Are You Doing Enough Customer Research? Yes, But . . .

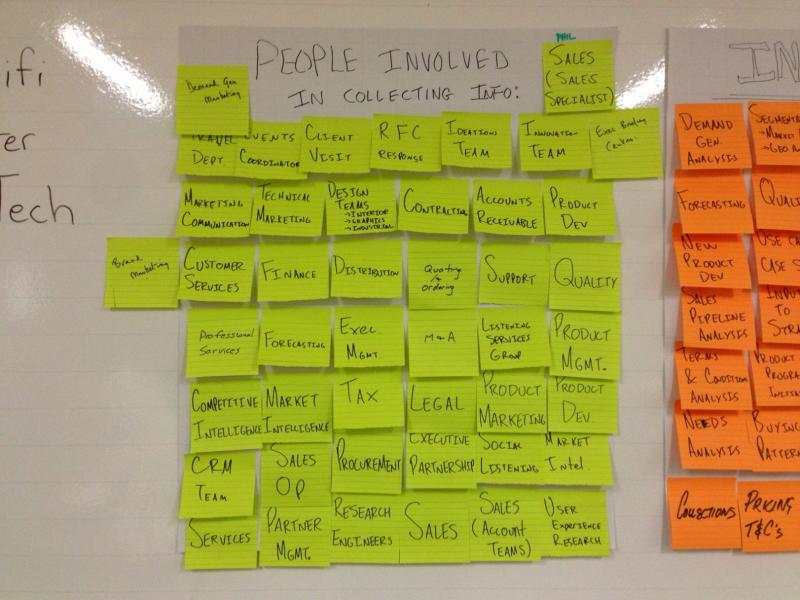

Peter O'Neill here: I attended a meeting of our FLB Sales Enablement Council earlier this month in San Francisco. The Council meeting included sales operations and content marketing executives from B2B companies Avaya, Cisco Systems, Haworth, HP, IBM, and Polycom. While the meeting is a facilitated discussion among peers, as per our standard FLB model, it is also more than that. It actively helps us analysts create new IP for our clients — we get their point of view and we test our own hypothesis before publishing reports. This meeting focused on the very important topic of defining the audience for our message (i.e., content and conversations) and messenger (i.e., the content channels, including sales). In an introductory exercise, the attendees listed all the groups and initiatives that they know are doing research with their customers. If you look at this photo, I think you’ll agree with what the Council attendees said after this exercise: “It’s absolutely frightening and quite chaotic!” This photo shows the list of people or departments – the list next to it is by "initiative" and it is just as long.

I am reporting this because Forrester has just published my latest report for B2B marketers on content marketing, Establish Your Content Marketing Life Cycle; in it, I discuss some critical success factors around content marketing. One of the most important is doing enough of the right research about your buyers in the first place. However, the research I describe in the report isn’t even on these lists!

In today’s “need-match-engage” world, where different buyers prefer to do their own early research before reading product collateral, marketers must create content that educates and informs without pushing their products too aggressively. The rules of digital engagement dictate that readers are only interested in an answer to their immediate query, which may be purely business-related — i.e., not about a product at all but about how to solve a business issue. So marketers must now invest time and resources to establish how different buyers research their product needs or business issues, which depends on each buyer’s level within a firm and range of responsibilities. Essentially, marketers must discover and document the typical full research and decision journeys of all the specific buyers they aim to reach with their communications. They should remember that:

· Buyers now include users or consumers.When planning research interviews, marketers frequently ask their sales colleagues for customer contacts and then interview those buyers. But projects are often initiated by business users who have a business issue or need to achieve a certain business outcome. These are the users or consumers of your business product or service, not the people who eventually buy it.

· A buyer research taxonomy is important.Higher-level or executive buyers don't type “ERP”into a search engine during their discovery phase. They look for information that relates to their business issues and outcomes and that is the language they use. As a result, it's critical that B2B marketers recognize that their awareness/discovery content must use the buyer's language.

· Buyers have many sources of content —most of which aren't vendor marketing or sales.Marketers must also ask where their buyers look for the content that influences their decision-making. B2B buyers tell Forrester that they find 70% of the content they read and study before making a purchase decision (using search, communities, discussion forums, websites, and blogs), rather than receiving it from marketing or sales. Marketers are learning to help their buyers access their thought-leadership and educational content by placing it outside their own website and communicating it in a way that's collaborative and useful from the buyer’s perspective.

The report concludes that content marketing is a business process and B2B marketers should be diligent, systematic, and professional about the marketing content they produce. Consider the full life cycle for each content asset and plan resources around this life cycle. More importantly, measure and report the return on your content assets. Need more details? Drop me a line. As always, I’d love to hear from you on this and other topics.

Always keeping you informed! Peter