MOBILE WORKPLACE SERVICES: AN ROI CASE IS NO ALTERNATIVE TO A SOUND STRATEGY

As European IT departments increasingly grapple with rolling out mobile workplace services beyond classic device protection, the debate is turning to technology ROI calculations to justify investments. But the purpose of developing such a business case is highly questionable if it is not put into wider strategic context. Take bring-your-own-device (BYOD) as an example. Can you really measure hardware savings through self-provisioning against extra efforts in setting up and communicating a policy, monitoring behavior, implementing additional security measures, and the lack of business continuity support for devices not administered by IT? Even if you could stack up these positions, is it meaningful for your organization going forward?

On the other hand, the prospect of soft business gains is not enough to warrant investment in mobile technology. As highlighted in our recent report, The Expectation Gap Increases Between Business And IT Leaders, business leaders buy into value generated via mobile deployments and integration with social media. But they have less comprehension of the supporting infrastructure upgrades needed in terms of technology innovation or higher bandwidth requirements.

A mobile strategy must be top on the agenda for both IT and business leaders

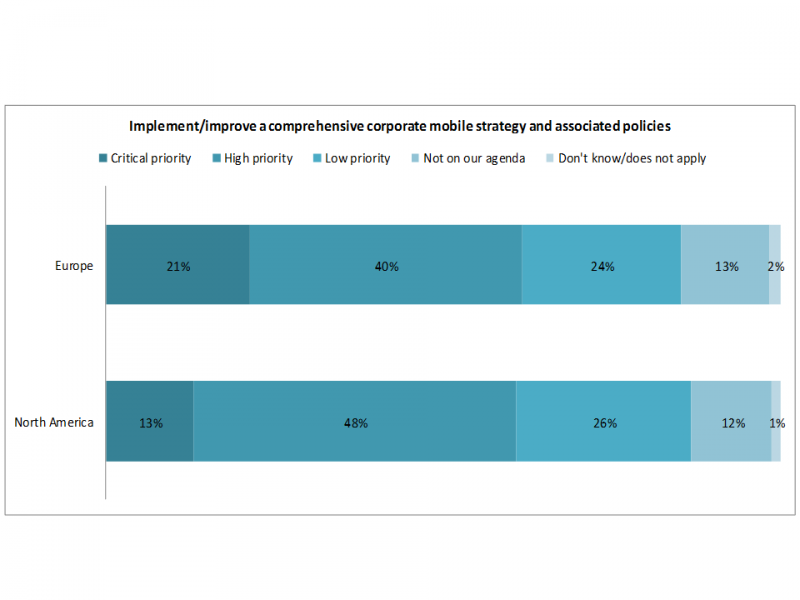

What is really missing is a comprehensive and conscious deployment strategy linking the technology business case to strategic business objectives. European IT leaders are painfully aware of this and have such a mobile enterprise strategy firmly on their agenda:

Figure 1: How Important Are The Following Organizational Initiatives During The Next 12 Months?

Source: Forrsights Mobility Survey, Q2 2013, Base: 2,258 North American and European network and telecommunications decision-makers

In practice, most mobile enterprise deployments were either driven by the IT department, such as distribution of email services on the first generation Blackberry, or by individual business requests, such as the drive for iPads on the executive floor. It seems though that neither party though has yet fully embraced two crucial steps in developing a successful mobile workplace strategy:

- Agree on a vision which is mapped to clear business objectives.

- Agree on a firm road map for implementation of the mobile infrastructure supporting devices, corporate business applications, and communication/collaboration for mobile workers.

A mobile enterprise strategy should also lay out the requirements and responsibilities for architecting and sourcing. Which architectural decisions regarding devices, connectivity, application certification and security belong into the overall framework run by IT leaders? Which devices, applications and services supporting productivity and business value are selected by business decision makers?

Leading vendors for mobile workplace services are gearing up their consulting capabilities to address such questions. Sourcing and vendor management professionals can play their part by challenging suppliers on their experience in supporting strategic cases of total economic impact as well as their ability to align business objectives with technology investments. A strategic alignment and clear responsibilities will go a lot further than seeking to calculate returns on BYOD on the IT side alone. And it helps avoiding the mistakes of the past.

We have been here before — remember the lessons from the deployment of IP telephony

Thinking back to about 10 years ago, telecom managers bought in early to claims of being able to generate value by switching their traditional PBX to IP telephony. Vendors including Cisco made powerful cases for added value generated by increased functionality such as conferencing and presence management. But these benefits were so hard to measure that ROI was stripped down to two factors: 1) cost savings through simpler employee moves, adds, and changes (MAC) in a campus environment and 2) cost savings on communication through SIP trunking. Since many cost cases did not really stack up, unified communications became popular in the modern enterprise in early 2008 with the push of presence management by IT departments. But solutions had already existed for years.

For its Forrsights Mobility Survey, Q2 2013, Forrester fielded this online survey of 2,258 North American and European network and telecommunications decision-makers from March 2013 to May 2013.