Sales Operations: Six Places to Find Hidden Revenue Opportunities

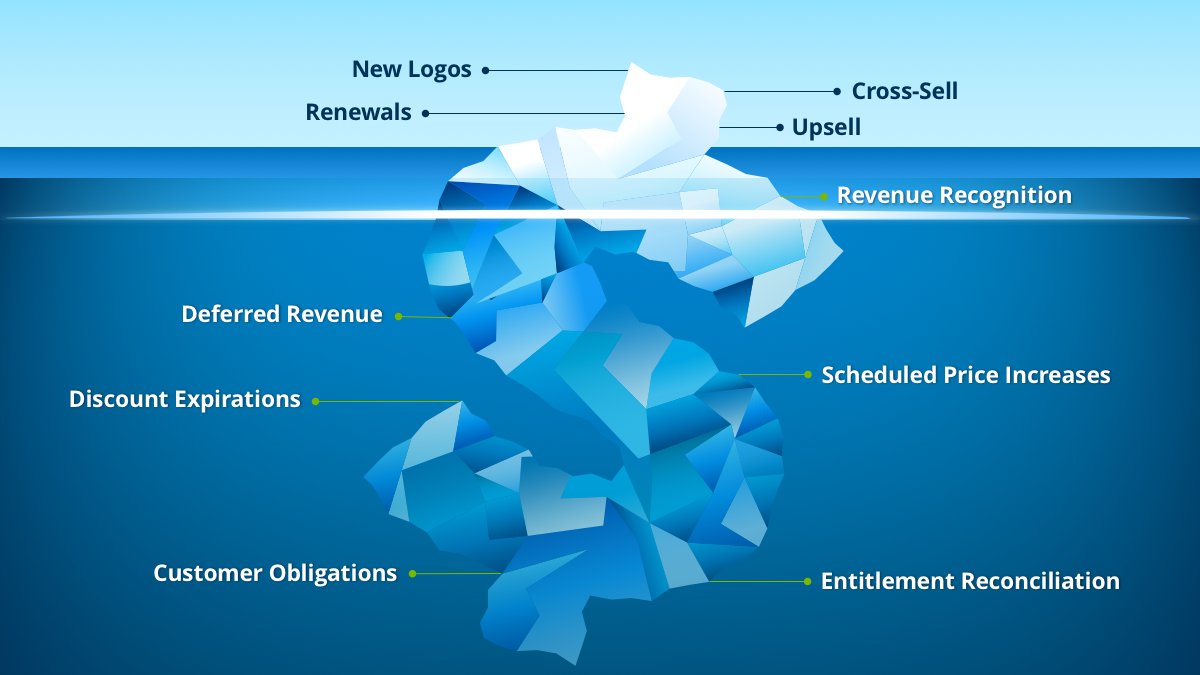

- The most common ways to drive sales revenue are through new logos, cross-sell, upsell and renewal – but sales operations can help uncover additional hidden paths to revenue

- High-growth companies reach a maturity point where customer churn becomes excessive and sales leaders split sales into hunter and farmer teams

- Farmer account manager roles are best suited to uncover hidden revenue opportunities

Rapid-growth companies often focus on acquiring new customers (new logos), but tend to leave sales territories undefined. Sales compensation plans are aggressive, with lower base salaries and higher levels of variable compensation, and commission rates are usually flat and pay a straight percentage of the opportunities closed by reps. Commission rates accelerate after reps exceed standard quotas uniformly set for reps regardless of size of their sales territories (if they are even defined).

For aggressive hunter-type account executives, life is beautiful in these companies because they can calculate their commissions using simple math – but then something else starts to happen. Reps start to call on the same prospects, the next new logo becomes more difficult to find. Worst of all, existing customers start to churn because account executives are so focused on finding the next new logo – leading to slower revenue growth.

When chief sales officers reach this point, a typical next move is to add a new sales role. In addition to hunter account executives, they hire farmer account managers to focus on improving relationships with existing customers, as well as cross-selling, upselling and renewing accounts. When the account executive and account manager roles are well defined, and when individuals are chosen based on skill sets and properly compensated, this strategy almost always reduces churn while continuing to focus on new logo acquisition. But one possible downside is that sales and sales operations leaders are failing to maximize account managers’ contributions to top-line growth.

When chief sales officers reach this point, a typical next move is to add a new sales role. In addition to hunter account executives, they hire farmer account managers to focus on improving relationships with existing customers, as well as cross-selling, upselling and renewing accounts. When the account executive and account manager roles are well defined, and when individuals are chosen based on skill sets and properly compensated, this strategy almost always reduces churn while continuing to focus on new logo acquisition. But one possible downside is that sales and sales operations leaders are failing to maximize account managers’ contributions to top-line growth.

