Steady Mobile Banking Growth To Drive Demand For Better Functionality

Mobile banking growth in the US continues to be fueled by aggressive adoption of smartphones and regular mobile web use. The problem with this scenario, as noted in my new report, US Mobile Banking Forecast, 2010 To 2015, is that consumers are still struggling to figure out exactly how they will use mobile banking. Lacking any clear differentiated functionality, mobile banking appeals most strongly to those consumers already inclined to use the mobile channel. Unfortunately, this segment is dominated by those already using online banking. As a result, banks are not realizing the full benefit of switching customers to cheaper servicing channels, but instead are seeing cannibalization of one low-cost channel (online) by another (mobile).

To reach one in five US adults, as Forrester predicts mobile banking will do by 2015, US banks will need to enhance today's functionality significantly to create a unique value proposition that resonates with both online and offline consumers. This can be achieved in several ways:

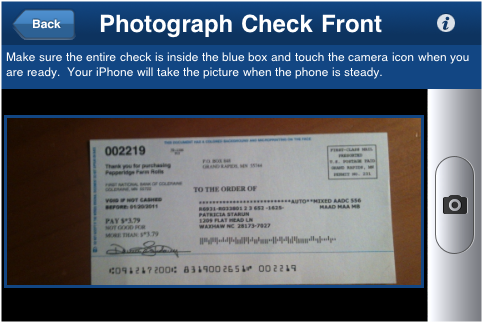

- Introducing innovative new features — like mobile remote deposit capture — not commonly available through other channels

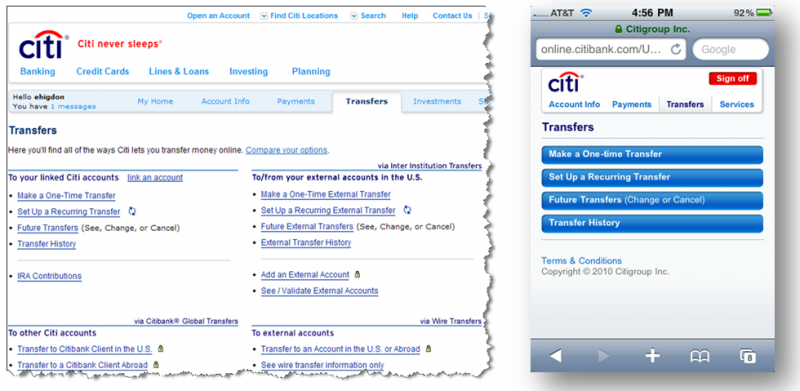

- Optimizing existing functionality to offer superior user experiences through the mobile channel

(which of these transfer interfaces would you rather use?)

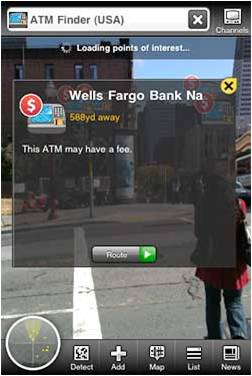

- Leveraging the unique capabilities of mobile devices and the mobile channel (think visual ATM locators and other location-based services)

Changes such as these will make the value of banking through the mobile channel readily apparent in a way that generic "bank anytime, anwhere" pitches cannot. The real ROI from mobile banking will come from engaging the 40% of US consumers who today do not bank online. Simply replicating today's online banking functionality will not get the job done.