Authors:

Christopher Gilchrist, Bobby Cameron, Matthew Guarini, Liz Herbert, and Ted Schadler

Contributors:

Rachel Kwon, Keith Johnston, Sharyn Leaver, Michael Kearney, and Ian McPherson

Steadfast Technology Decisions Delivers Business Value

Uncertainty comes in many forms. We are still facing the pandemic’s long shadow. Geopolitical strain is expanding from the Russia-Ukraine war to the recent China-US tensions over Taiwan. Inflation and challenged supply chains are driving economic strife. Despite these issues, 67% of IT decision-makers who responded to Forrester’s Budget Pulse Survey, 2022 anticipate increasing tech budgets over the next 12 months, with 26% expecting more than a 5% increase in their tech budget. As we saw in the pandemic, pragmatism and opportunism are outpacing fear, with companies turning to technology to deliver new customer value. We expect the same in 2023. So, for the year ahead, the question is: Where should the successful technology executive focus?

Benchmark Your Budget Growth

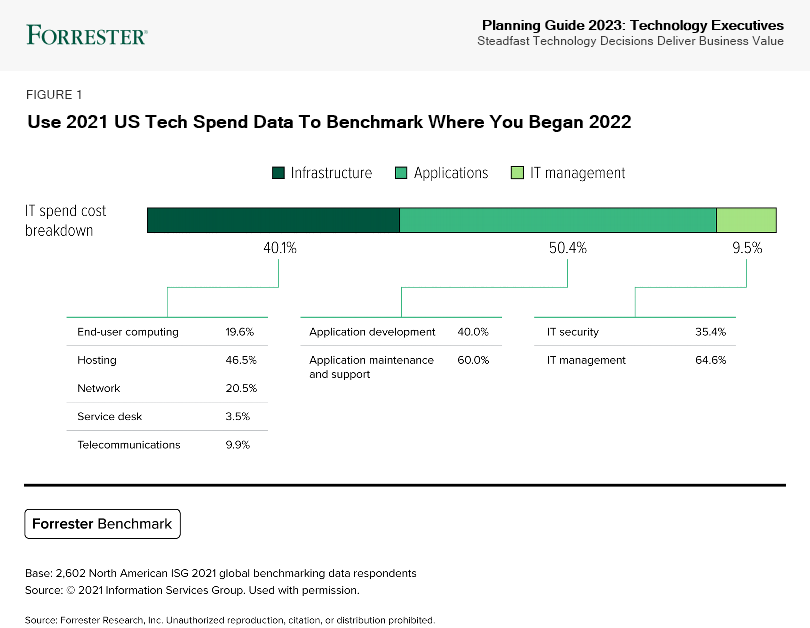

Forrester’s research has seen an acceleration in tech spending since the start of the pandemic. US tech spending increased 9% in 2021 and is projected to hit 7.2% year-over-year growth by the end of 2022. Companies have accelerated their move to digital, with IT organizations continuing to align technology architectures to close the digital divide across the enterprise. Forrester, in partnership with Information Services Group (ISG), tracks tech budgets across the three major spend categories: infrastructure, applications, and IT management (see Figure 1). Each of these categories includes IT’s spend on personnel, hardware, software, outsourced services, and other costs. For 2022, the major budget considerations for tech execs include:

- Infrastructure spend comprises 40.1% of total IT budgets. Momentum keeps building toward a cloud-first, platform-based technology strategy to simplify integration, accelerate innovation, and speed delivery. In 2021, digital investments soared as companies raced to support customers and employees in the unique circumstances brought forth by the pandemic. These investments have continued: Of the respondents to Forrester’s Priorities Survey, 2022, 39% reported their organization’s cloud infrastructure and development services investment grew. In addition, investments in platforms that scale across the enterprise and in partner ecosystems have shown no signs of slowing.

- Software and applications corner 50.4% of the tech exec budget. While cloud and digital transformation investments accelerated, tech execs took significant steps to modernize and uplevel their application portfolios. Forrester’s research shows overall software spend growing at a compounded annual growth rate (CAGR) of 10.3% through 2022, more than twice the CAGR of all other tech spending combined. Enterprise software is set to grow even faster than overall software, with 12% year-over-year growth projected by the end of 2022. Tech execs are currently treating software and application investments as mission-critical and vital to customer delivery.

