Marketo Files for IPO

On April 2, marketing automation vendor Marketo filed for a $75 million initial public offering; its ticker symbol on NASDAQ will be MKTO.

Within the filing, key data points provided by Marketo include:

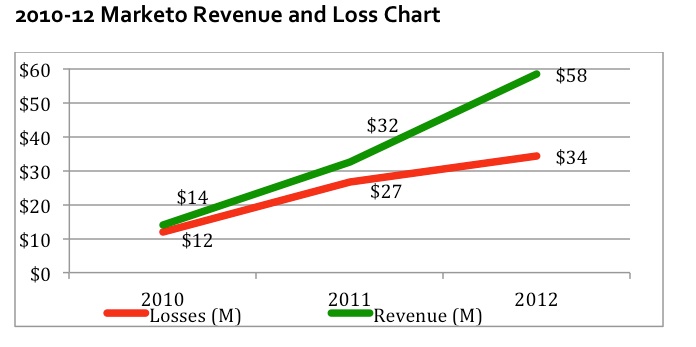

- Its net revenue amounts for 2010, 2011 and 2012 were $14.0 million, $32.4 million and $58.4 million, respectively

- Its net losses for 2010, 2011 and 2012 were $11.8 million, $22.6 million and $34.4 million, contributing to a net deficit of $84.2 million

- No single customer in 2012 represented more than 1 percent of subscription and support revenue

- 87 percent of its revenues originate within the United States

Marketo also noted some of its growth strategies and risks. Key points cited in its IPO filing include:

- New customers. Marketo plans to expand its indirect sales channels (agency and OEM) and enter new geographic markets. SiriusDecisions analysis: Expansion into new geographic locations is a sound strategy. Expansion of the vendor’s channel sales also represents a potential new revenue source, but to tap into this source, Marketo will need to expand its relationships with major systems integrators in addition to the boutique consultancies it currently partners with.

- Customer expansion. Marketo plans to increase the revenue it generates from existing customers by extending the use of its solutions and selling additional component modules. SiriusDecisions analysis: Like the majority of marketing automation platforms (MAPs), many times Marketo is used within only one division of a multi-division company, so expansion into other divisions could be a revenue opportunity. However, many organizations have multiple marketing automation platforms (e.g. Marketo, Silverpop) up and running in various divisions, often as a result of growth through acquisition, and this will limit the effectiveness of a “land and expand” strategy. As for selling additional component modules, the sale of Sales Insight, Dedicated IPs, Revenue Cycle Analytics (RCA) and Social Marketing represent a low-cost-of-sale, high-yield potential for Marketo. However, the question is what percentage of Marketo’s clients A) currently have not purchased these capabilities and B) are at a MAP and process maturity level to derive benefit from the additional modules.

- Expand into B2C. Marketo plans to expand into B2C organizations. SiriusDecisions analysis: The marketing automation platform market as a whole is pursuing this strategy. It makes sense, because the value that marketing automation can drive is not limited to B2B organizations, and Marketo already has many B2C companies on its customer roster. From a competitive perspective, Marketo must determine how easy it will be to access this target segment vs. other marketing automation platform vendors, notably Pardot (recently acquired by Exact Target) and Eloqua (recently acquired by Oracle), both of which now have strong connection points with B2C companies.

- Sales force automation (SFA) platforms. Marketo has noted that if it is unable to maintain a strong relationship with SFA vendors (notably Salesforce.com), its operating results will suffer. SiriusDecisions analysis: To receive the full benefit of a marketing automation platform, a company needs to have a bidirectional integration between its MAP and its SFA system. The impact that a deteriorating relationship between a marketing automation platform and SFA vendor could have on an end customer was widely discussed after Oracle’s announcement of its acquisition of Eloqua. At the time, there was significant concern that Eloqua could stop supporting Salesforce.com (a known Oracle foe, to put it bluntly) or supporting Salesforce.com integrations at existing quality levels. We do not view this as a significant risk factor for Marketo, unless a marketing automation platform is purchased by one of the SFA vendors whose systems it frequently integrates with. Of concern is the potential that Salesforce.com or Microsoft CRM may choose to enter the marketing automation platform arena. We exclude Oracle from this statement; although Marketo can and does integrate with Oracle, Oracle integrations with Marketo represent a small percentage of client integrations.