MDF: Three Small Letters That Cause Big Headaches, Part II

- As budgets and resources tighten, so do partner marketing funds

- Channel marketing must justify all MDF spend and measure the channel marketing influence and contribution

- Organizations must guarantee they have the required information to make informed and valid decisions

After my previous blog post on market development funds (MDF), it’s now time to diagnose some of those symptoms that are causing the “MDF headache.” As budgets and resources tighten, so do partner marketing funds, and it’s no longer acceptable to simply look at performance metrics – such as campaign downloads, number of participating partners and MDF utilization percentages – to show the return on investment. Today, channel marketing is being asked to justify all MDF spend and measure the channel marketing influence and contribution, as well as the overall channel marketing investment to pipeline.

In the past, MDF programs had not been under such scrutiny, and the shift is causing additional process, measurement and operational headaches. Couple this with some of the key issues that I mentioned in my last post, and organizations need to constantly question how to achieve an end-to-end, best-in-class successful MDF program that drives required behaviors and results.

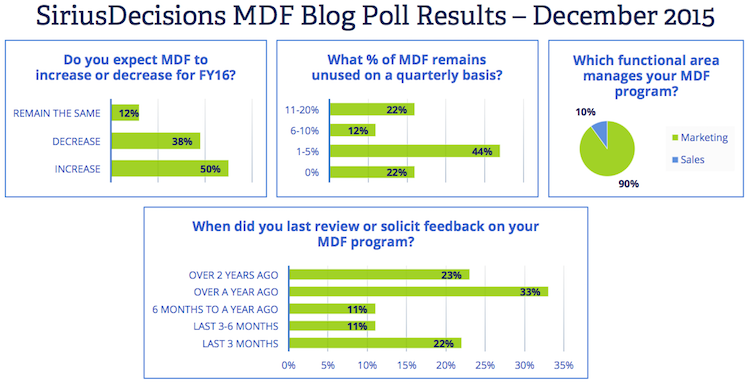

After reviewing the poll results of my last post, I was surprised to find the amount of MDF funds that still remain unused on a quarterly basis – with 78 percent of responders reporting that they still have funds remaining unused. Of those responders, 22 percent report that this can be as high as 20 percent left remaining on the table! A lot of usage challenges come from cumbersome approval processes and red tape, painful claim and audit requirements, and a lack of effectively packaged marketing activities.

Through extensive research, we have uncovered the most effective means for delivering lead-generating programs through indirect channels that deliver the highest adoption and ROI. The Fast-Tracking Demand Creation in B2B Channels roadmap provides a continuous process that drives partner engagement and improves partner performance when organizations deliver supplier-created marketing programs.

Another constant we see with MDF programs is that you can always expect change! With 88 percent of survey respondents reporting that their MDF amount would change in the next fiscal year, 50 percent see that change as positive (i.e. an increase in the funds). However, 38 percent expect the funds to decrease. Quite often, funding variations are due to changes in business strategy, routes to market or offerings. Suppliers that can measure their MDF contribution to channel pipeline and revenue can inform future funding decisions and secure the funds they need to meet their channel marketing and sales objectives.

Whether formalizing and optimizing an existing MDF program or looking to implement a new one, organizations must guarantee they have the required information to make informed and valid decisions about what a best-in-class MDF program looks like for them and for their partners.

Thank you to everyone who participated in my last poll. I hope you’ll help me diagnose MDF pain points and symptoms by completing the new poll on this page. I will present further findings in my next blog post in this series and also identify the key priorities as to how you can get some relief for your MDF headaches. Be sure to also attend SiriusDecisions Summit 2016 to learn more about the evolution of channel incentive programs!

Be a part of the results. Take our survey!