Forecasting In Uncertainty: Too Soon To Declare The Worst Is Over In The US Tech Market Downturn

Remember the old Road Runner cartoons where Wile E. Coyote runs over a cliff chasing the Road Runner then hangs in midair for a couple of seconds before plummeting? Right now, the tech market reminds me of that cartoon. Recent tech vendor earnings and other data suggest the pandemic recession’s damage to the US tech market was not that bad and perhaps improving. For example, in August, Salesforce reported a 29% increase in its quarterly revenues ending in July compared with the same quarter a year ago, and Workday announced a 20% increase in revenues over the same period. In September, Oracle reported that its Fusion and NetSuite ERP subscription revenues in the quarter ending August 2020 were 33% and 25% higher, respectively, than a year ago (though total cloud software services and license support revenues only went up 2%, in line with growth rates over the past year). Adobe’s revenues for the same period rose 14%. And the Q2 2020 data on US tech investment released in late July was surprisingly strong.

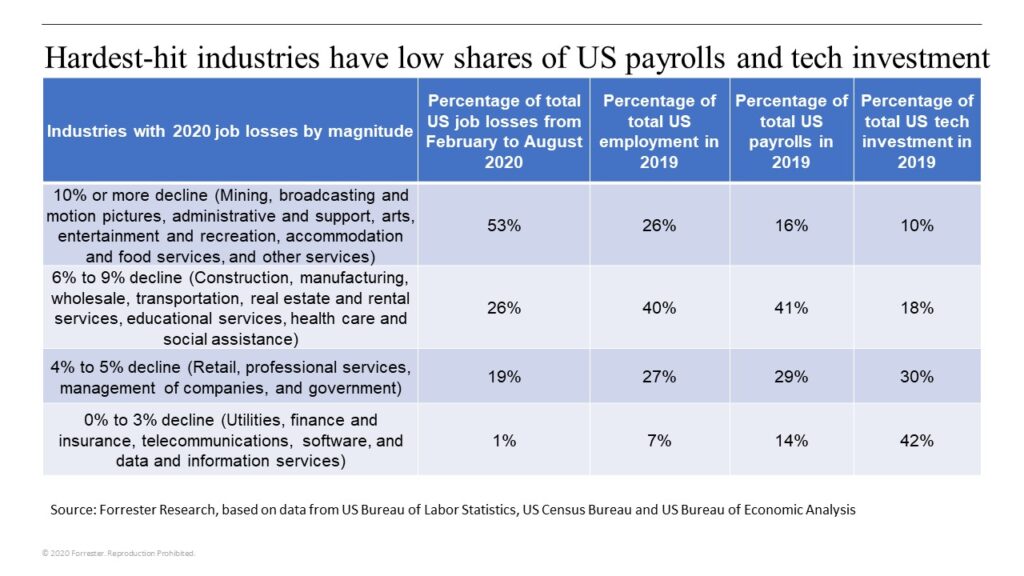

As much as all of us in the tech industry hope that this is a harbinger of a strong and rapid recovery, I think the worst still lies ahead. The US pandemic recession has so far been very different from past recessions. This recession slammed certain US industries very hard but so far has had a relatively light impact on other industries. I’ve written about this industry variation in past blogs. But US employment data in August 2020 reveals new insights about the industries that’ve been hit hard and about those that have escaped damage — so far.

- Six industries, mostly consumer services, bear the brunt of the downturn, representing only 10% of US tech investment. Using the NAICS (North American Industry Classification System) industry categories, five industries on the front line of pandemic shutdowns had the biggest job losses: (1) broadcasting and motion pictures; (2) administrative and support services; (3) arts, entertainment, and recreation; (4) accommodation and food services; and (5) other services. Mining, especially oil and gas, also had big job losses. While some employment has recovered in these industries, August numbers were still down by 10% or more from February’s peak. Their job losses equal 53% of all US jobs lost and not regained as of August. These six industries provided 26% of all US jobs in 2019. But average wages and salaries are relatively low in these industries, so their share of total US payrolls was only 16%. They include some of the most discretionary categories of consumer spending, so they remain highly vulnerable to coronavirus retrenchment or consumers feeling the need to tighten their belts. Still, they generally spend very little on technology, so they’re just a 10% share of US business and government investment in computer and communications equipment and software in 2019.

- The industrial heart of the economy, along with education and healthcare, suffered a quarter of total job losses, making up 18% of tech investment. Manufacturing and construction industries that make things and wholesale and transportation industries that move them saw job losses in the 6% to 9% range. Real estate, educational services, healthcare, and social assistance have experienced similar job losses. These industries made up 40% of total US employment in 2019 and 41% of total payroll. Some parts of these industries, such as construction and auto production, have seen good rebounds. Others, like pharmaceuticals, recreational equipment, and residential real estate, have had surprising growth. But sectors such as apparel, commercial real estate, ambulatory care services, and higher education are already weak and could deteriorate further with any resurgence in the pandemic. These industries do use technology but rely much more on other types of equipment and structures. As a result, their tech investment only adds up to an 18% share of the US total in 2019.

- Retail, professional services, holding companies, and government have seen 4% to 5% job losses, making up a third of the US economy and tech market. Retail, which was initially hard hit by the pandemic, has generally recovered quickly. Professional services such as legal, accounting, marketing, IT consulting, management consulting, and holding companies — AKA, management of companies — readily adapted to remote work when their offices shut down, and demand has held up reasonably well. Government employment has been solid at the federal level but is starting to weaken at the state and local level, where balanced budget requirements and an absence of follow-on federal support will lead to job cutbacks this fall. These industries made up 27% of US employment and 29% of US payrolls in 2019 but have only contributed 19% to the job losses in 2020. Professional services and governments are two of the largest industries in terms of tech investment, which helps explain why this group of industries represented 30% of US tech investment in 2019. Any slowdown in consumer spending will cause retailers, professional service firms, and state and local governments to cut their tech budgets more aggressively.

- Digital services sectors that have avoided job losses will have an outsized impact on the future US tech market. The industries of utilities, telecommunications, and, especially finance and insurance, software, and data and information services have seen job losses of less than 3%, contributing to just 1% to total US job losses in 2020. But they also are just 7% of total employment in 2019. Their relatively high compensation means that their share of US payrolls was twice as high, at 14%. And they are big investors in technology, making up 42% of US tech investment. The outlook for the telecom, utilities, and information industries is still pretty bright. The wild cards are financial services and insurance. US Federal Reserve support, low interest rates, the ease of supporting remote work, and the relatively strong stock market have kept these industries humming along so far. But they are heavily exposed to loan losses and insurance payouts — revenues could suffer if businesses fail or retrench. We will be watching closely for signs of layoffs, as that will be the early indicator of these industries’ potential cuts in their tech spending.