How to Start Your eCommerce Business in China

China has become the leading emerging market for many Western brands and retailers. For many businesses, the growing spending power of high-income consumers and the middle class in China has become a compelling growth engine. For luxury brands, China is already a huge growth market, and many Western companies have had a brand presence in China for many years, albeit often with counterfeit products and even whole counterfeit stores. But as the economy grows in China and consumer thirst for foreign brands increases, companies will be compelled to consider an online direct-to-consumer presence due in-part to the following factors:

- The scope of the Chinese market is immense. Not only is China one of the largest in the world by area, it already had more than 171 cities with more than 1 million inhabitants as of the country’s last census, which has likely increased markedly in the last 10 years. While launching physical stores in core markets such as Beijing, Shanghai, Chengdu, Guangzhou, and Shenzhen may be feasible, reaching even just the top-tier cities is extremely challenging operationally, particularly for a Western brand or retailer. eCommerce presents an important way to reach consumers across the entire country while complementing any decision to invest in core physical retail operations.

- The Chinese consumers’ strong appetite for foreign brands. While status is typically given as the key reason why Chinese consumers prefer foreign brands, the leading reason cited by consumers is actually quality: Fifty-nine percent of online adult consumer electronics buyers, and 34% of online adult apparel buyers state that their preference for foreign brands is driven by superior quality. By contrast, the key reason why a Chinese consumer buys Chinese brands is price. And while Chinese products will likely improve in quality over time, there is a sense that Western brands must have a sense of urgency and move now to win the hearts and minds of Chinese consumers.

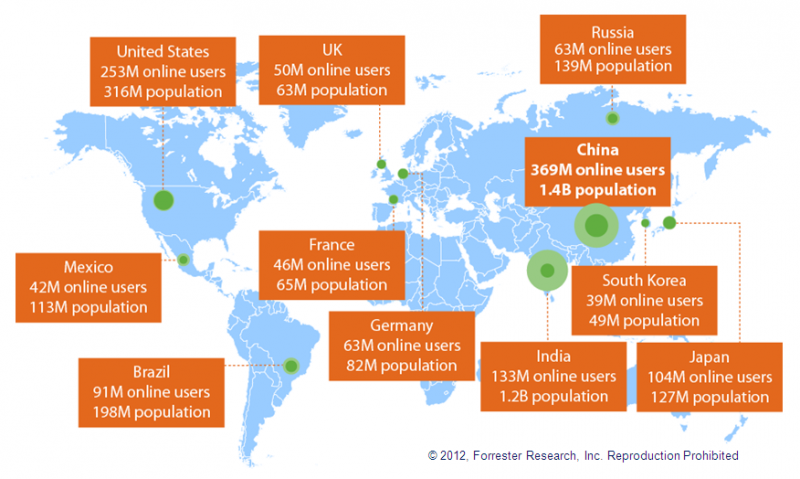

- eCommerce in China is growing very quickly. Online spending in China is poised to more than double over the next four years, growing to more than $356.1 billion by 2016*. Driven by both new consumers online and by increased spending by consumers already online, it is expected government reforms will make it easier for both domestic and foreign companies to sell online and for consumers to transact.

My latest report, with research support from Kelland Willis, explores the options a non-Chinese brand or retailer has in starting an eCommerce business in China. The report explores the unique needs and requirements of doing business in China and the four key options retailers and brands should consider for technology and services solutions when starting their eCommerce business in China.

*Note: Forrester’s 5-year Chinese online retail forecast included in the report.