The Data Digest: What Do US Consumers Expect From Their Healthcare Provider?

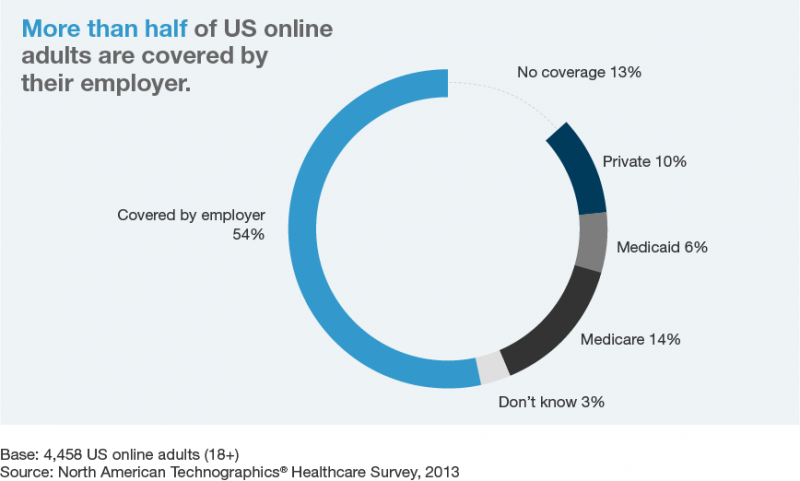

At the beginning of 2013, approximately 153 million US online adults had health insurance coverage. While it serves the majority of US adults, the health insurance industry is unique in that only a minority of health insurance customers choose their health insurance provider directly. Forrester estimates that just 14% of US online adults — 25 million US adults — actively chose their health insurance provider in 2013.

However, with the onset of the Patient Protection and Affordable Care Act, otherwise known as "Obamacare," many new customers will enter the healthcare market. While we don't know exactly what portion of uninsured US adults will follow the mandate that all US residents must obtain health insurance, there is a large pool of potential new customers.

In fact, Forrester’s Technographics® data shows that 13% of US online adults (23 million adults) reported having no health insurance at the beginning of 2013. Of these uninsured adults, 47% don't have health insurance because they can no longer afford personal coverage; 25% left the employer that provided their coverage; and 15% never had health coverage.

In her recent report Mapping The US Health Insurance Landscape From The Consumer's Perspective, my colleague Gina Sverdlov looks at what consumers want from a health insurance provider and how to meet consumer needs. Using advanced analytics, she found that having a large network, access to doctors, and low copays drive new customer acquisition.

But it’s not going to be easy: Our Technographics and ConsumerVoices data shows that consumers are disengaged from their health insurance providers and lack information, healthcare literacy, and trust in their health insurer. Health insurers will face an uphill battle to not only engage their customers but also build trust and alleviate consumer fears through messaging and healthcare tools.