- IT management costs are 9.5% of the total tech budget. While personnel costs are embedded within the applications and infrastructure budgets, it is important to note that a large and growing part of spend for tech execs is the management team. As tech becomes increasingly more common and complex, it is increasingly critical for deeper specialization and an increased scope and scale in today’s leadership. From 2020 through 2022, Forrester has seen IT management costs grow at 6.9% per year in the US.

- Tech services spending continues to grow. It’s worth noting that tech execs continue to increase spending on outsourced services associated with all three of these categories (infrastructure, applications, and IT management). Forrester’s research shows technology services are rebounding from the pandemic, projecting growth of 6.3% ($850 billion) globally by the end of 2022. Why so much? To keep up with the frenetic pace of business change and digital demands sparked by the pandemic.

Increase And Defend Investments That Drive Long-Term Value

No matter what happens in the broader economy or in your sector in 2023, the need to rapidly translate technology decisions into business value has never been more important — e.g., when during the pandemic, Verizon Business took only four months to launch a digital solution that allowed new business customers to purchase wireless devices entirely online. To get it right in 2023, technology executives must keep their company’s customers’ needs and expectations central, aligning technology investments with the same risk and opportunity calculus as the business itself. Use the 2023 planning cycle to strengthen the continuity between tech investments and strategic business objectives. To do so, increase and defend budget for:

- Infrastructure and apps tied directly to revenue generating opportunities. As organizations break out of traditional IT models, they expect their tech execs to take a stake and partner with business leadership to align tech strategies with the delivery of long-term customer value. For 2023, tech execs should accelerate tech spend toward cloud platforms, value-driven practices, and carefully selected strategic partners. This will enable your organization to adapt quickly to address rapidly emerging business opportunities or to recover from unexpected crises. Focus funding on areas where technology dependencies affect customer touchpoints the most. Allocate these investments to modernize infrastructure and the application portfolio directly linked to customer-facing business services.

- CX and employee productivity capabilities. Use the critical business capabilities as your guide, linking funding for tech initiatives with strategic business outcomes. According to Forrester’s 2022 data, 46% of business and technology professionals at future fit organizations see linking investment initiatives to strategic business objectives as a critical priority in the next 12 months. Focus funding on where technology delivery impacts business capabilities the most. Allocate these investments to front-office capabilities that improve customer experience and employee productivity. Specifically, extend platform integrations, expand CRM capability, and further leverage business intelligence suites.

- IT operating model performance improvements. Planned changes to your business capabilities demand more of your IT operating model. According to Forrester’s 2022 data, 49% of respondents at future fit organizations see improving their IT operating model performance as a critical priority in the next 12 months. Set aside spending to rebalance the efficiency and effectiveness of your IT operating model with high scale and low reuse cost in mind. Process automation and operational redundancy to support critical business services are top priorities. Specifically, integrate RPA/ML/AI into high-throughput environments like transactions and analytics. Consolidate the database, middleware, and service layers of the tech stack to find further efficiencies and increase effectiveness of delivery.

Jettison Spending That Does Not Move Value Forward

With seemingly endless amounts of tradeoffs, tech funding can quickly become distracted and ineffective. And for those organizations hunkering down and fearing the worst from a recession, doing nothing may seem the best path forward. Instead, future fit technology executives are taking a cost-to-value approach to keep tech spending directly tied to the delivery of business objectives and customer value. According to Forrester’s Budget Pulse Survey, 2022, 80% of IT decision-makers ranked aligning IT performance and investment initiatives to strategic business objectives and outcomes as a high or critical priority. Adopt this approach to empower your organizations to navigate any crises most effectively. For most of you, this means you should pull back on:

- Projects that aren’t delivering customer or employee value. We all have them — projects that we are executing with no direct links to clear customer or employee outcomes. Use the current levels of looming uncertainty to cut projects that yield too little value. Ensure that your portfolio follows their lead by keeping it focused on improving customer and employee digital engagement. And, like Oshkosh Corporation, leverage a strategic portfolio management practice to build transparency that helps you evaluate the full set of tech-based initiatives and make the right decisions.

- Redundant, early cloud implementations. Where many thought the cloud would be the antidote to technical debt, the truth is that inadequate governance, misdirected investments, poor coordination, and failure to manage change continuously increase cloud redundancies and waste. This is an easy win for cost savings and efficiency gains. A leaner cloud portfolio will also allow you to consolidate vendors while improving monitoring and addressing vendor viability and poor ROI issues. An example of the wrong practice? One large Forrester client told us that they have only one resource to do vendor management across their SaaS and cloud investments, making it impossible to monitor and manage performance.

