How PayPal Can Succeed Where Google Wallet Failed

Today, PayPal launched a redesign of its mobile digital wallet in the US, Australia, Canada, China, Hong Kong, Japan and the UK[i]. Although the digital wallet marketplace welcomes new or evolving competitors regularly, others – like Google Wallet- have gone back to the drawing board. To date, no third-party wallet provider has yet to achieve “broad-scale adoption” with both consumers and merchants, or, said differently, “success” with proximity or in-person mobile payments.[ii] Although most consumers around the globe have used PayPal’s online digital wallet, and some may have heard of or perhaps even used its mobile digital wallet for in-person payments, adoption is still a long way from mainstream. Google Wallet helped to drive awareness of mobile digital wallets — a useful byproduct for all competitors — yet it failed to deliver consumer adoption or merchant acceptance. With the latest wallet update, PayPal is poised to accelerate adoption by embedding value-added services designed to give consumers a reason to use the PayPal wallet across multiple categories and give merchants a reason to consider adding yet another payment method.

Some of its value-added services include:

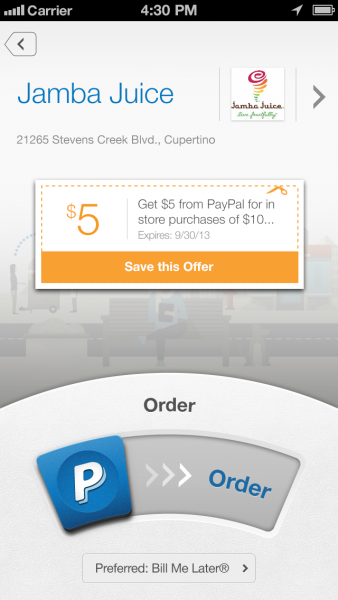

- In-store and Online Offers. Offers have been the foundation for other wallets in the past; they are considered a baseline feature in the marketplace and are highly valued by consumers.

- Order Ahead. PayPal has been testing this feature with Jamba Juice since 2012 but is now rolling it out more broadly. As discussed in my Three Disruptive Payment Trends In 2013 report, this feature delivers value to both consumers and merchants.

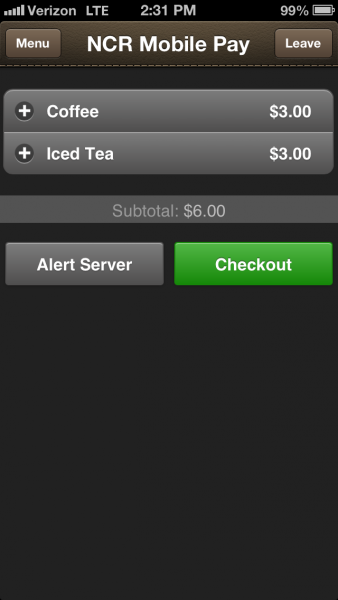

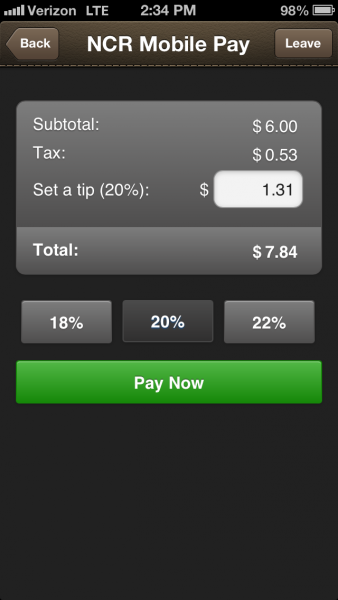

- Pay At Table. PayPal is rolling this out in partnership with NCR to enable mobile payments table service restaurants, remove friction (the wait) from the dining experience.

- Instant Credit with Bill Me Later. Next to offers, this may be the most appealing and widely used feature of the new PayPal wallet from the outset, especially for consumers who want to have options for how to manage their spending but don’t have or want to use a credit card. No other wallet service offers instant credit where the cost and payment options are on par or better than credit cards.

Even with its cool new features, winning consumer adoption and merchant acceptance (the “success” equation) won’t be a slam dunk. PayPal must:

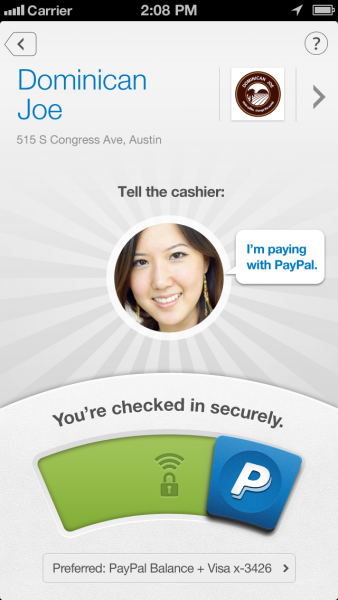

- Provide a better alternative to the payment methods consumers are content to use today. Although the new features of the updated PayPal wallet aim to deliver greater value before and during the payment moment, PayPal must demonstrate that it can meet consumers’ payment and commerce needs in a more convenient, contextually relevant, and compelling manner than the next best alternative. In addition, PayPal must deliver a compelling experience that is both reliable and secure.

- Have sufficient points of use or points of merchant acceptance so consumers can experience the value of these services in their everyday lives.Today’s announcement is about the new consumer wallet experience, but PayPal won’t have success without merchant acceptance at scale. PayPal is leveraging strategic partnerships and other tactics to drive merchant acceptance across several categories and with large and small merchants. But it needs more than just general merchant acceptance — it must have merchant partners who can help deliver great experiences through PayPal’s new features in order to achieve meaningful consumer adoption. This degree of merchant partnership isn’t a slam dunk either.

- Demonstrate at least neutral if not positive merchant economics.Merchants will carefully look at the PayPal value proposition to understand what they are getting in return for partnering with PayPal. Will PayPal deliver new customers? More loyal customers? More frequent visits? Greater spend per visit? Lower operational and/or marketing costs? Merchants will want to know what’s in it for them.

Nothing will dampen consumer curiosity and enthusiasm faster than failed attempts to use loudly touted cool new features and services. PayPal is facing the proverbial chicken and egg situation of mobile payments. PayPal says it has been very focused on demonstrating and delivering value to merchants, but only time will tell if it receives the required return on its investment to soon claim “success” with in-person mobile payments.

So, what do you think? Does the new PayPal mobile digital wallet have the winning formula for success in driving consumer and merchant adoption at scale?