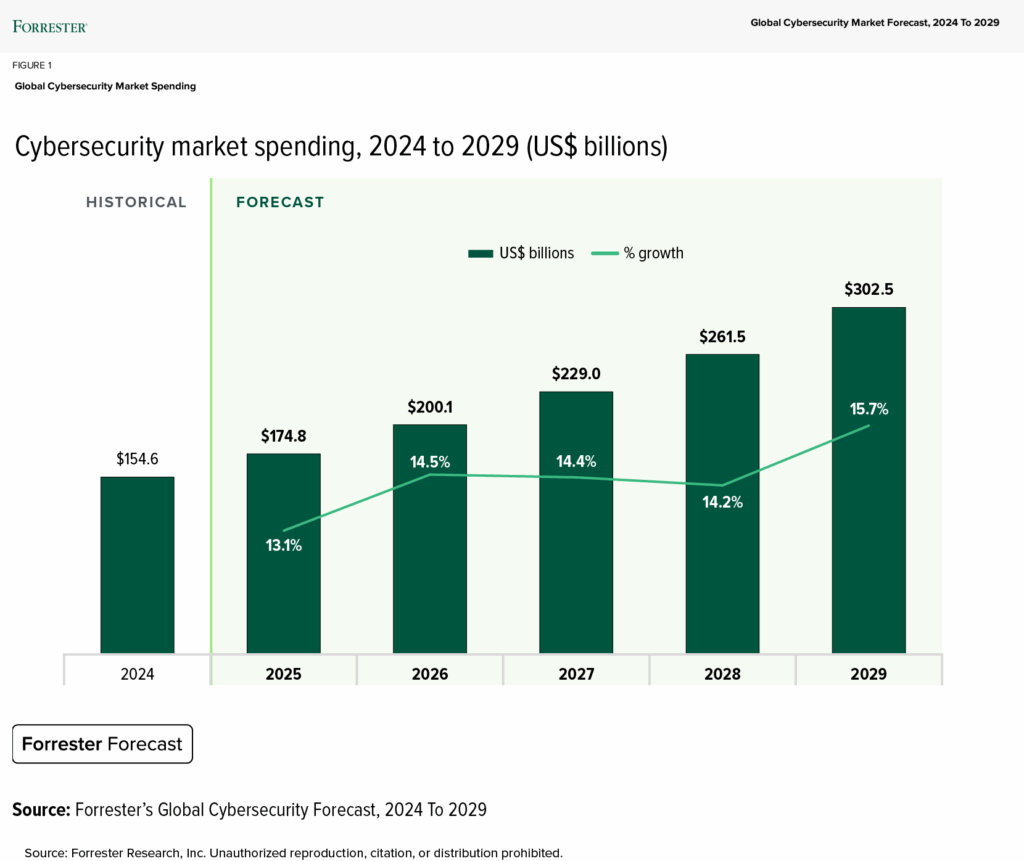

Global Cybersecurity Spending To Exceed $300B By 2029

Despite the ongoing macroeconomic uncertainty in 2025 fueled in part by sudden changes in US trade policy and tariffs, demand for cybersecurity products and services will remain a tech-spending bright spot, projected to grow faster than overall global commercial software. According to Forrester’s Global Cybersecurity Market Forecast, 2024 To 2029, cybersecurity spending will rise by 13.1% in 2025 to $174.8 billion, driven by ongoing concerns around cyberattacks and coupled with organizations’ need to secure new cloud-based deployments and other emerging technologies such as generative AI (genAI).

Forrester’s new cybersecurity forecast looks at cybersecurity spending across eight major segments:

- Application security

- Cloud security

- Data security

- Endpoint security

- Identity and access management

- Network security

- Security operations

- Security services

The forecast provides details on growth and spending for each segments over a five-year horizon. While we forecast some segments to have higher growth, several factors are driving the projected healthy growth across all these segments, including:

- Continued scale and scope of cyberattacks. Cybercriminals are not relenting in their quest to pilfer data, disrupt IT systems, or hold organizations hostage with ransomware. This requires ongoing vigilance and spending from security leaders, especially for detection, investigation, and response.

- Ongoing cloud modernization and adoption. The use of cloud and software as a service continues to grow, as does the need for solutions that can secure these deployments. The transition of legacy on-premises workloads to cloud will still take time for many orgs, and not all workloads can (nor do organizations want to) move to the cloud. This means that spending on on-premises software will persist into the next decade. The demand for flexible cloud deployment models will remain a significant catalyst driving product innovation and revenue growth in cybersecurity.

- The rise of AI. Forrester forecasts that AI software spending will grow at a compound annual growth rate (CAGR) of 21.2%, from $74.3 billion in 2024 to $194.3 billion by 2029. GenAI will capture 53% of all AI software spending by 2029, with a 34.3% CAGR from 2024 to 2029. These new AI deployments will need appropriate security and governance, which will contribute to the ongoing increased spending in cybersecurity across all eight segments.

Security leaders should monitor these trends, as they will influence and drive cybersecurity vendor spending and innovation in their respective segments — which will inform the rate of innovation and product development in those areas. This will enable security leaders to maximize the efficiency of cybersecurity spending.

Forrester clients can schedule a Forrester guidance session for more insights and to explore the narratives within this forecast.