Healthcare Spotlight: Gaining Cross-Functional Consensus on Marketing Investments

- With limited resources, healthcare CMOs are under pressure to gain consensus with sales and product functions on where marketing should invest

- To prioritize investment areas, organizations must consider their internal capabilities to succeed as well as external market opportunities

- By using the SiriusDecisions Relative Targeting Framework, Change Healthcare achieved cross-functional consensus on strategic business priorities for marketing investment

This is the ninth in a series of blog posts that describe how B2B healthcare leaders are driving results with innovative marketing, sales, and product strategies. Although the approach of each blog post may vary, the concept is consistent: examining what’s really working for B2B and B2B2C healthcare leaders today, on the basis of Forrester SiriusDecisions clients’ priorities and progress.

We often see members of a company’s executive team have different opinions on which segments and products marketing should fund and support. With limited marketing resources and pressures on cost efficiency, companies must carefully determine how to maximize the business impact of marketing investments. When strong alignment on priorities and execution exists across product, marketing, and sales, companies can boost their growth and profitability significantly.

Change Healthcare, headquartered in Nashville, Tennessee, is a $3B healthcare technology company providing data and analytics solutions to healthcare payers, providers, and consumers. Kevin Brooks, senior vice president, segment marketing, is responsible for Change Healthcare’s segment and portfolio marketing. We helped Brooks and his team adopt and operationalize the SiriusDecisions Relative Targeting Framework to help Change Healthcare drive strategic collaboration among sales, marketing, and product groups to achieve alignment on the segments and products that marketing needed to prioritize for support and funding.

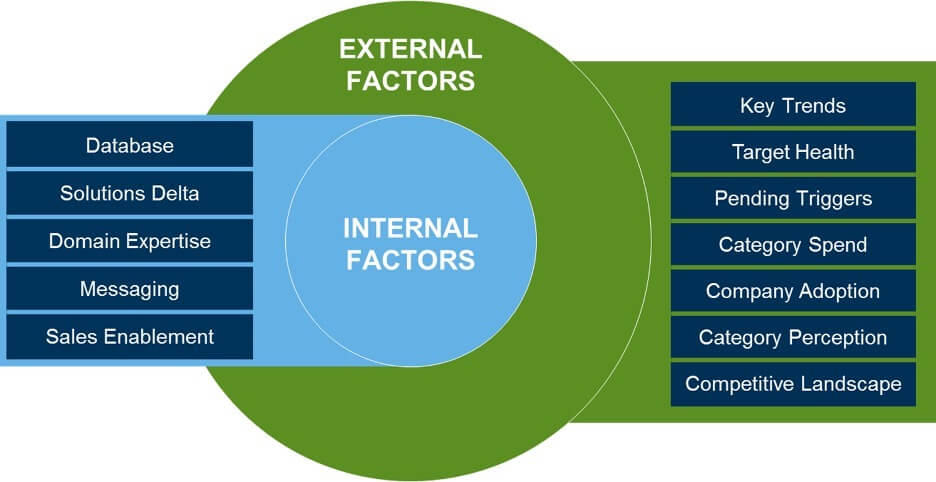

The SiriusDecisions Relative Targeting Framework is a process that runs potential targets through two sets of variables — external (market related) and internal (capabilities and readiness) — to score and rank these targets against each other. The framework was created to address one truth we have witnessed over and over again: Though there may be limitless targets that could buy something, at any given time, only a select group of these targets have a higher propensity to buy.

With a recent merger of two large companies with four major business units, a broad portfolio of hundreds of products and services competing for marketing support, and a company-wide belt-tightening due to an upcoming IPO, the Change Healthcare marketing team couldn’t invest in marketing at the same level as it had in prior years. To further complicate the situation, marketing was pivoting from a product-centric go-to-market approach to an audience-centric approach, which meant it needed to change the mix of marketing investments.

The segment marketing team used the Relative Targeting Framework to guide its planning decisions about current fiscal year marketing spend. It conducted alignment meetings with sales and product leaders across 17 product areas. In these meetings, the participants analyzed different targets and solutions and assigned them into the following groups:

- Active — invest now. These offerings have strong external and internal factors.

- Nurture until external factors improve. These offerings have weak external factors and strong internal factors.

- Dormant to fill internal gaps. These offerings have strong external factors and weak internal factors.

- Dormant that won’t be worked. These offerings have weak external and internal factors.

Two-thirds of the demand generation budget will focus on segments scoring in the active range, and one-third will focus on nurture areas. Sales reps who choose to continue selling offerings to dormant targets will get little, if any, support from marketing.

The team also discovered internal factors that were making marketing investments less attractive and created focused projects to overcome these obstacles (e.g., more sales training, bundled product launches, improved hiring practices, additional talent with more specific domain expertise).

“Ultimately, we were able to invest our marketing budget with more confidence in the areas of our portfolio and target markets where we were more likely to get a stronger ROI,” said Brooks. “Using a data-driven approach with relative targeting quieted many voices in the sales and product organization that were demanding more investment and pushed leadership to challenge whether they were adequately funding marketing investments across the portfolio.”

If your organization needs to improve cross-functional alignment on marketing investments, consider taking these initial steps:

- Assess the current state of your sales, product, and marketing alignment on where marketing should invest across the enterprise.

- Align cross-functional teams around a consistent process that focuses on external segment and product attractiveness and the internal capabilities of the organization to deliver successfully.

- Categorize segments or initiatives into active, nurture, or dormant on the basis of each target’s combined external and internal attractiveness.

- Guide internal investments to fill gaps in your organization’s ability to deliver before making broader investments.