CEM For Telcos: Just Started With A Lot More Potentials

Telcos across the world — and especially mobile operators — are now struggling with increasing network complexity and lower customer satisfaction due to exploding data traffic, decreasing ARPU, and OTTs marginalizing their opportunities to generate new revenues via content. The Japanese market, with one of the highest ARPUs, has been the battlefield for technology providers to offer local telcos to services their high-value customers in a country where people have very high expectations of telecommunications services. Two weeks ago, I participated in Nokia Networks’ analyst days in Tokyo and was interested to see how the company has increased its share in Japan in the past couple of years. To continue its success in the age of the customer, Nokia Networks must help Japanese telcos better win, serve, and retain customers.

Two days of briefings and discussions convinced me that Nokia Networks’ must address three critical items to maintain its leadership position in LTE radio in Japan:

- Optimizing its networks to make its coverage and performance the best it can be in this very high-density market.

- Introducing customized features from its Japan R&D lab to meet the most demanding operators in the world.

- Helping telcos meet or overfulfill their customers’ expectations via a customer experience management (CEM) solution, although the revenue contribution is much smaller. Obviously, what customers experience and perceive are what really decides how effective all of the network improvements have been.

With the product introduction and demo at its Kawasaki R&D facility south of Tokyo, I also got the chance ask some follow-up questions about how Nokia has been helping telcos on CEM, a topic that both CIOs and CMOs are interested in. I even heard that the CEOs of many operators in US and Europe are looking at CEM. A couple of highlights I found interesting include:

- CXi monitoring and improvement. A firm’s customer experience index (CXi) score, calculated using weighted KPIs including network and service quality, customer care, revenue, and devices, will demonstrate the experience that different types of customers are having at different locations. The solution can make recommendations to telcos to improve their CXi for high-value customers; in many cases, this can be done by taking precautions, so customers may not even know that they might experience poor service quality in certain parts of the city, such as busy business districts, shopping areas, or stadiums.

- Cross-organizational CEM. While some competitors still focus on helping improve customer care centers to better address customers’ service calls, Nokia Networks tries to get telcos to access and share information across their entire organization, from operations to marketing to customer care. It offers CEM on demand as an option to some smaller operators.

- Real-time network visibility and data analytics adding more value: Nokia Networks’ solution provides real-time visibility of subscriber activity across the whole network by collecting information directly from the networks and devices. Analytics of customer behavior on their devices (over the network) could guide marketing professionals to better evaluate existing services and creating new differentiated services; network planning engineers can see network resource utilization and make more effective future investment decisions; operational staff can clearly measure voice and data service quality; and customer care executives have more lead time to discover and resolve problems.

A simple comparison of similar solutions from the top four global telecom equipment providers indicates to me that Nokia Networks’ CEM solution is the most comprehensive one at the moment. However, it is still at the early stages of a mature customer experience solution, as it focuses on leveraging the company’s core assets: the network gears.

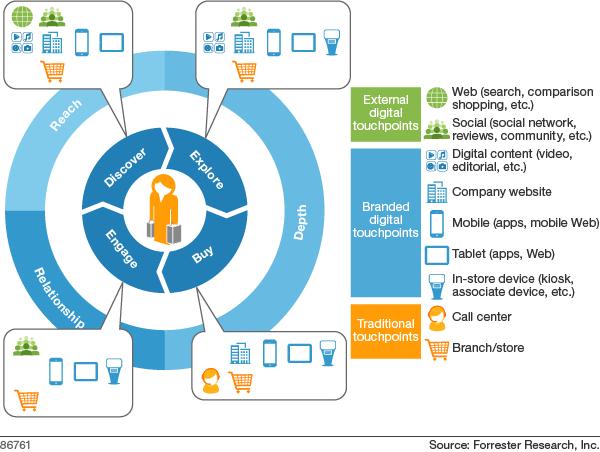

With Forrester’s insight about how brands should manage the cross-touchpoint customer journey (also see the figure below), telcos should be able to better identify promising customers and recommend new services to customers before they explore themselves. The experience has to be extended to every touchpoint at which a customer interacts with the operator, from the company’s own digital touchpoints (such as its website), third-party digital touchpoints (such as social sites), and offline channels. The key to making this happen is to make network management and marketing departments at telcos collaborate more closely and open data to each other, draw a clear and common business goal for improving the customer experience, and have a cross-organization evaluation tool to monitor every parameter that influences the CXi.

Telcos are among the most advanced businesses at using technology. Most traditional telcos are also very hierarchical, and interorganizational collaboration can be very difficult and inefficient. Improving the customer experience means improving the overall experience that the telco can bring to its customers. Nokia Networks has made an effort with some very interesting offerings, but there is still a long way to go to make telcos — especially large incumbents — truly customer-centric.