There are several hidden revenue opportunities – also known as revenue moments – that farmers in the sales organization can pursue if they know where to find and exploit them. They can be grouped as follows:

- Revenue recognition. Financial scandals of the early 2000s tightened global revenue recognition rules. In an ideal world, account executives and account managers wouldn’t need to understand these rules, but it’s imperative that sales operations work with finance and accounting to first understand them. Work with sales enablement to train sales reps on basic revenue recognition, especially when selling complex solutions comprised of hardware, software, implementation and professional services, and maintenance. One incorrectly structured contract can result in revenue deferments that span years. Additionally, sales operations must work with finance to identify existing deferments to incorporate them into revenue forecasts, and to research opportunities to end the deferments based on new information, changes in accounting rules or the fulfillment of relevant obligations.

- Deferred revenue. As explained above, accounting and revenue recognition rules cause unintended revenue deferrals. Try to avoid them by correctly structuring opportunities. When deferrals can’t be avoided, build them into revenue forecasts. Deferrals become a real problem when they come as a surprise after the order has been booked. The most frequent example of an unintended deferral occurs when someone (not necessarily a sales rep) promises a customer a roadmap feature in future product releases in exchange for a signed sales contract today. When that happens, accounting has no choice but to defer revenue until the feature is available – their hands are tied. The best way to avoid this problem is for sales operations and sales enablement to partner in training sales and others to not make these promises. However, there might still be several deferrals from the past. Sales operations needs to lead the effort to investigate if commitments might have been delivered so that revenue can be accelerated and recognized.

- Schedule price increases. There are six inflection points during any sales process: opportunity identification, opportunity qualification, order creation, order delivery, cash collection and customer experience. Compensation that credits best practices dictates sales reps should be paid when sales leaders want them disengaged from the process. For account executives (hunters), the rule is simple: pay them upon order creation (booking) so they can move on to the next deal. The same rule applies for account managers (farmers). Pay them when securing orders for renewals, cross-selling and upselling. Account managers should also confirm that scheduled price increases get booked. It sounds simple, but what if a scheduled price increase is tracked manually? Manual tracking is very common, and it’s an even bigger problem when one company acquires others. Failing to book scheduled price increases is a missed revenue moment. To check that these moments aren’t missed, sales operations must work with finance, legal and order management to verify that price increases occur automatically. Audit existing contracts to ensure expected increases are booked. Regarding renewals, sales operations must confirm the sales force automation platform is configured to create renewal opportunities automatically when new orders are booked. Finally, work with finance and legal to audit existing contacts to ensure scheduled price increases aren’t missed. If they are, book them! It’s found revenue!

- Discount expirations. Introductory pricing is a powerful incentive that drives new business, but sales operations must work with finance to ensure discount expirations are executed. These are like scheduled price increases, so order management teams should ensure they happen automatically. If there’s no process in place, it’s incumbent on sales operations to create one. Also, sales operations must lead efforts to audit existing agreements to ensure these revenue moments are being realized.

- Entitlement reconciliations. Entitlement reconciliations are also like scheduled price increases and discount expirations, but they’re perhaps the most difficult to track automatically. An example of entitlements is dedicated resources assigned to a customer for a specific period, or access to enhanced features and functionality for a defined period. Customers often forget that these specially negotiated entitlements expire. Therefore, it’s account managers’ responsibility to inform them, and ensure arrangements have either ended or that new orders get booked to charge for their extension. One of the worst potential problems of entitlement reconciliation is for sales to learn a customer has been overbilled for entitlements and be forced to reverse recognized revenue. Although sales and sales operations leaders are usually not responsible for billing accuracy and reconciliation, they are responsible for revenue results and forecasting. Ultimately it falls on their shoulders. Make sure someone is auditing contracts and enforcing them, for the good of the company and its customers.

- Customer obligations. Sometimes customers can make commitments in return for special pricing and terms and conditions, such as agreeing to act as a reference in exchange for discounts. Usually the discounts get applied at the time of booking, but frequently no one confirms that the customer delivered on the commitment. In this case, then discounts should be discontinued. These revenue moments should also be automated, but sales operations must confirm compliance. Have account executives keep an eye on these situations.

Many of these revenue moments seem like administrative billing issues. Do we really want account managers chasing down billing issues? If sales operations discovers missed revenue moments, then the answer is initially yes! Have them get involved at least until you get systems and audits in place to recover lost revenue. It can be difficult to identify all these hidden revenue moments, especially in a large company that has acquired many others over time. All the information, terms and conditions, and obligations are hidden in customer contracts, and few account managers have the bandwidth to read every customer agreement. This is where artificial intelligence (AI) is showing some real promise: there are technologies available that use AI to read and analyze contracts on a massive scale and search for these unrealized moments. Finance obviously has a vested interest in exploring these solutions, but sales does as well. It’s additional revenue for the company, and a real productivity boost for account executives that can help them produce more bookings, revenue and value.