A Conversation With LoopFuse About The Marketing Automation Market

Since publishing the market overview for the lead management automation space, I have been pleasantly surprised by the number of current and emerging vendors who got in touch wanting to talk further, learn more about my research, and (well, frankly) “influence” the analyst. (That’s why I’m here, after all.) Since last fall, I’ve met 7Degrees, Leadforce1, Marketing Advocate, and SalesFUSION and talked more with eTrigue, Loopfuse, Manitcore, and Pardot. A common thread in these discussions is a desire to know more about what I think of this market and where I see it going in 2010.

Loopfuse CEO, Sean Dwyer, cornered me for a long conversation about this market when I was in Atlanta last month. He thought it would be fun to reprise our exchange in a Q&A format which Sean is publishing on the LoopFuse blog. Here is Part I of our conversation with a little commentary and annotation on my part:

Part 1: Defining the Lead Management Automation Market

Q1. The term Marketing Automation is thrown around internally at companies and in the marketing media, how do you define Marketing Automation?

As part of Forrester’s research team that serves the marketing professional, I agree that the term Marketing Automation is bandied about ambiguously. To help marketers use technology to improve marketing effectiveness and efficiency, Forrester talks about the Marketing Technology Backbone. It’s a term we have used since 2004, defined as, “A technology infrastructure that supports an integrated approach to marketing strategy, development, delivery, and measurement across the marketing mix.” This definition helps to keep marketers focused on the entire discipline of marketing and not just on technology for executing tactics and campaigns. It also includes two important words, integrated and measurement, because I see B2B marketers worry too much about running campaigns and not enough time knitting marketing programs together and connecting the dots between marketing activity and bottomline business results.

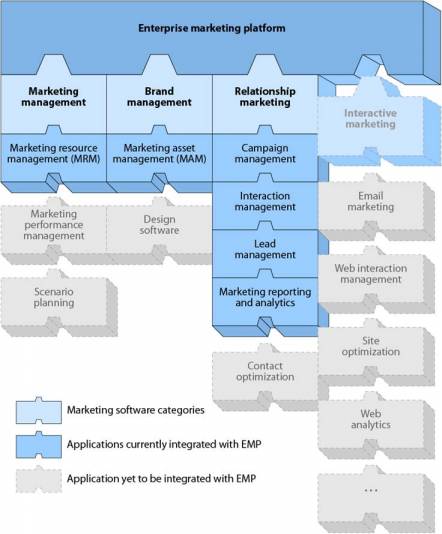

Looking at the marketing technology landscape, Forrester sees marketing automation focus on six core applications: 1) campaign management; 2) customer analytics; 3) interaction management; 4) marketing resource management (MRM); 5) marketing asset management (MAM); and 6) lead management (see figure). Lead management plays a key role in the marketing automation space and in our view of what marketers need to put an effective marketing technology backbone in place.

Q2. From a B2B perspective, when a direct salesforce is involved, what is the difference between Marketing Automation and Lead Management Automation?

In my research, I study and write about lead management automation specifically. My colleague, Suresh Vittal, writes about marketing automation generally. In B2B marketing, where a direct salesforce or channel partners sit in the driver’s seat for winning new deals and retaining existing customers, technology that manages demand is an essential part of the marketing technology backbone. Wikipedia has a solid definition of lead management that I used to develop a working definition in my research. In short, lead management is the tooling and processes that help firms generate new business opportunities, manage volumes of business inquiries, improve potential buyers’ propensity to purchase, and increase alignment between marketing activity and sales results. Increasingly this process is becoming tech-centric, and lead management automation is the technology that helps marketers to manage this process. I would also point out, however, that technology alone is not sufficient and that automating ineffective, immature processes – especially those that lack a tight alignment between marketing and sales measured in the creation of more qualified opportunities and closed sales — will likely cause more problems than it solves.

Q3. Is Lead Management Automation (LMA) a term that is catching on in mainstream business?

I would like to see it catch on more than it has. The 2009 recession, which appears to be experiencing a slow recovery in 2010, forced many firms to concentrate on demand generation as business investment was deferred, delayed, or shrank. The down economy benefited lead management solution providers as marketers invested in LMA technology to get sales pipelines pumping again. Despite this trend, lead management automation is still an emerging industry category. Today, LMA has yet to emerge as a separate, distinct category from Marketing Automation. Based on our estimates, I see market penetration growing from 5% to 10% over the next 18 to 24 months – but there are many marketers out there who have yet to explore the value that lead management automation can bring to their organizations. This can be both a blessing and a burden to firms like Loopfuse who look to grow their share in this emerging space.

Stay tuned for Part II and further editions to this series.