Build Contingencies To Prepare For Inflation That May Not Be Transitory

For tech execs, it’s key to understand where inflation is occurring, its short- and long-run effects, and the practical steps that can be taken to manage it. Inflation can be classified in three ways: supply-side, demand-side, and built-in. Supply-side inflation pushes costs higher, weakening industry purchasing power; demand-side inflation pulls prices higher, weakening consumer purchasing power; and built-in inflation refers to a large shock on either the supply side or demand side that persists and becomes the “new normal,” subsequently lifting prices on both sides in the long run. So where are we today? And what do you need to do? More importantly, what do you not need to do?

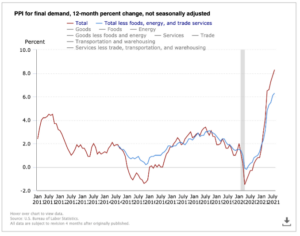

Inflation is being driven by a supply-side shock. Costs are currently being pushed higher. Supply chains were not prepared for the economic rebound to be as quick as it has been. Couple that with the global cut in oil production that cannot come back on line fast enough, and you get a supply-side shock. This shock is especially sticky as countries divesting of fossil fuels in favor of clean energy increased their exposure to these higher prices. The most recent US Bureau of Labor Statistics (BLS) economic release shows that the increase in the Producer Price Index (PPI) is primarily driven by food and energy prices.

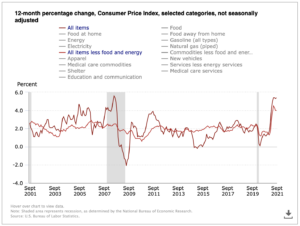

Understand the built-in market signals among the inflationary noise. The uniqueness of this supply-side shock is one of timing and price inelasticity — timing, because prices already seasonally increase heading into the holiday season, and inelastic, because energy and food prices have little effect on demand response. Therefore, prices have been pulled through to the demand side. The prices of gas and food have both spiked for consumers per the most recent BLS economic release on the Consumer Price Index (CPI). This strongly implies that the inflation’s current impact will extend, not necessarily expand, into Q1 of 2022.

Tech execs must remain vigilant but for less obvious reasons. Inflation can be isolated and not always integrated across multiple economies. There will be lingering signs of inflation after Q1 of 2022 but not necessarily on a global scale. If found not to be isolated, however, the momentum for inflation expanding globally to other prices longer-term becomes very real. In this scenario, tech execs need to develop contingencies for unplanned increases in equipment, services, partnership, and overall ecosystem costs. Not all contingencies are created equal, so tech execs should prioritize those that deliver the greatest customer-experience and employee-experience value if budgets and supply chains begin to further constrain.

Unless these prices persist into next year, triggering a structural lift across the board, we believe that markets will begin to regain confidence when quantitative easing goes into effect through mid-2022. With both the production of oil and global supply chains ramping up again, the key is to understand if the price instability is isolated or integrated among economies during Q1 of 2022. For now, tech execs should continue to monitor the situation and prepare to make changes should prices turn away from trending stable post-Q4 2021.