FINANCIAL SERVICES DIGITAL TEAMS: KEEP THINKING MOBILE IN 2013

A few weeks ago, the four largest Dutch banks revealed that the number of app users had doubled again in the past year. Dutch mobile phone users are checking their current balance twice as often via their phone as they do via their PC. Unsurprisingly, activity peaks around payday. Given that mobile can be seen as the most important development in financial services in recent years, it is time to get your mobile act together. Digital teams at financial services firms should think seriously about adding relevant mobile touchpoints to their distribution channels. What does this mean for specific sectors of the financial services industry?

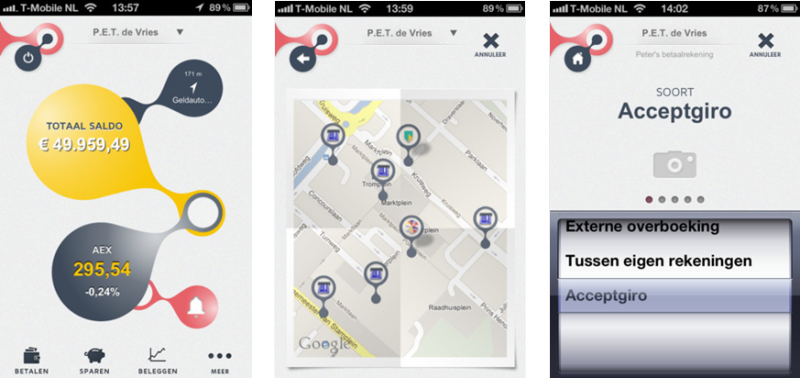

Mobile is crucial for retail banking. As my Forrester colleagues Peter Wannemacher and Tiffani Montez show, mobile banking is not just a business opportunity — mobile banking is an imperative. As we can see from our Dutch news story, mobile banking is now growing rapidly in some countries and will displace online banking for everyday tasks like checking account balances, viewing transaction histories, making transfers, and paying bills. Great design is key, however: One nice example is the mobile app from Dutch banking challenger KNAB, in which inter active design and functionality deliver convenience and simplicity:

Mobile will change the way insurance companies market, sell, and deliver service to customers. The smartphone is at the center of the opportunity for insurance companies. Digital insurance professionals must tap into the power of mobile context to deliver the right information at the right time, empowering customers and agents. This varies from finding new ways to engage with customers or using smartphone features like sensors for the underwriting process. In the health insurance arena, mobile solutions will help effectively manage costs by encouraging customers to look after their health. In the UK, Aviva has developed the My Stress kit: The app helps users identify what’s raising their stress level and manage it. To learn more about the state of mobile insurance, read my latest report, The State Of Mobile Insurance In 2013.

Keep in mind , there are three rules that you must follow to ensure that your mobile initiative is fully adopted and successful. Every app must comply with the following elements:

1. Immediacy. The app must deliver content when customers need it most. Immediacy is timeliness that’s not limited to an exact measure of minutes or hours. For example, customers will want to know immediately that a tow truck is on the way or where they can find the nearest ATM machine when they need cash.

2. Simplicity. This removes usability hurdles. Simplicity is driven by the right decisions on the content, services, and features that make sense for mobile as well as how well mobile experiences are designed. Simplicity must be revisited regularly, as the pace of change in mobile technology knocks down some usability barriers and creates others.

3. Context. This makes content relevant to the customer. We define mobile context as the sum total of what your customer has told you and is experiencing at the moment of engagement. You can read more about this topic for banking teams in The Mobile Banking Imperative.

The pace of development and adoption is picking up, so it’s time for digital teams at financial services companies to start thinking mobile. Share your ideas or experiences on how mobile has added value for your customers in the comments below.