Architecting Agility: Decoupled Banking Systems Will Be The Key To Success In 2026

I spent this past year advising our clients at major banking and financial institutions globally about their banking architecture, their priorities, and their challenges. Additionally, I’ve traveled to and been engaged in key industry events such as Finovate, Finacle Conclave, Sibos, Money20/20, Temenos Community Forum, and Georgetown University’s Financial Markets Quality Conference, where I’ve been struck by the realization that there’s a pivotal moment that has taken hold in the banking industry. Globally, there looks to be a more receptive appetite to be less risk-averse and make bold steps toward taking on fintech solutions, partnerships, and innovative technologies, adopting a decoupled approach to financial services architecture. My own experiences at Citadel Securities, CME Group, and ABN AMRO Bank allow me to validate these observations to realistic, practitioner experiences.

Digital Banking, AI, And Fintech Innovations Are Driving A Seismic Market Shift

The banking industry is undergoing an evolutionary and market-driven shift. Digital banking systems, once rigid and monolithic, are being reimagined through decoupled architecture, AI-driven intelligence, programmatic consumption of technology, and fintech innovation and partnerships. All industries are facing AI disruption, but it’s unique for the banking industry because:

- This market shift is not just an evolution — it’s a race. The pace of innovation is accelerating, and the winners will be those who embrace agility, AI intelligence, and strategic partnerships.

- Delay is no longer an option — the future of banking is already being built today. To capitalize on these innovations, tech leaders must prioritize digital core banking agility, ensuring integration with new innovations and adapting to evolving market demands.

Stay Competitive With Decoupled Banking Innovation Architectures

Faster product innovation driven by digital-only banks that are open to decoupled innovation advantages as well as the consumerization of commercial banking is accelerating the pace of change in banking architecture. To keep pace, tech leaders at established banking institutions must:

- Learn from the architectures of digital-only banks. Digital-only banks are less restricted compared to traditional banks because they are built natively on modern, cloud-based architectures and operate without the burden of decades-old legacy systems. They are the proving grounds for banking innovation and show what the future holds when banking tech leaders finally pay off their technical debt.

- Embrace the principles and elements of a distributed architecture. This architecture can free your systems and avoid the constraints of maintaining large physical-branch networks, enabling more efficient cost structures and faster scalability.

- Modernize core banking systems to handle real-time demands. At the very heart of every financial institution lies its core banking system — the powerful engine that processes daily transactions, manages accounts, calculates interest, and orchestrates the seamless flow of financial information. For decades, these systems were monolithic, complex, and expensive to maintain. Core banking must modernize to deliver agility, efficiency, and a truly customer-centric approach. Paul van der Merwe, head of enterprise architecture and director at Standard Bank Group of South Africa, states that innovations in core banking, payments, and compliance are now by nature built on the latest technology and are expected to handle real-time demands.

