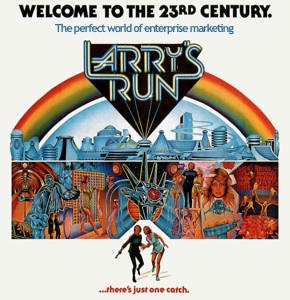

Siebel & Eloqua: Can You Outrun Your Future?

"Logan: That's the way things are. The way things have always been."

In Redwood City this week, the answer I heard from Oracle was an emphatic yes. At Oracle's Industry Analyst World, the company stressed its cloud bonafides against Salesforce, IBM, and SAP with its new Customer Experience (CX) Suite. The CX Suite is a horizontal offering, assembled primarily from acquisitions, newly rechristened as Oracle Marketing (Eloqua), Oracle Commerce (ATG, Endeca), Oracle Sales (Oracle CRM On Demand), Oracle Service (RightNow), Oracle Social (Collective Intellect, Vitrue, Involver), and Oracle Content (Fatwire).

In Redwood City this week, the answer I heard from Oracle was an emphatic yes. At Oracle's Industry Analyst World, the company stressed its cloud bonafides against Salesforce, IBM, and SAP with its new Customer Experience (CX) Suite. The CX Suite is a horizontal offering, assembled primarily from acquisitions, newly rechristened as Oracle Marketing (Eloqua), Oracle Commerce (ATG, Endeca), Oracle Sales (Oracle CRM On Demand), Oracle Service (RightNow), Oracle Social (Collective Intellect, Vitrue, Involver), and Oracle Content (Fatwire).

The Software as a Service (SaaS) suite promises to deliver a lower total cost of ownership, easier integration, and faster time to value for a business looking to streamline its enterprise software providers. While Oracle's approach is to lead with SaaS, it also promotes an Enhance, Augment, Migrate strategy, enabling existing customers to extend an on-premises deployment — think Siebel Loyalty — with one or more CX products, say Eloqua's email delivery capabilities.

You Can Outrun Your Past

So what does it mean for Eloqua? Marketers using or considering Eloqua should recognize that Oracle:

- Sees a differentiator in CX, not EMM. To it's credit, Oracle is differentiating by going wide rather than long, emphasizing that firms need a solution that addresses all customer facing functions (marketing, sales, service) across the entire customer lifecycle. Marketers who instead want a single provider focused on solving the overall enterprise marketing management (EMM) challenge — mix, planning, analytics, campaign management, measurement, and optimization — will want to look elsewhere.

- Will kick the interesting developments down the road. The Eloqua product team will spend several months heads-down integrating at 3 fronts: with CX Suite products, with other Oracle products, and with non-Oracle products. Integration will keep it away working on new development, either within Eloqua or by building new cross-suite products. For example, marketers who do want to instrument the full customer lifecycle with thousands of possible customer interactions (campaigns) will still have to design and maintain these interactions one by one. And more exotic cross-suite products, like a common interaction/session store or a suite-specific customer analytics offering are even farther off.

- Wants you to see Eloqua as a B2C, not just B2B offering. Throughout my time at the event, I heard Oracle's executives stress Eloqua's appeal to B2C marketers as much as B2B. This claim isn't unjustified: a smattering of sports franchises use Eloqua today. I've heard from some retailers and financial institutions that are interested in adding life cycle marketing capabilities to their existing programs. While it's a possibility, B2C marketers interested in Eloqua need to see it as an addition to, not a replacement for, existing campaign management or media delivery applications.

Can You Outrun Your Future?

So Oracle Marketing finally gives the company the ability to go after B2C marketers? If you're a Siebel marketing or loyalty customer, perhaps your eyebrows are steadily climbing your forehead? We've seen this story before, and Teradata is still trying to figure out how to position, support, and grow its Casanova-like conquest of campaign management products (Teradata Relationship Manager, Aprimo Marketing Studio, and eCircle).

Oracle takes a reasonable-for-the-moment position on Siebel and Eloqua. Essentially, it boils down to two common use cases (see the table below). First, Oracle will direct B2C marketers who want on-premises software to Siebel, and second, B2B marketers who want SaaS product, will go to Eloqua. A less common case, B2B marketers who need an on-premises application will stay with Siebel.

| On-Premises Delivery | SaaS Delivery | |

|---|---|---|

| B2C | Siebel | ? |

| B2B | Siebel | Eloqua |

What about that upper right quadrant? What should B2C marketers who want to move to the cloud do? Lacking a definitive position from Oracle, the best I can say is, it depends: perhaps you'll choose to augment your Siebel solution with Eloqua for email delivery, or perhaps you'll migrate to Eloqua in order to focus on marketing automation over traditional batch campaigns. And perhaps that's good enough.

Perhaps.

Oracle only announced the Eloqua acquisition 5 months ago. Siebel and Eloqua product management teams are, quite literally, just getting to know each other. These teams each have their roadmaps to execute against, so building a third roadmap, a common path for both, is a not a top priority yet. But there are clear signs that Oracle will need to address it sooner or later. Oracle must:

- Adopt a consistent, forward-looking position for both Siebel and Eloqua customers Oracle is right to cite both changes in consumers' expectations of brands and consumers' technology use as requiring a new approach focused on customer experience. Promoting two very different marketing applications, however, muddles the message at best, and sends conflicting messages to clients at worst. Oracle needs to pick a strategic position and promote it across both Siebel and Eloqua customers. Oracle can buy time on an unified offering, but competitors won't wait for message consistency. And I see an increasing number of Forrester clients who want to buy sophisticated segmentation and real-time automation through a SaaS offering.

- Create a full marketing solution for the cloud, not just marketing automation. Be it freedom from IT, subscription pricing, or faster innovation, marketers increasingly look to the cloud to address a growing percentage of technology needs. I hear from more and more enterprise customers turning down on-premises delivery, and I see more and more vendors adding SaaS options. As competitors line up in 2013 and 2014, Oracle's will need more than today's horizontal focus. It needs to provide a vertically integrated, marketing-specific offering that ranges from planning to execution, combining Siebel's segmentation and loyalty offering, with Eloqua's automation, ease of use, and cloud delivery.

- Decide which product is the primary marketing product. Oracle doesn't have to guess at the risks of a divided product strategy. Not only does it have Teradata's example with TRM versus Aprimo, it also can pay heed to IBM and Salesforce. The former's prioritization of Unica within the EMM division has so far led it to limit its SaaS offering, and the latter's heavy duty investments in Radian6 and Buddy Media continue to distort its understanding of all marketing as social marketing. For the time being, Oracle has a shot at creating the first credible enterprise marketing cloud. But it will have to make tough choices in order to get there.

For the time being anyway. Other marketing technology vendors are gearing up to run this race. Firms an acquisition or two away from changing the course of the race. Hurry up: consumers, running away from traditional campaigns, aren't going to wait for us to tiptoe around past technology offerings.