Forrester’s “The State Of Consumers And Technology: Benchmark 2012, China” Report Shows Differences In Technology Adoption Stage

I am delighted to announce that for the first time, our annual US and European consumers and technology benchmark reports have a Chinese counterpart: The State Of Consumers And Technology: Benchmark 2012, China. This report is a graphical analysis of a range of topics about consumers and technology and serves as a benchmark for understanding how consumers change their technology adoption, usage, and behavior over time. The report, based on one of our Asia Pacific Technographics® surveys, covers a wide range of topics, such as online activities, device ownership — including penetration data and forecasts for smartphones and tablets — media consumption, retail, social media, and a deep dive on mobile.

For this report, we divided the metropolitan Chinese online consumers into three distinct groups based on their technology optimism and economic power:

- Early adopters are high-income individuals who are also technology optimists — people who see technology as a positive force in their lives.

- Mainstream users are either high-income technology pessimists or low-income technology optimists.

- Laggards are low-income technology pessimists.

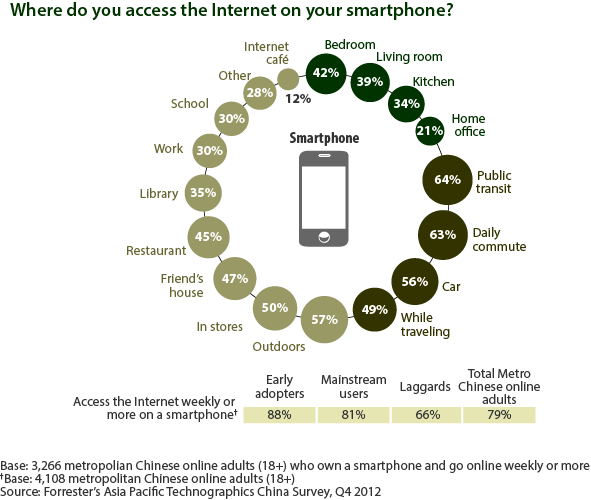

Overall, we found that metropolitan Chinese online consumers embrace technology. For example, as the graphic below illustrates, metropolitan Chinese online smartphone owners take full advantage of their smartphone’s convenience and use them everywhere, especially when they’re outside their home.

A few other interesting insights we uncovered about metropolitan Chinese online adults:

- They are just as comfortable consuming media online as offline. In fact, with some media, such as newspapers, they spend more time reading these online than offline.

- Online retail plays a big role in their lives. Nine in 10 metropolitan Chinese online adults have shopped online in the past three months. Although they buy a wide range of products, apparel/clothing and accessories and footwear are the most popular categories.

- They are socially savvy. The competitive and fast-changing social media landscape in China leads to the uptake and usage of many social media platforms. Not only do metropolitan Chinese online adults interact with brands on social media, 85% of them are so-called Creators.

- Mobile phones are essential to them. To metropolitan Chinese online adults, mobile phones and smartphones are almost interchangeable terms: 88% of metropolitan Chinese online mobile phone owners own a smartphone. They are more loyal to their smartphones: Second mobile phone ownership dropped significantly in 2012 compared to 2011.[i] Moreover, owners across all three segments are very active mobile phone users.

These insights show only the tip of the iceberg in terms of the information available in the report. We’ve based our analysis on Forrester’s Asia Pacific Technographics surveys. Technographics is the biggest and longest-running survey of consumers and technology in the world — and it covers the impact of technology globally on a variety of consumer markets, including automotive, consumer technology, banking, healthcare, marketing, media, retail, and travel. The Asia Pacific Technographics China Survey, Q4 2012 on which this report is based captures China’s unique profiles and market trends. Please contact me if you’d like more information.

[i] Metropolitan Chinese adults led in owning two or more mobile phones in 2011 in markets that Forrester surveyed.