Why Google – Not Facebook – Will Build The Database Of Affinity

Recently we described an idea called the database of affinity: A catalogue of people’s tastes and preferences collected by observing their social behaviors on sites like Facebook and Twitter. Why are we so excited about this idea? Because if Facebook or Twitter or some other company can effectively harness the data from all the likes and shares and votes and reviews they record, they could bring untold rigor, discipline, and success to brand advertising.

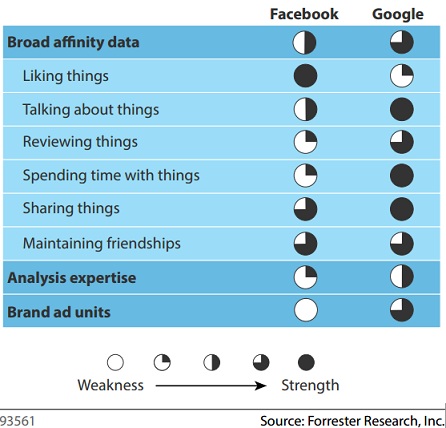

But exploiting the database of affinity won’t be easy. Any company hoping to turn affinity data into something marketers can use will need three things:

- Lots of affinity data from lots of sources. The raw data required to build a functional database of affinity doesn’t live in just one place. Facebook controls the most "like" data, recording more than 80 billion per month at last check. But Twitter records more "talking" than anyone else (1.5 billion tweets per month); Amazon collects the most reviews (well over 6 million per month); and Google’s YouTube and Google Display Network have data on how a billion people prefer to spend their time.

- The ability to bring meaning to that data. It’s easy to draw simple conclusions from affinity data: If you ‘like’ snowboarding you might like to see an ad for energy drinks. But the real value in affinity data won’t be unlocked until we can find hidden combinations of affinity that work for marketing. That’ll require technologies and teams that can do some serious data analysis — as well as a real-time feedback loop to determine whether people really are interested in the ads targeted to them based on such complex assumptions.

- Brand ad units to get the best value from that data. If marketers are going to use affinity data to power brand advertising, simple text-based ad units won’t cut it. Brand advertising demands large, video-based ads to create discovery — TV spots, pre-roll ads in online videos, and supersized online banners. To succeed, a vendor supplying affinity data must help marketers use that data to target online and offline brand ad units, such as the type offered today by TV networks, online video sites and networks, and online portals.

When we started researching this topic, it seemed like a no-brainer that Facebook would best be able to offer marketers the database of affinity. After all, it’s by far the most dominant social site online; and it already possesses the largest collection of ‘likes’ anywhere online.

But the more we looked at the facts, the more obvious it became that Facebook isn’t going to win this race. Instead, Google is the company most likely to bring marketers a usable database of affinity. Surprised? Don’t be — Google can beat Facebook on all three of the criteria listed above:

- Google possesses a broader set of affinity data. I’ll admit it: This one looks like a close call. But while Facebook has more affinity data than anyone else, Google’s got a lot more of this data than you think it does — and Google’s affinity data covers a much broader range of social actions. Every month, Google tracks what 800 million YouTube visitors watch and what they like; it also sees the most important social connections of its nearly 500 million Gmail users and tracks what they share. And crucially, the Google search index includes almost every review posted on any site online; the contents of billions of blog posts; and nearly everything posted on Twitter.

- Google’s better at bringing meaning to data. After all, it’s the core of Google’s business: Dynamically evaluating enormous amounts of data to figure out what content people most want to see. It doesn’t just do this on the search side of its business; its DoubleClick unit has been working to deliver more relevant ads to online users for more than 15 years. And Google already offers marketers tools for using performance data to optimize ad buys — exactly what’s needed to get value from the database of affinity.

- Google's got the ad units that put affinity data to work. Let’s be honest: No online ad unit can compare to TV for brand impact. But pre-roll video ads come closest. And that’s Google’s sweet spot; it can deliver pre-rolls to hundreds of millions of YouTube users every month. And while I chuckled along with everyone else when Google launched — and later folded— a TV ads business, that experience could come in handy as they work to apply affinity-based targeting to the ad units where it’ll work best. Meanwhile, Facebook offers brand advertisers mostly text-based and static-image ads.

We're excited to watch Google and Facebook (and Twitter and Epsilon and a lot of other firms) race to build a database of affinity over the next few years — and we're excited to see how this idea will change marketing.

For more insight on how the database of affinity will develop over the next few years, Forrester clients can read our new report published today, How To Exploit The Database Of Affinity.