What’s My Data Worth?

That question seems to come up often. I know I’m sitting on valuable data but I’m not sure just how valuable. When it comes to using the data internally to improve operational efficiency or service delivery, the resulting cost savings demonstrates the value. Or when using the data to identify new customer opportunities, either upsell to existing customers or identifying potential new customers, the resulting revenue generated demonstrates the value. But what if I want to take the data to market? What’s the data worth? That question is harder to answer, but not impossible.

That question seems to come up often. I know I’m sitting on valuable data but I’m not sure just how valuable. When it comes to using the data internally to improve operational efficiency or service delivery, the resulting cost savings demonstrates the value. Or when using the data to identify new customer opportunities, either upsell to existing customers or identifying potential new customers, the resulting revenue generated demonstrates the value. But what if I want to take the data to market? What’s the data worth? That question is harder to answer, but not impossible.

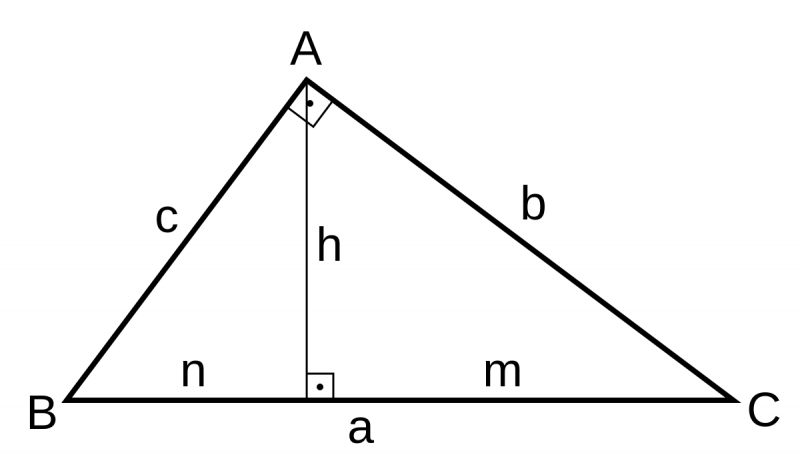

The first question I’d ask myself is what I already know. What are the givens in the equation? Think back to a math course. You are trying to solve a problem. What have you been told? In fact, I’ve been doing math with my son and that exercise has helped me in framing the approach to pricing data. We know the length of one side of the triangle, and we know the relationship with the other sides. While we don’t know the length of all sides we know enough to figure it out.

First though, if you’re going to sell the data itself that means you are looking for a customer who can derive a value from the data itself. That customer must be data-savvy but might not necessarily know what to offer for the data or even the value he will accrue from it. But that value may be similar (or in some way related) to what you’ve accrued from the data internally. The pricing exercise in this case is to identify the potential use cases and demonstrate the potential value to the end customers, helping them estimate the value in their particular context. The “given” in this equation can start with your own cost saving or revenue generated and then adapting those to the new context. In other cases, the starting point is based on a proof-of-concept. Then once you have a pool of customers using the data, the model for estimating the value in a given use case will be more robust. You can identify average savings or estimate the likelihood of achieving those savings.

Another approach is to sell the insights derived from that data. And, there are many examples of this happening today. One of the early examples is Lexis-Nexis with their legal spend management software, CounselLink. Now they offer CounselLink Insights: are you spending too much on outside counsel? Do you have more workers comp claims than other companies in your industry of your size? Software as a service has enabled this type of benchmarking to take off: data across companies has common elements in common formats, and can be aggregated and analyzed. Another example is Siemens Mobility offering insights into train conditions to better predict maintenance requirements, facilitate scheduling, and improve availability for better customer experience. These valuable insights can be offered as a subscription service, or bundled with implementation support.

Determining the value of these data-derived insights services is similar to valuing the data itself. What is the value accrued to the end customer? Not sure? Then estimate based on what you know or can estimate?

- Savings generated times the likelihood of achieving that savings.

- Revenue generated times the likelihood of earning that revenue.

With a vast fleet of trains under management, Siemens knows that predicted and scheduled maintenance is cheaper than a breakdown at some unforeseen time. An analytical model can predict those maintenance needs accurately (increasingly the likelihood of the savings). Do the math and estimate the value over time based on the size of the fleet. Maybe sprinkle something in for better customer experience due to fewer breakdowns and higher availability of trains.

Having competitors allows price comparisons but some data products and services are first to market. Others are not sold directly but rather through business partners. In those cases, pricing can be a collaborative effort and revenue-sharing or outcome-based pricing enables risk-sharing. The value of data may be an unknown but it isn’t necessarily unknowable. It’s time to do the math.