Innovation Lessons From BBVA

I spent Tuesday and Wednesday at Forrester’s European Customer Experience Forum in London, which was based on the theme of Outside In, Forrester’s new book. One of the most interesting sessions I attended was ‘The Customer Centric Bank’ from Gustavo Vinacua, Innovation Center Director at BBVA’s Centro de Innovación in Madrid.

I spent Tuesday and Wednesday at Forrester’s European Customer Experience Forum in London, which was based on the theme of Outside In, Forrester’s new book. One of the most interesting sessions I attended was ‘The Customer Centric Bank’ from Gustavo Vinacua, Innovation Center Director at BBVA’s Centro de Innovación in Madrid.

Over the past decade, BBVA has worked hard to become more customer centric and match its offerings to its customers’ needs. Given the pace of technology change, customers’ rising expectations and the digital disruption those forces cause, innovation is a critical part of the role of eBusiness and channel strategy executives. I thought I would share a few of Gustavo’s insights here for those of you who couldn’t attend. BBVA has become systematically innovative, launching a continuous succession of innovations many of which were a first in Spain, in Europe or in the world, such as:

- Tú Cuentas money management. In late 2008, BBVA became one of the first banks in Europe to introduce online money management (PFM), introducing a series of innovations. Its online personal finance management service, then called Tú Cuentas, let the bank’s online customers see their account balances and transactions from different providers in a single place, categorize their transactions, and benchmark themselves against their peers. It also makes personalized product offers and let customers tailor the layout and functionality. The service was built in partnership with Strands. (Forrester clients can read our case study).

ABIL next-generation ATMs. BBVA in Spain is deploying a radical new design of touchscreen ATMs across its network. These ATMs, known as ABIL, were designed in partnership with global design consultancy IDEO based on a detailed study of customers’ needs and observations of how people behaved at ATMs in branches in Spain, Mexico, and the US. The ATMs sit tilted in a white cradle that floats out from the wall to accommodate people with disabilities. The ATMs have a multi-purpose shelf for setting down personal items or signing paperwork, and a privacy shield. Customers stand at 90° to people waiting in the queue, shielded by a frosted panel. All activities are conducted on a 19” touch screen. All deposits, cheques, cash, statements and receipts are handled in and out through a single slot, eliminating the complexity of standard machines. A virtual teller named Hero greets customers to guide them through transactions, instead of the usual text prompts.

ABIL next-generation ATMs. BBVA in Spain is deploying a radical new design of touchscreen ATMs across its network. These ATMs, known as ABIL, were designed in partnership with global design consultancy IDEO based on a detailed study of customers’ needs and observations of how people behaved at ATMs in branches in Spain, Mexico, and the US. The ATMs sit tilted in a white cradle that floats out from the wall to accommodate people with disabilities. The ATMs have a multi-purpose shelf for setting down personal items or signing paperwork, and a privacy shield. Customers stand at 90° to people waiting in the queue, shielded by a frosted panel. All activities are conducted on a 19” touch screen. All deposits, cheques, cash, statements and receipts are handled in and out through a single slot, eliminating the complexity of standard machines. A virtual teller named Hero greets customers to guide them through transactions, instead of the usual text prompts.  Development began in 2006, with the first prototype tested in late 2007, and pilot ATMs operating in central Madrid. There’s a video about the development of these ATMs here and a detailed explanation on BBVA’s innovation site here (which is itself a design delight). The ATMs have won a number of design awards and are so beautiful one has even featured in an exhibition at the Museum of Modern Art in New York.

Development began in 2006, with the first prototype tested in late 2007, and pilot ATMs operating in central Madrid. There’s a video about the development of these ATMs here and a detailed explanation on BBVA’s innovation site here (which is itself a design delight). The ATMs have won a number of design awards and are so beautiful one has even featured in an exhibition at the Museum of Modern Art in New York.- Efectivo Móvil transfers. BBVA’s Efectivo Móvil (mobile cash) feature for its iPhone, Android, BlackBerry and iPad apps lets customers send money from a phone to anyone simply by entering her telephone number and the amount. The recipient receives an SMS on her mobile phone with a secret code that she can use to withdraw the money from any of BBVA’s cash machines in Spain, without needing to be a customer of the bank.

