Alibaba Beyond eCommerce: Understanding The World’s Biggest Digital Ecosystem

Following Alibaba’s announcement that it will list on the New York Stock Exchange, global eBusiness professionals are paying closer attention to the Chinese Internet giant, wondering what impact it will have on their business. For those who need to get up to speed on the company, here is a preview of Forrester’s upcoming report on Alibaba, which summarizes its development history, revenue streams, business expansion, and the impact it will have on digital services business value chain:

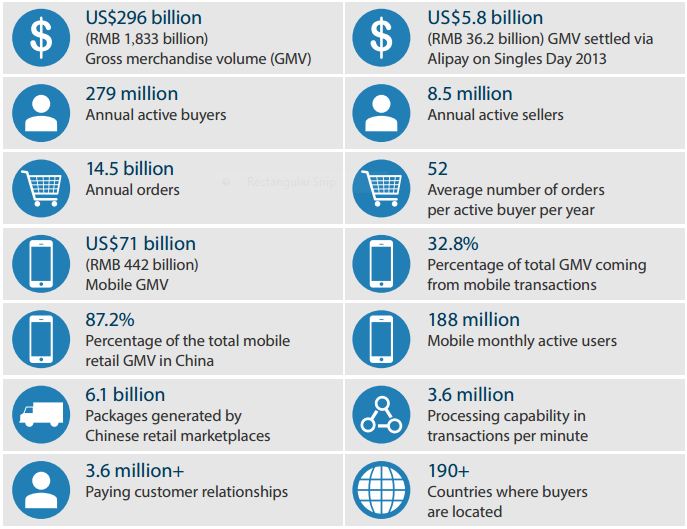

- Alibaba draws its revenue streams from the ecosystem around its eCommerce platform. According to Alibaba Group’s F-1 filling, the main businesses for the Alibaba Group include B2B (168.com and alibaba.com), C2C (Taobao.com), B2C (Tmall.com, Juhuasuan.com and AliExpress.com), and digital services. Alibaba's revised filing from August 2014 indicates that it handled more than RMB 1.8 trillion (about $296 billion) of transactions for 279 million active users across its three Chinese online marketplaces in 2013. Over the past 15 years, Alibaba has built an ecosystem of buyers, sellers, third-party service providers, and strategic alliance partners around its platform. By leveraging buyer and seller data from this ecosystem, Alibaba has created a data analytics product that gives a complete view of a customer at any phase of their purchase journey, resulting in a very successful marketing and commerce business that generates significant revenues.

Figure 1: Alibaba Group: A Business And Ecosystem Overview

Source: US Securities and Exchange Commission

- Taobao and Tmall are China’s eCommerce darlings. Launched in May 2003, Taobao was one of the earliest eCommerce players in China; within two years of operation, it overtook eBay to become China’s largest C2C platform. Just like eBay, Taobao offers great deals and a large selection of products across many categories. At the end of 2013, Taobao had 500 million users and about 800 million product listings. While the Taobao platform offers innovative services, it has a number of shortcomings. To solve the problems of cluttered listings, counterfeit goods, and a lack of authentic name brand options, the Alibaba Group launched Tmall in 2008. Tmall established a platform with business license and service requirements that bigger brands could trust. However, counterfeits on Tmall and Taobao are still widely available; as a result, a number of high-end brands have yet to open online stores on Tmall.

- Alibaba is expanding beyond eCommerce and China through investments and acquisitions. Since 2006, Alibaba has been trying to add digital services to its ecosystem and integrate them tightly with its traditional eCommerce platforms. In the past 18 months, Alibaba has continued its efforts to extend its reach to almost everything a Chinese consumer needs by investing more than $11 billion in cash in a series of acquisitions and partnerships. Forrester has identified five major digital platforms in the US market, each with its own focus. In China, however, the top Internet players (including Alibaba) strive to create a complete digital services offering by pulling together a much more comprehensive set of digital services. With its data and analytical tools, Alibaba will be able to provide a better portrait of any online consumer to brand marketers and eBusiness professionals. Simultaneously, Alibaba has launched eCommerce offerings outside China and invested in global businesses to help drive its eCommerce global sales, provide better logistics services, and enter the mobile space.

Although Alibaba has primarily competed in the Chinese market, global eBusiness professionals need to be aware of the impact that Alibaba may have on their businesses. For a detailed analysis, watch out for our report coming soon!