Not All Cloud Services Are Equally Mature

SaaS has been around for 20 years, cloud platforms nearly a decade. That must mean they’ve worked all the kinks out, right. You know better. There are wide variances in the maturity, stability and enterprise-readiness of the many cloud services categories. There are certainly differences between vendors within the same category, as demonstrated in each of our Forrester Waves, but there are significant differences between the many classes of cloud services. For example, internal private clouds are far less mature than their public counterparts and the desktop-as-a-service category continues to struggle to find its place in the market.

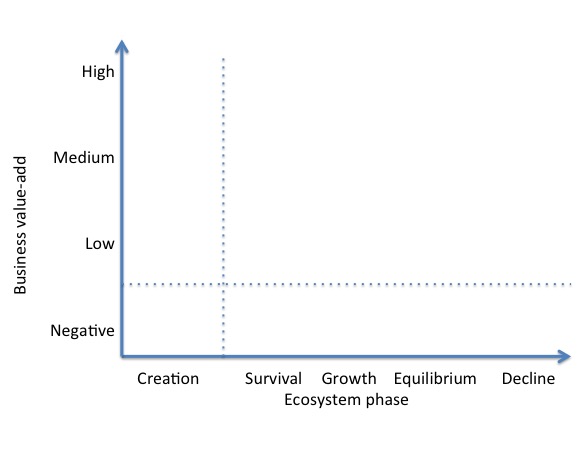

This is the reason Forrester created the Tech Radar. This class of report helps enterprise clients delineate between categories of services based on their maturity, adoption by other enterprise clients and helps ascertain the likely return on investment you can expect at its current level of maturity. The latest Cloud Computing Tech Radar, published this month on Forrester.com, plots each major category of cloud services along two axis:

* Ecosystem Phase – this horizontal axis plots each category of cloud service along stages of maturity in such terms as the financial health and viability of the leading solutions in the category, how commonly they can be found in use by enterprise customers, how healthy their ISV and go-to-market partner ecosystems are, and how strong their growth is, as a category. Mirroring, somewhat, Geoffrey Moore’s Crossing the Chasm research, this axis calls out phases that include Creation, the period of initial market penetration for a category prior to it crossing over, and Survival where growth becomes sustainable onward, through decline as the technology gets replaced by a new value proposition.

* Business value-add – the vertical axis plots expected return on investment enterprises will likely get from subscribing to a category of cloud service at this stage of its maturity. The bottom of this axis is Negative, denoting that investments in this category of technology at a given state of immaturity will likely cost you more than you will see in return.

When you draw these basic axis you end up with a bottom right quadrant aligning to Creation and Negative ROI. All new technologies start in this quadrant and hope to mature out of it, if they cross the chasm driving growth for the participating vendors and positive business value for their customers. But inevitably there are technology or service categories in every Tech Radar that land in this bottom right quadrant. If you are a conservative enterprise, looking at cloud services purely for efficiency and cost savings, it makes no sense to invest in services that fall into this lower right quadrant. Yet given that all technologies start here, why would you take the risk?

Agility and differentiation are the answer. You take the risk to gain an advantage over your competitors. This is why so many now market leaders invested early in Amazon Web Services, Salesforce, Netsuite and other pioneers in cloud computing.

But there’s a downside too – not all the cloud service types that debut in this quadrant will prove out and these early investments may lead to failure. This could be especially true when a given service category lands in this quadrant year after year. See the report for a look at what categories are currently suffering this fate.

In our latest Cloud Computing Tech Radar we added analysis on a variety of cloud categories that did not appear in the prior studies, including hosted private clouds, data warehouse as a service, and cloud cost monitoring tools. They didn’t appear prior because at that time, they hadn’t yet established themselves enough to warrant analysis or were part of larger categories and hadn’t yet broken out as viable standalone service categories. We also dropped a category that hadn’t left the lower right quadrant – platform as a service (PaaS). We didn’t drop it because it failed but because it has been subsumed through the maturity of cloud platforms. This market, that remains dominated by infrastructure as a service (IaaS) solutions, has matured by adding PaaS and PaaS-like capabilities to the platform suite and via their partner ecosystems. And two of the leading PaaS vendors in the market, Google and Microsoft, struggled for customer success until adding IaaS underneath.

As you build out your cloud strategy it makes sense to evaluate your investments via the Tech Radar mechanism. While the business may lead the early adoption of cloud services, shifting their use from ad hoc, opportunistic investment to corporate strategy will fall to CIOs who need to ensure this greater level of investment aligns with corporate goals and business metrics.

Now is the time to start making those calls.