- BBVA Compass video-conferencing. BBVA Compass was one of the first banks to make extensive use of video-conferencing between customers and employees. The BBVA Compass Virtual Banker is a video conference platform that lets the bank offer specialized help, such as mortgage and investment advice, directly to any branch regardless of the advisor’s geographic location. Integrated document sharing functionality lets the advisor exchange documents and brochures on screen with the customer, send documents to a printer next to the customer in the branch, and retrieve signed documents from the customer using an integrated scanner.

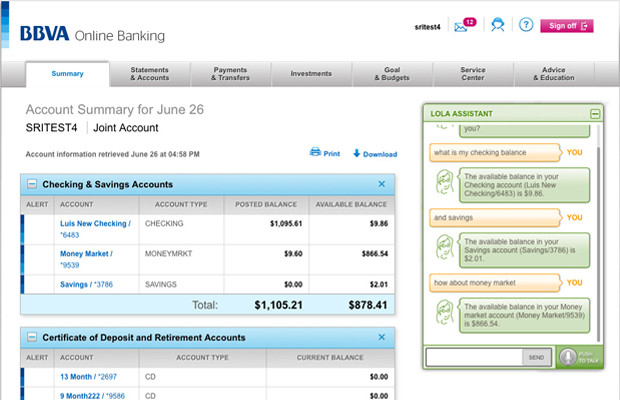

Lola, an intelligent banking assistant. Somewhat like Apple’s Siri, Lola is a virtual digital assistant that is able to perform banking tasks and use reasoning in response to a customer’s requests which has been built by BBVA in partnership with SRI International. Lola is now being tested at BBVA Compass in the US. (There’s a video here or you can read more here).

Lola, an intelligent banking assistant. Somewhat like Apple’s Siri, Lola is a virtual digital assistant that is able to perform banking tasks and use reasoning in response to a customer’s requests which has been built by BBVA in partnership with SRI International. Lola is now being tested at BBVA Compass in the US. (There’s a video here or you can read more here).- BBVA Contigo personal advisor. Perhaps the most significant of all BBVA’s innovations is the BBVA Contigo service which combines personal advice with the use of remote channels, complementing (and in my mind eventually replacing) the branch network. Each customer has a personal advisor they can contact via e-mail or phone to make inquiries or perform transactions, in addition to BBVA’s various virtual banking channels. (You can read more about it here).

BBVA clearly has an innovation budget and team that most eBusiness and channel strategy professionals can only dream of, but Gustavo shared some lessons that can apply to any business:

- Take an open approach to innovation. BBVA has built an international innovation network that inclues relationships with both academic institutions, like Massachusetts Institute of Technology (MIT) and Stanford, and commercial organizations like IDEO and Continuum. The bank’s innovation teams also make extensive use of social networks like LinkedIn, Facebook and Twitter (@ cibbva) to gather, develop and propagate ideas from both inside and outside the bank.

- Define your success metrics. Having a clear, common understanding of what you are trying to do with this or that innovation is vital if it’s going to go to the next step to get embedded in business as usual.

- Test and prototype. Develop something tangible that you can show internally and offer to end users to play with and tweak to get the right feedback.

- Use a lab to test ideas. BBVA has its own innovation centre in Madrid where people can share and test ideas. According to Gustavo: “Having a living lab where we can put things in front of people where they can really touch the things we are developing is huge in terms of feedback.”

- Test ideas with early adopters. Conduct research among the early adopters who will enrich the final output. “Otherwise you are cheating yourself with the mainstream average response or answer,” according to Gustavo.

Like any big organization, BBVA isn’t perfect. But what makes it stand out is its determination to create better customer experiences. BBVA has embedded innovation at the heart of its strategy to become a more customer-centric bank.

I’d like to say a big thank you to Gustavo for sharing his insights and travelling all the way from Argentina on Sunday to be with us in London on Wednesday.

Benjamin