Usage-Based Insurance Onboarding: It’s All In The Packaging

Alright, I admit it. I'm not necessarily the most loyal insurance customer. I like mixing things up to test out different experiences, which means that if you're my insurance company, I'm going to talk about you in my job…a lot.

Back in 2012 when I was writing the US Secure Auto Insurance Site Rankings report, I changed my car insurance to Progressive (so underwhelmed was I by their predecessor, I can't remember the name of the insurer, just that I got from my agent). And I not only changed to Progressive, I also switched from a traditional auto policy to the company's usage-based insurance coverage, SnapShot.

A few days after signing up, I was surprised to get this box in the mail–note the SnapShot logo on the packaging tape (and trust me that there's a Progressive logo on both ends of the box). Best of all, there was a compelling call to action on the box: "Plug In Today!"

And inside the shipping container? This smaller box, about the size of…the box an engagement ring might come in. Oh my! I felt like I was about to go with Flo on a Thelma and Louise-like adventure, assuming that we'd be safer drivers than they were, at least when the movie ended.

The box itself opened like a flower, and swaddled in a comfy nest of orange tissue paper was the device that I was going to plug into my Mini. And there were even more messages imploring me to "Plug It In" and "The Key To Savings Is In My Hand". In very small print in one of the "petals", there was a message that this was the property of Progressive and that they'd whack me for 50 bucks if I didn't send it back.

The device itself? A masterful execution of Jetson space-age industrial design. Note the Progressive blue winglets on the silvery, rounded sides, ostensibly flying my driving data back to all the Big Data scientists in Mayfield Village. And plugging it in? Meh–not quite so fun for a 56-year old pair of knees that got up close and personal with my stone driveway, and my same-aged neck that had to crane to install it under the steering wheel of my Mini.

Fast forward to 2014. With a four-report series on usage-based insurance and an update of the US Mobile Auto Insurance Benchmark that will include three new auto insurers on the docket for 2014, I returned to my wanton insurance shopping and switching ways. Beguiled by their campaign about quotes in about seven minutes (and actually, it was multiples of that to quote and bind, but more on that in another report) I said good bye to Flo and SnapShot and said Hello There to Esurance and DriveSense.

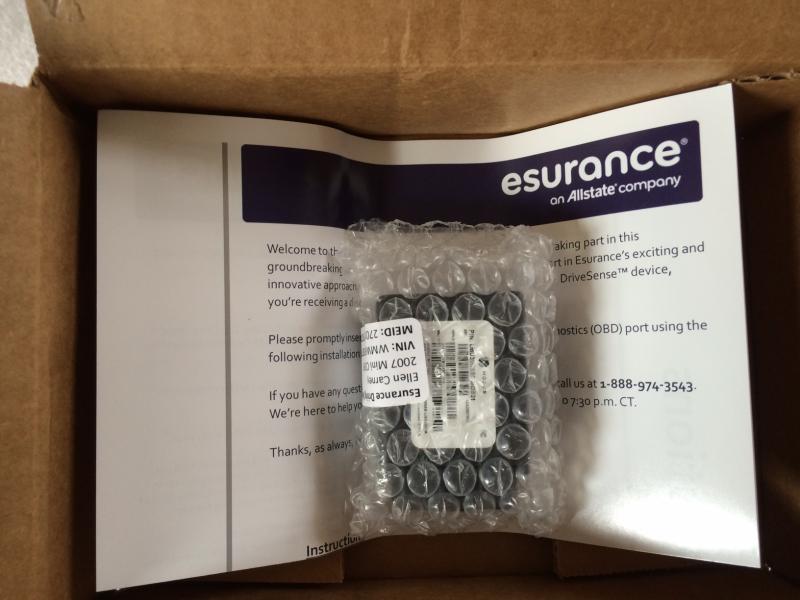

With Esurance's hipster cool marketing (who can forget the Super Bowl non-ad!), I couldn't possibly imagine what the Esurance version of the device delivery (aka "on-boarding) experience would be like. Thirteen days later (Mike, the agent in the South Dakota call center said it would be about 10 days), this is what comes in the mail:

…a plain brown box. Why, I had to put on my old lady glasses to see if it was the carburetor for my tractor or something from the Medical Marijuana Business Daily (which really is for my job and also ships in a plain brown wrapper). I thought "Those saavy Esurance guys–why waste an extra dime on the shipping package? Let's pull out the stops and invest in what's IN the box."

My anticipation only mounting, I cut the packing tape to reveal:

Instead of my jewelry box-like packaging, I got an 8 1/2 x 11 sheet of paper folded in half with a message telling me that "…you're now playing an even larger part in Esurance's exciting and innnovative approach to car insurance." Really???? I never would have used "exciting and innovative", based on the packaging. The call to action was this: "Please promptly insert the device into your car's on-board diagnostics (OBD) port using the following installation instructions." Where was the message about my savings (which Esurance was admittedly about $400 less than I was paying for SnapShot, even after my 30% discount, mostly because my one and only speeding ticket in my life was a non-issue by the time I switched).

And the Esurance device did look like a tractor part–square, flat, and BIG, which doesn't bode well for me, since I regularly dislodged the smaller streamlined SnapShot device getting in and out of my Mini's cramped driver compartment. BIG and more surface area for me to knock doesn't promise me fewer re-installations and re-seatings with the Esurance device, plus it stays in my car all the time, not just the 6 months of SnapShot.

So, what's the takeaway? If you have to send me something in order to become a customer, you might as well be clever. In my case, one did it in an engaging and enjoyable way with a clear call to action. The other? Not at all, leaving me disappointed in how I was on-boarded and skeptical about how they'll engage with me as a customer.

Want to know more about the state and future of usage-based insurance? We have two reports (US and European landscapes) coming out this quarter; a Canadian landscape this summer; and our future of in Q4.