Takeaways From The Yahoo! Investor Day: The Focus Moves To Display Monetization

I spent last Wednesday at the Yahoo! investor day conference in Silicon Valley where Yahoo! execs outlined the future of one of interactive marketing's largest players. Yahoo! spent a large part of the day on its content and audience, touting its efforts in customization, mobile, and social integration and demoing a slick and creative web-based email client for the iPad. It was nice to see Yahoo! show off some content innovation, but what I (and I suspect many of the financial analysts in the room) were really interested in was Yahoo!'s approach to advertising and its revenue projections. That's not to say keeping and growing its audience isn't key to Yahoo!'s advertising offering. Yahoo! is as close as the web has to a "must buy", TV-scale property and that in and of itself is a strong incentive for media buyers to keep pumping dollars its way. Still, the future of Yahoo! as well as the broader online media industry isn't just about obtaining the largest audience, it's also about effective monetization.

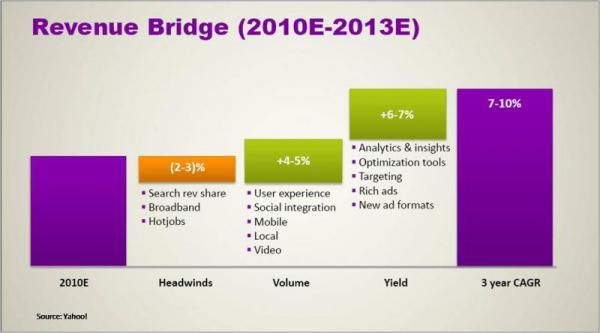

Yahoo!'s own projections bear this out. Let's take a look at some numbers presented by Yahoo! CFO Tim Morse:

That +4-5% number labeled as "volume" is what Yahoo! expects to get from its content and user experience initiatives. The +6-7% that Yahoo! labels as "yield" is all about monetization. Yes, scale and audience engagement are going to be significant contributors to Yahoo!'s revenue growth, but even more important will be convincing marketers that an ad on Yahoo! is worth more than it is today. Some of this will come simply as the economy turns around and demand for advertising grows. Still, it's going to take more than just passive efforts from Yahoo! to hit its projections. So how can Yahoo! do this? I see two core components:

- Enabling creative online advertising to shine. Much discussion of "brand-friendly" online advertising focuses on keeping banner ads away from uncontrolled social environments, pornography, and other forms of undesirable content. Content quality is undeniably part of the equation for many brand marketers, but the fact remains that few online publishers offer the same rich, medium-appropriate creative experiences common on TV and in print. Static banners and standard rich media placements aren't enough for many top brand marketers. Yahoo! is responding by emphasizing its in-house creative services and opening up new areas of its site (such as the log-in page) to rich media advertisements and bold full-page takeovers.

- Executing on technology investments. As Yahoo! focuses on better serving high-CPM brand advertisers, it can't afford to takes its eye off the bigger picture. Higher-value creative will only affect a small slice of Yahoo!'s inventory and Yahoo! will have to find more efficient and effective ways to target customers using both its own data and third-party information all while preparing for the complex value-chain of "bid-based" display media buying. Yahoo! reports already seeing some yield improvements through the implementation of its Right Media exchange for non-guaranteed inventory and audience-based sales efforts; however, reaching its goals will require Yahoo! to roll out similar improvements on the guaranteed inventory side. This begins with the implementation of Yahoo!'s long-awaited APT platform across all US guaranteed inventory. This will allow Yahoo! to not only better target audiences and forecast inventory availability, but should also enable Yahoo! to optimize for publisher yield across guaranteed and non-guaranteed buys.

For Yahoo! to thrive again, it is going to have to both maintain its leadership in serving brand advertisers as well as execute on its advertising technology initiatives. I'm confident Yahoo! will succeed on the former, but Yahoo!'s recent history has left me somewhat skeptical of its ability to execute in the ad technology arena. So will Yahoo! buck the trend this time? It might not have a choice. The online media ecosystem is entering a period of tremendous change, both for the marketer but even more so for the publisher. New methods of media buying will necessitate new methods of media selling and online publishers need to be prepared. Be on the lookout for more research on this topic coming soon.