their spending.

An example that helps consumers get better insight into their finances is for example Orange Planet from ING, that helps educate young kids about earning, spending, saving and investing. Or this tool from ABN (Het Financieel Dagboek) which lets online banking customers see their account balances and transactions from different providers in one place, categorize their transactions, and benchmark themselves against their peers. And Barclaycard's mybarclaycard secure site sorts customers' transactions automatically into categories to provide a clearer picture of their spending patterns. In today’s challenging economic times, customers will only expect more support from their financial providers on how to manage their finances.