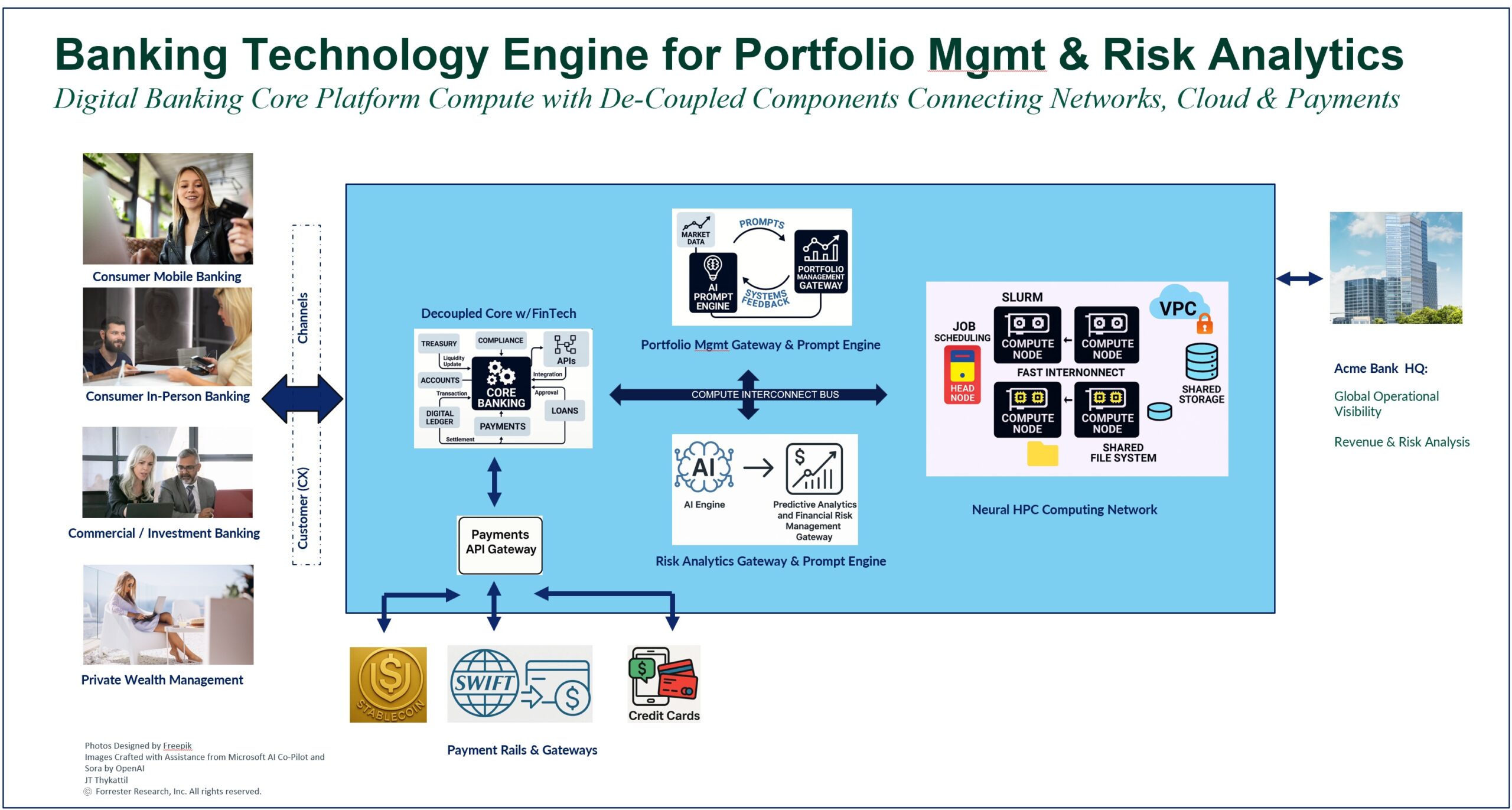

- Include a portfolio management gateway and prompt engine. Designed for flexibility, this component can be built in house, codeveloped with a fintech partner, or sourced as a third-party solution. It integrates seamlessly via APIs into core banking systems, customer experience channels, payment rails, and transaction hubs.

- Develop advanced portfolio management and data analytics. Leverage algorithmic computing and AI intelligence to enhance portfolio management, optimize asset allocation, and deliver real-time insights for better decision-making.

- Drive AI-powered portfolio management. Apply quantitative AI models to identify trading opportunities, optimize fixed-income strategies, and execute decisions faster across banking, private wealth, and insurance portfolios. These models enable scenario-based risk analysis and accelerate performance under dynamic market conditions.

Embrace AI-Enhanced Architecture Options And Adopt Fintech Innovations

Banks (for example, Bank of America) are leveraging AI (including predictive, generative, and agentic) to revolutionize every facet of their operations. This isn’t just about chatbots answering basic queries; AI is now powering sophisticated fraud detection systems, offering risk scenario analysis, financial crime management, and streamlining complex loan approval processes. Tech leaders should explore how AI innovations can:

- Reduce latency in back-office operations. The ability of AI to analyze vast datasets provides banks with unparalleled insights into customer behavior, allowing them to anticipate needs and offer tailored products that truly resonate. Aditya Singh, Chief Architect and VP at Capital One states that when banks pair generative AI with process mining, they can automate process reconciliation, exception handling, and regulatory reporting.

- Advance fraud detection and automate compliance. Identify suspicious patterns in real time. As illustrated in the figure, a decoupled risk analytics gateway and prompt engine streamlines regulatory reporting and ensures adherence to evolving rules (regtech). Whitney Morgan, VP at Skaleet, a fintech provider, states that generative AI kicks this up a notch by automating regulatory reporting and accelerating product development.

- Enhance risk management. AI-enabled risk management empowers banks to detect anomalies across large translation datasets with the speed and accuracy that manual processes can’t match. Risk modeling and stress testing will enhance credit risk scoring, market risk simulations, and scenario analysis that drive preemptive and revenue options.

The banking and financial services innovation race, with challenges in adoption and capturing market advantages, beckons leaders to be nimble and at the same time stay focused on the fundamentals. CIOs, CTOs, and other tech leaders can take proactive steps to strike the right balance. To embrace banking innovation, leaders need to go beyond simply adopting new technologies; they must cultivate an environment that fosters digital transformation and a curated and controlled risk-on approach to innovation. We’ll dedicate a lot of research to banking architecture in 2026. In the meantime, to understand these trends, how to modernize, and how to deploy a decoupled banking architecture, Forrester clients can schedule a guidance session with me.