Follow the Money: Analyze the Impact of Economic Changes on Your Business, Then Plan Your Marketing Accordingly

- Many factors come into play when organizations assess how slow economic growth impacts the business

- Predictive analytics can estimate the impact of dynamic economic and market conditions on pipeline inflow, bookings and revenue

- Predictive analytics can even be used to find which regions and industries offer the greatest opportunities or risks

What happens to your business when economic growth slows? Many factors come into play, including the countries and industry segments that comprise your market, where you focus your sales and marketing resources, how well you communicate with customers and prospects, and how prepared you are to respond to continuous economic and market changes.

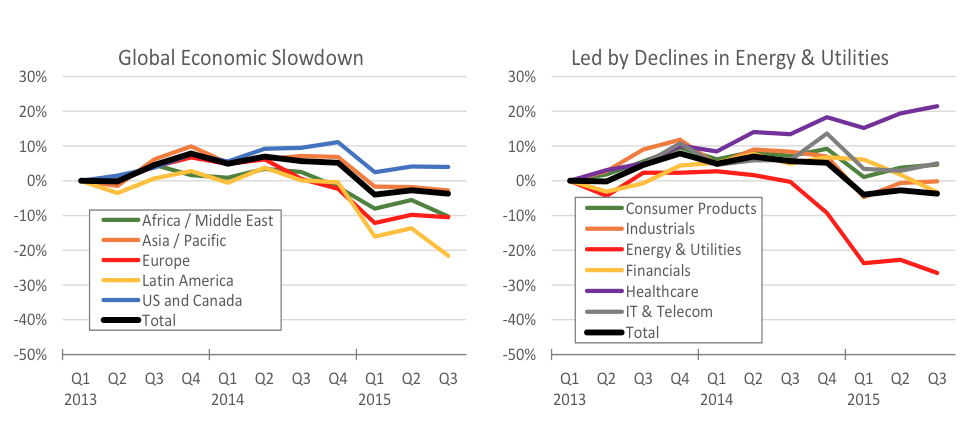

The charts below depict cumulative revenue change over the last two-and-a-half years for 10,000 of the largest businesses in the world. The first chart shows that all regions of the world have decelerated over the last year and that total revenue is now lower than it was in the first quarter in all world regions except the U.S. and Canada.

The second chart shows that the primary culprit is the energy and utilities sector. Energy prices are at their lowest level in more than a decade, forcing a severe contraction in the industry. This is rippling throughout the global economy and affecting other industries to varying degrees. Fortunately, some industries are holding up pretty well, including healthcare, IT and telecom, and consumer products.

The good news is that, as companies report fourth-quarter financial data, revenues will probably increase or at least hold steady relative to the third quarter. The bad news is that a promising fourth quarter is often followed by a tepid first quarter. But what happens after that? Will businesses shake off recent declines, significant weakness in Europe and Latin America, and slower growth in China? Or will the world economy weaken even more and drag down the few bright spots currently glimmering? Nobody really knows, but whatever happens, chances are it will affect your business.

Using predictive analytics, you can estimate the impact of dynamic economic and market conditions on pipeline inflow, bookings and revenue. To do this, you must compile internal and external data, statistically test the relationships that exist between and among various data series, and quantify the impacts of key factors that explain changes in your business. The typical specification looks like this:

| Business Metric = |

α + β1 * Market Conditions + β2 * Relative Prices + |

| β (I – j) * Marketing Tactic (I – j) + | |

| β (k – l) * Sales Activity (k – l) + | |

| β (m – n) * Other Factors (m – n) |

In this specification, the business metric could be your pipeline inflow, bookings or revenue. You can analyze selected industry segments and geographic areas. Market conditions can be constructed using publicly available data to reflect the industries and countries that comprise your target market. Relative prices can be constructed using your average selling price or average contract value, publicly available industry price indexes and broad measures of inflation. Data on your marketing tactics can be drawn from digital analytics, marketing automation and sales force automation (SFA) platforms. Data on your sales activities can be drawn from your SFA platform. Other inputs could include technological change and seasonal factors.

Once the data are compiled and the statistical analyses are completed, the estimated coefficients (that is, the β’s) can be used to calculate the impact each factor has on your business metric. And these can be structured into a simulation model that will help you test the impacts of each factor in the equation. In the case of economic and market conditions, you will learn which regions and industries offer the greatest near-term opportunity and which pose the greatest risk. Then you can allocate your marketing budget to get the highest near-term return and make adjustments as economic and market conditions change going forward.

To learn more about this analysis and how you can develop a simulation model for your business, contact SiriusDecisions.