PaaS Is Entering The Next Business Maturity Phase With AT&T

Forrester has done quite a number of reports in the last two years around platform-as-a-service (PaaS) from the long-term strategy perspective from me and from the application developer perspective from my friend John R. Rymer. During this time, we saw many different business cases around PaaS. We have predicted and quantified that the major buying power of PaaS will come out of three camps:

- ISVs are buying PaaS technology. This is a model that we saw with many ISVs on major platforms that managed to create a viable marketplace such as salesforce.com's AppExchange and Google's marketplace.

- Corporate application developers are using PaaS to deploy custom apps and add-ons around SaaS applications. They are doing this significantly faster and at a lower TCO than before.

- Telcos and IT service providers are using PaaS to create value beyond infrastructure. Telcos are either hosting SaaS applications or simply allowing customers to create their own custom apps.

The key difference between the first two cases and the latter one is the following: In cases one and two, the PaaS technology is sold or “subscribed” to the ISVs or IT user companies directly. In most cases, the creator of the PaaS technology stack operates the platform exclusively. Force.com and Microsoft's Azure are great examples of this situation. (Let's forget about the Azure appliance for a second, which is only hosted in a single instance outside Microsoft today.)

In contrast to this, the third case is a channel approach! If multiple large telcos or IT service providers are hosting PaaS technology stacks, even innovative smaller PaaS providers can be extremely successful without investing in their own operations and infrastructure. They found a channel partner with these telcos. Frankly, this model was a bit behind my expectations for the past 1.5 years. Only after Cordys announced partnerships with Getronics (KPN) and Fujitsu, did I know that the PaaS technology would work in a channel model as well. However, it was still not a large volume business.

In contrast to this, the third case is a channel approach! If multiple large telcos or IT service providers are hosting PaaS technology stacks, even innovative smaller PaaS providers can be extremely successful without investing in their own operations and infrastructure. They found a channel partner with these telcos. Frankly, this model was a bit behind my expectations for the past 1.5 years. Only after Cordys announced partnerships with Getronics (KPN) and Fujitsu, did I know that the PaaS technology would work in a channel model as well. However, it was still not a large volume business.

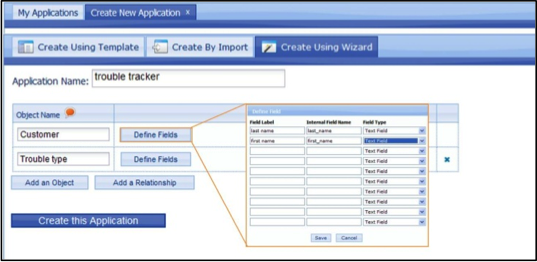

The market situation is significantly changing today: AT&T announced its PaaS offering – a very simple, easy-to-use environment for tech savvy business people. AT&T has the potential to get into a real volume business with this offering bridging the gap between consumer style services and corporate usage of PaaS – similar to what Google managed around email and the rest of Google’s applications. AT&T managed to combine its core strength around network and hosting infrastructure, identity, and billing with the PaaS technology stack from Longjump. This is not only a smart value proposition for end users and even smaller ISVs focused on business applications; it is also a very promising advent of channel-based go-to-market models for the PaaS players that may license their stack to telcos such as Longjump, Cordys, Servoy, WorkXpress, OrangeScape and others recently compared in the Forrester Wave™.

Please leave a comment if you believe PaaS is a direct, self-managed model such as Force.com or a channel model such as Longjump managed and extended by AT&T.