“Letter From Germany” – Phew! Marketing Automation Is Hot In Europe This Year

“Letter From Germany” Feb. 2013 – Marketing Automation Is Hot In Europe This Year

Peter O'Neill here with the latest edition of my (somewhat) regular blog in which I highlight important information for you about B2B marketing in Germany. This time, I have exclusive details for the German market on marketing automation; the data is taken from the survey used in my upcoming report entitled “European B2B Marketers Will Invest In Automation In 2013.” The report will have two pieces of research for Forrester clients:

1. Data from our Q4 2012 US And Europe B2B Marketing Tactics And Benchmarks Online Survey.

2. An update to our list of innovative marketing automation vendors that have headquarters in Europe.

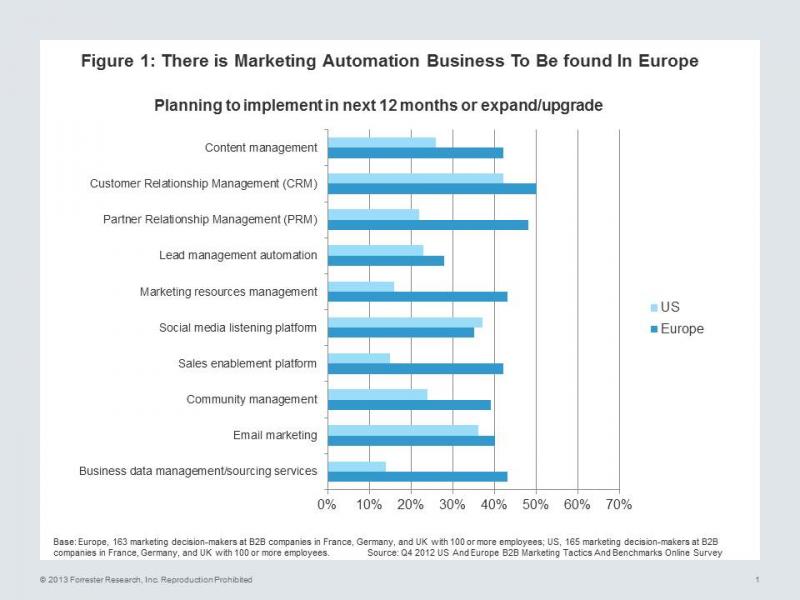

Many of the leaders at international marketing automation vendors we speak to have been wary of seriously setting up in Europe, as they believe firms in that region are late adopters of marketing automation. But we have important news for them: It’s now high time to show more presence in Europe! Our survey shows that the rate of investment is actually higher in Europe than in the US for nine of the 10 categories of marketing automation about which we asked. In the graph below, we show the aggregate of those planning to implement the technology or expand/upgrade their system.

This is remarkable news indeed. To some extent, it’s a result of the evangelical marketing work that vendors like Eloqua, HubSpot, Lithium, and Neolane have done, as well as the sterling achievements of European vendors like Alterian (now part of SDL), Copernica, eCircle (now part of Teradata), Searchmetrics, Sitecore, and Weloroi. Even Marketo is now holding events in (Continental) Europe, flying in each time from its beachhead office in Dublin. But these numbers are also a result of European B2B marketers realizing that they need to do something: In Forrester’s inquiries with European clients in 2012, we hear them discussing a new role for themselves within their organizations, reflecting on the importance of digital marketing, and moving from lead generation to lead-to-revenue management. However, one clear difference prevails between the US and Europe: While North American marketers focus more on demand generation and sales, European marketers focus equally as much on loyalty and relationship marketing.

Here, as promised, is the German data that corresponds to the graph above, based upon 27 respondents.

|

Content management |

40% |

|

Social media listening platform |

48% |

|

CRM |

62% |

|

Sales enablement platform |

48% |

|

PRM |

68% |

|

Community platform |

42% |

|

Lead management automation |

56% |

|

Email marketing platform |

48% |

|

Marketing resources management |

52% |

|

Business data management/sourcing services |

48% |

Whether you are a B2B marketer or an automation vendor, this is great news. If you are a buyer, you have the ammunition to justify an automation budget. If you are a Forrester client as well, you can take advantage of the series of reports in the lead-to-revenue management (L2RM) playbook that we are building out this year to optimize your project (as always, technology forms only one-third of this). And, if you are a vendor, you know there is a market in Germany — and my experience is that you can’t conquer that market without opening up here or at least developing partnerships here.

Another statistic from our survey: German B2B marketers struggle with content marketing as a discipline: 44% say that they face difficulties in “getting the right customers/prospects to view the content,” while 19% cite “developing a content strategy” as their greatest hurdle. I’ll be reporting more on this in a future Absatzwirtschaft article.

Need more details? Drop me a line. As always, I’d love to hear from you on this and other topics.

Always keeping you informed! Peter