Bank of America seeks to evaluate user experience, not technology, with mobile payments pilot

Later this month, Bank of America will roll out a mobile payments trial to its employees in the New York metropolitan market. One of the primary goals of the pilot is to understand the user experience expectations of potential mobile payments customers, according to Michael Upton, Bank of America’s executive leading the initiative. The trial involves outfitting users’ phones with a microSD card that supports contactless payments based on near field communications (NFC) technology.

This is not the first large trial of contactless payments. Citi, Chase, and other large US banks have invested millions of dollars in trials of NFC programs launched by MasterCard and Visa. These efforts, though, have relied primarily on chips embedded in the user’s credit or debit card. Citi earlier this year also introduced an NFC sticker that users can apply to their mobile phones, alleviating the need for a physical card. The Bank of America pilot takes this a step further by including a mobile wallet application that can support multiple payment cards. Users could, for example, make contactless payments from their Bank of America, Citi, Chase, and American Express accounts all through a single mobile app.

Are consumers ready to ditch their plastic? What has changed in the mobile landscape that makes now the right time for such a trial? Upton admits that the pilot is less a confirmation that the technology has matured far enough than it is an acknowledgement of how rapidly mobile devices have become a mainstay in consumers’ daily lives. The bank is looking to gauge whether consumers’ current love affair with smartphones is enough to change card payment behaviors that date back more than 50 years.

Curiously, the microSD solution that Bank of America is leveraging leaves out iPhone users, due to Apple’s lack of support for the industry-standard storage device. Given that the iPhone offers what is arguably the best mobile user interface available today, this seems like a big gap if a primary goal is to understand consumer expectations around mobile payments and the use of a mobile wallet application. Indeed, nearly 50% of current iPhone users indicate that they are interested in mobile payments, as noted in Forrester’s recent report on consumer mobile payments adoption. To be fair, the bank’s hardware partner in the pilot, DeviceFidelity, does offer a solution for iPhones, but it is an inelegant one involving a special case with a built-in microSD card slot. No word yet on whether the case cures the iPhone 4 antenna problem!

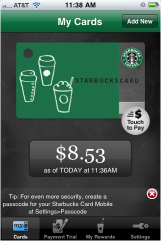

To build any sort of momentum behind consumer use of a mobile wallet solution, banks need to convince customers that using a mobile wallet can be as simple and convenient as swiping a plastic card — something mobile developer mFoundry was able to show Starbucks stored value customers earlier this year. Of course, delivering a world-class user experience is just one part of consumer acceptance, and use, of mobile payments. Even if Bank of America’s pilot proves to be hugely successful, it still must address consumer concerns about mobile security and privacy – as well as competitive issues regarding control of the mobile wallet application itself – before any broad consumer rollout could be contemplated. Perfecting the mobile wallet user experience may well turn out to be child’s play compared with these Renaldo Nehemiah-worthy hurdles.