The State Of Data Commercialization In China’s Financial Services Industry

The growth of the data economy in China is accelerating. Financial services (FS) firms are actively participating in it, increasingly commercializing their data to create new revenue streams and expand business opportunities. Danny Mu and I have recently published a report, The State Of Data Commercialization In China’s Financial Services Industry, which presents current trends in data commercialization in China’s FS industry, reveals key data commercialization business models and stakeholders, and advises FS firms on how to successfully participate in the data economy.

Forrester defines data commercialization as:

A strategy for taking proprietary data to market by selling it to or sharing it with business partners or customers in the form of raw data, data assets, and data-derived products or services.

Data commercialization in China’s FS industry is accelerating, driven by:

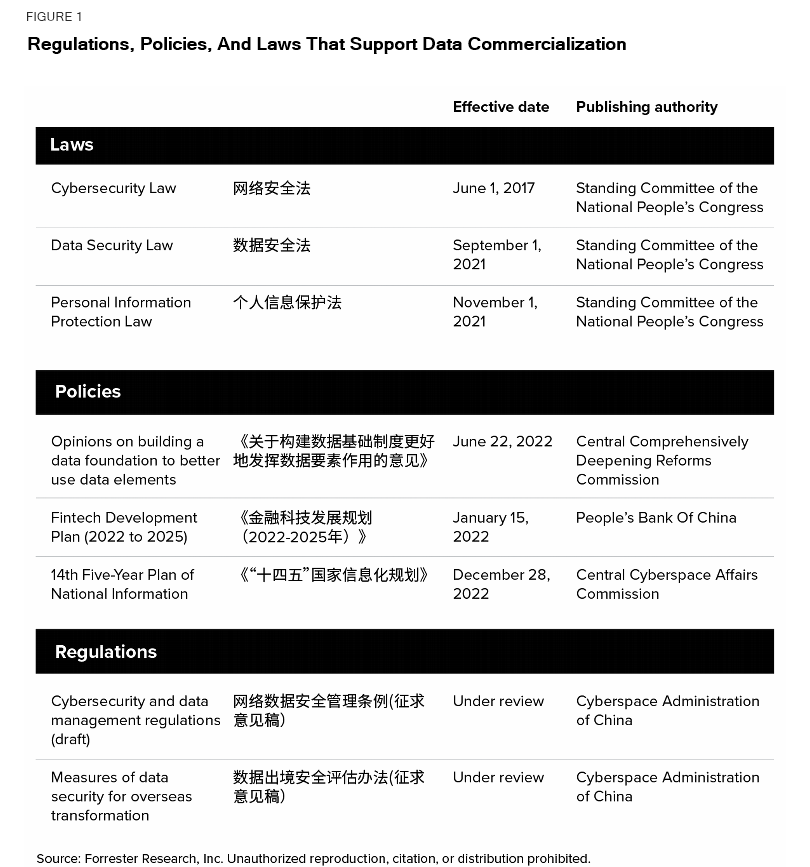

- Policies and laws to support data commercialization. In June 2022, the government approved new policies aimed at building a system to ensure regulated and effective ownership, circulation, trading, and allocation of data. China’s central bank also named “developing a secured and regulated data sharing mechanism and maximizing the value of data elements” as a key goal of its Fintech Development Plan for 2022 to 2025 (see figure).

- The establishment of regulated data exchanges across the country. Local governments in China have established about 80 data exchanges to regulate and secure the trading of data. For example, the Hubei Huazhong Big Data Exchange offers both raw data sets and data services including APIs, data analytics, and data model-building.

- Rapidly emerging technologies to support data commercialization. China’s thriving digital economy has advanced the development of emerging technologies such as big data, AI, privacy-preserving technologies (PPTs), and blockchain. The financial services industry has developed rich deployment capabilities for these technologies, which FS firms use to facilitate data commercialization.

Emerging Technologies Herald A New Phase Of Data Commercialization

The new data commercialization paradigm in China is that the use of data should be controllable and measurable; data should be usable but not directly visible to the customer. To achieve this, Chinese FS firms are aggressively embracing emerging technologies.

- Blockchain technologies protect data property and enable continuous trading. From a technology perspective, data exchanges are piloting blockchain-based mechanisms to record the full lifecycle of data assets from aggregation to storage to computation to trading to destruction. They also leverage smart contracts to support continuous data exchange — data owners can continue to accrue benefits in addition to the ongoing data trading.

- Privacy-preserving technologies empower federated insights. PPTs such as federated learning and multiparty computation can help all parties perform analytics and gain insights without ever exchanging raw data. Other supporting technologies such as differential privacy, data masking, deidentification, and data synthesis can improve regulatory compliance.

- AI and automation technologies enable intelligent data governance. AI and automation are empowering anomaly detection; enhancing data quality; automating compliance processes to increase trust in data assets; automating the process of discovering behavioral data insights; enabling intelligent data classification; and analyzing data links for efficient data management.

To learn more about data commercialization in China’s FS industry, Forrester clients can access the full report or schedule a guidance session or an inquiry.