Understand The Digital Wallets Landscape In China

Internet giants like Alibaba and Tencent are aggressively promoting digital wallet usage via competing mobile apps for taxi-hailing. Alibaba has gone further and is cooperating with big brick-and-mortar shopping mall chains to promote mobile commerce via the Taobao and Alipay digital wallets, with the aim of boosting merchant adoption of its digital wallet solution.

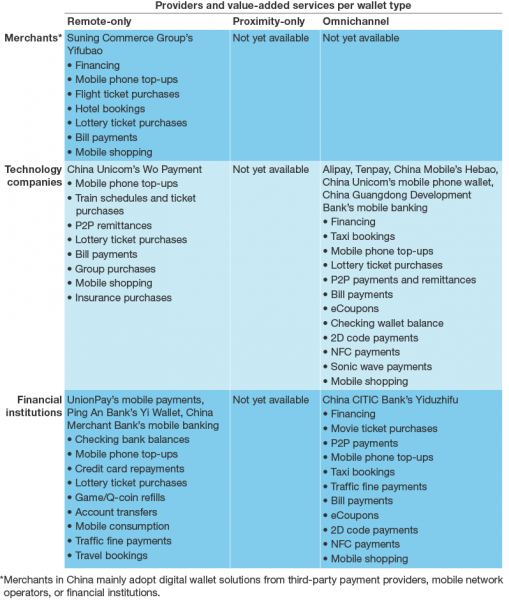

In light of the emerging trend of digital wallets in China, my first Forrester report, Understanding Digital Wallet Options For Your Business In China, introduces the digital wallet solutions that the major players in the Chinese market provide, the typical usage scenarios, and merchants’ adoption strategies. Most of the digital wallet options offer abundant value-added services as a means of attracting consumers.

The following chart shows the digital wallet options that the major players provide in China. They fall into three types: remote-only, proximity-only, and omnichannel wallets. The latter incorporates the different types, provides the most value-added services, and integrates mobile commerce, payments, and financial management in a single mobile app — giving digital wallet players the most space to deliver their services and capture consumers.

Compared with the Chinese digital wallet market, the US market is more balanced; it has a number of solutions for each wallet type. (The next chart shows the US counterparts of Chinese digital wallet players and their solutions.) In the US, merchants often provide their own digital wallet solutions, with rich value-added services. In China, merchants tend to adopt the digital wallet solutions of other vendors rather than developing them in house. Why? In China, the top three payment service providers (Alipay, Lakala, and Tenpay) dominate third-party mobile payments; in addition, the two Internet giants, Alibaba and Tencent, have cultivated the mobile payment habits of their consumers with powerful payment systems and aggressive promotions, resulting in rapid end user adoption of their digital wallet solutions. For merchants in China, using an existing digital wallet solution is a fast, easy way to start.

Although Chinese digital wallet usage has surged since the start of 2014, largely thanks to Alibaba and Tencent's taxi-hailing campaigns, it’s still at an early stage of development. Financial institutions and mobile operators are fast and powerful followers; they have a large customer base and are vigorously promoting their digital wallet services. They will be able to leverage the advantages of their established payment services to compete with the Internet companies in the long run.

The digital wallet market in China is also changing fast; more followers like Internet companies and local commercial banks are entering the fray with different solutions. New regulations and policies regarding mobile payment solutions are possible to be introduced in the future. Forrester will be tracking the online retail trends in China closely and if you'd like to participate in our research, please contact me at vzeng@forrester.com.