Forrester’s 2014 UK Mobile Banking Functionality Benchmark: Late Starters Are Catching Up

It’s no secret that UK banks were slow to take mobile banking seriously. The iPhone launched in 2007, and it wasn’t until 2010 that we had the first mobile banking app from NatWest. Barclays and HSBC, two of the biggest banks in Europe, let alone the UK, didn’t release apps until 2012. But our new report, 2014 UK Mobile Banking Functionality Benchmark, suggests all that is changing. UK banks now do well where it matters most to customers – across money movement, balance checking and transaction history search. Some of last year’s laggards have overtaken last year's leaders, and many UK banks now offer mobile sales functionality – ahead even of their peers internationally. Here’s the headline story:

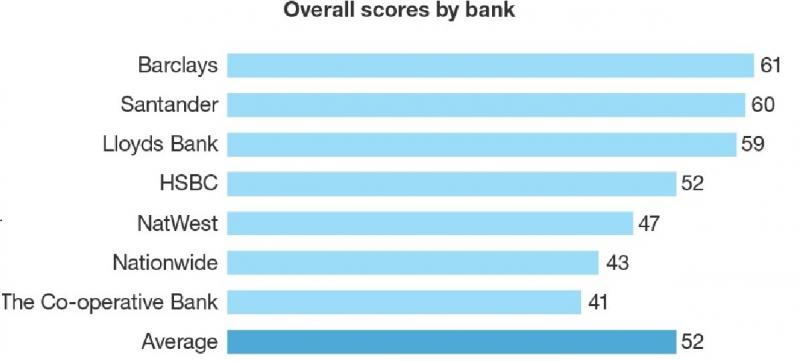

(1) Barclays takes the top spot, closely followed by Santander and Lloyds. Barclays has spent time and money on mobile – and it shows. The bank was first to market in the UK with a useful digital vault in which customers can access electronic statements, upload other documents by taking a photo, and set reminders. Customers can also report a card lost or stolen entirely in-app, access many personalization features and view simple money management visualizations across smartphones and tablets. Santander is close behind with a dedicated tablet app and mobile website, strong money movement capabilities and helpful in-app alert management. Lloyds came third, and still the only bank in the UK to let customers add a payee entirely in app.

(2) HSBC makes big strides forward to overtake last year's leader, NatWest. HSBC had made big improvements on its Fast Balance app and now lets customers make current and future dated transfers and payments and access key features, like its branch locator, pre-log-in. NatWest, last year's leader, has delivered fewer functionality updates in the last 12 months, but still remains the only bank in the UK to offer integrated P2P functionality pre-Paym and a useful Get Cash feature. The banks also offers excellent transaction history search and in-app alerts management.

(3) UK banks are pioneering basic mobile sales features. Last year only Lloyds TSB offered in-app product applications. This year Barclays, HSBC, Nationwide, Lloyds and NatWest all offer end-to-end applications for at least one simple product. UK banks also support the research process in mobile. Santander has mobile optimized mortgage and loan calculators with embedded product comparisons; HSBC has a Financial Health Check-Up; Barclays has a loan calculator with integrated money management visualizations; and Lloyds lets customers tailor product comparisons.

Forrester clients can read our full report here to see the detailed breakdowns of each individual banks' overall score (shown below), and where we think digital teams can drive yet further improvements. Also note that our Paneuropean companion report, 2014 European Mobile Banking Functionality Benchmark, written by my colleague Benjamin Ensor was also published this week.

Feel free to let us know what you think in the comments section. (Note: reviews for this report were conducted between the 14th and 25th April).