A New Shopping Arena For Consumers

For consumers today, online and mobile channels have become an integral part of the shopping experience — for both researching and purchasing products and services.

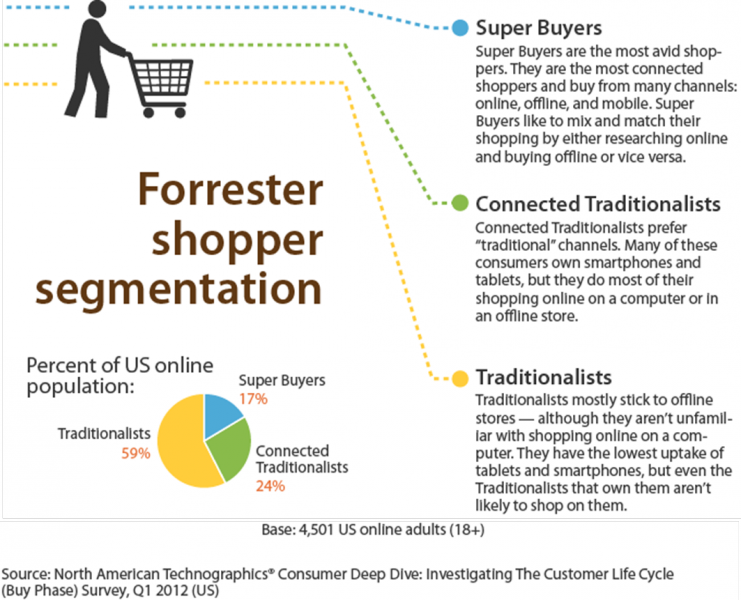

In their transition to agile commerce, companies must understand how consumers are interacting and using multiple touchpoints to research, transact, and get service. Our recent report Segmenting Buyers: Introducing Super Buyers, Connected Traditionalists, And Traditionalists examines how three distinct retail segments of US online consumers — Super Buyers, Connected Traditionalists, and Traditionalists — leverage various channels for their shopping needs and explains how companies can best engage with each segment.

Some highlights from the report, which is based on a survey of more than 4,500 US online consumers:

· Super Buyers are the most connected shoppers and buy from many channels: online, offline, and mobile. Super Buyers like to mix and match their shopping by either researching online and buying offline or vice versa.

· Connected Traditionalists do most of their shopping online on a computer or in an offline store.

· Traditionalists are the largest segment; they do most of their shopping in-store — although they are also shopping online on a computer. This group has the lowest uptake of tablets and smartphones.

How large are these segments? The largest segment is the Traditionalists, who make up 59% of US online adults; Super Buyers make up 17%; and Connected Traditionalists make up 25%. This means that more than half of US online adults mostly stick to physical stores to shop. However, it’s the Connected Traditionalists who show the most growth potential — their relative size will grow over time and steal share from Traditionalist shoppers as the uptake of smartphones and tablets continues.

A report just released today by Corinne Madigan and Tracy Stokes, The Role of Digital in the Path to Purchase, shares further insight: For product research, most shoppers embrace mature digital channels, only few have adopted emerging channels like social media and mobile. But the physical store remains the dominant channel for the average consumer to buy.

So what does this mean for companies and marketers? They need to understand their customer dynamics and offer shopping options that meet their needs — like “buy online, pick up in-store” and mobile shopping options for Super Buyers; consistent multichannel experiences for Connected Traditionalists; and knowledgeable in-store staff for Traditionalists.

The bottom line is that the arena in which consumers shop today is distributed across online and offline touchpoints — and this creates great opportunities for retailers and marketers to link these experiences. Forrester clients can read the Segmenting Buyers and The Role of Digital in the Path to Purchase reports to find out more.