- Technical debt. The shadow of technical debt grows longer all the time. According to Forrester’s 2022 data, 55% of respondents at future fit organizations view upgrading, refreshing, or consolidating business apps, hardware, and software infrastructure as a critical priority. Entering 2023, minimize legacy investments as an intentional part of your planning. Keep mission-critical enhancements like regulatory responses but postpone less important spending like digitization of terminal emulation. And yes, maintain a laser focus on prioritizing technical debt reduction. For example, many clients are struggling with doing a point upgrade to an old, on-premises ERP as their plans for real modernization are further out. Most should live with their current version and save the money and effort for the inevitable — and higher payoff — modernization to the cloud looming.

- Bloated apps contracts and pricing. Uncertainty is destabilizing some software markets. Established software companies are struggling to deliver the returns required by their valuations, while emerging software companies are struggling to survive. For example, a large enterprise apps vendor has aggressive midterm targets to cut costs by moving its customers off legacy products. And in financial services, there has been a surge of startups willing to cut deals to maintain funding. Use this discord to your advantage by renegotiating prices where possible and pushing for subscription-based or even consumption-based pricing. Further, look for opportunities to reduce first-year charges, expand seats, optimize contract terms, and improve other contract dimensions that improve your business. In addition, look for ways to optimize your tech stack by rationalizing investments.

Experiment With Value As Your Compass

It is hard to swim against the tide, but it can be worth it. For 2023, take the time to place bets but focus them more on the pragmatic than the dynamic. We all want a moonshot, but it’s often pragmatic innovation that yields growth. Focus on proving out technologies, concepts, and capabilities that can directly impact the top or bottom line. Use experimentation as an opportunity to uncover where the IT organization becomes more valuable to the business. Focus experimentation on:

- Pragmatic innovation that drives the employee experience (EX). Make this the starting point to look for opportunities where you can tap into established technologies like machine learning, AR/VR, and automation to drive increased efficiency and effectiveness. For example, the CIO in a large US city has brought an EX-specialist onto the leadership team to improve self-service apps for the city’s employees, reducing demand on the tech organization. As this approach requires reassessment of current and near-term funding, consider a value-driven adaptive governance practice to speed the shift, making you more future fit.

- The right balance of co-innovation partnerships. For future fit organizations, the days of owning all the strategic assets, processes, and innovation thinking are ending. Build your future by trimming the non-strategic partnerships and creating a series of strategic co-innovation partnerships that help you identify opportunities, scale capabilities, and orchestrate better and faster results to the business. Consider building value-aligned term sheets, including metrics for agility, velocity, and skills transfer. Inventory your existing partners to find out which ones generate the most value — not just the ones you spend the most money with. For example, you might that find the best co-innovation from your modern application development partner rather than your lift-and-shift cloud migration partner. Sometimes they are one and the same. HCL, for example, worked with a telecom equipment customer to fund cloud migration in part with savings in operating costs, but also refactored applications to take advantage of modern applications for key platforms.

- Existing emerging tech use cases. Rather than shutting down more forward-thinking ideas, reassess the way you think about and deploy them. The financial industry is starting to realize practical use cases for distributed ledger technology (DLT), with payment processing, interbank transfers, anti-money laundering, and clearing and settlements delivering real value today. Furthermore, more than a hundred DLT use cases across all major industries have emerged in China, such as supply chain finance, asset attestation and protection, distributed identity, product provenance, digital asset management, and privacy-preserving computing. In China, CATL, COMAC, and State Grid are embracing metaverse precursor solutions to expand digital twins for virtual operations; meanwhile, Burberry, Coca-Cola, and Tesla are activating virtual marketing to attract novelty-seeking customers.

More From Forrester

Modernize your tech faster with cloud. Learn the most common approaches that IT teams are using to modernize applications with cloud and how to work around common constraints.

Supplemental Material

The ISG data used in this report was collected in 2021 from a selection of benchmarking, strategy/operating model, and outsourcing advisory projects fielded by the proprietor. The data from ISG’s Inform database is an aggregate of 6,000+ projects across Asia Pacific, EMEA, Latin America, and North America with topline benchmarks representing around 4,000 company data points and drill-down benchmarks representing around 200-700 company data points.