Royal Bank Of Canada, Citi, & Wells Fargo Top Forrester’s Digital Sales Rankings In 2012

Every year, Forrester employs its Website Benchmark (WSB) methodology to evaluate the effectiveness of North American banks’ digital sales efforts. This year, our evaluation has yielded two reports: 2012 Canadian Bank Digital Sales Rankings and 2012 US Bank Digital Sales Rankings. Here are some of the highlights:

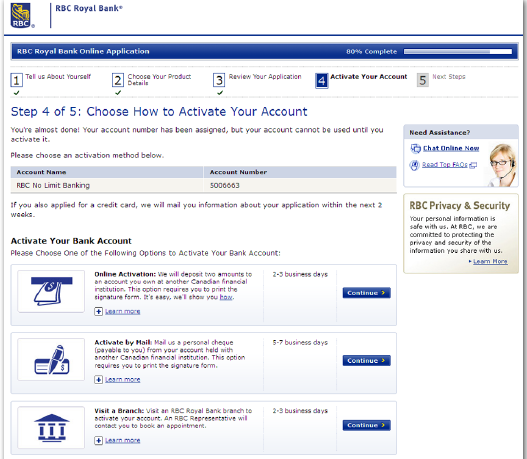

- Royal Bank of Canada (RBC) leads all of North America.RBC again took the top spot in the 2012 Canadian Bank Digital Sales Rankings, scoring 77 out of a possible 100. It continues to tweak and improve an already good design; the bank started a major redesign in 2009. RBC continues to excel in areas big and small: For example, the firm presents fulfillment options in an easy-to-read format (see screenshot below). In 2012, Royal Bank of Canada improved its navigation, content, and online application functionality, and its score for 2012 reflects that improvement.

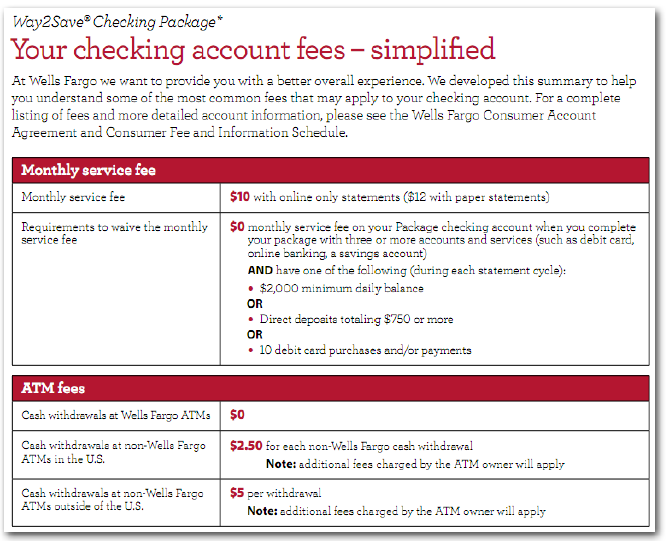

- Citi and Wells Fargo top the US banks.Citi and Wells Fargo topped Forrester’s 2012 US Bank Digital Sales Rankings by delivering on multiple levels. Both banks combine good usability with exceptional account-opening processes. For example, Wells Fargo uses presentation best practices to make its checking account fees clear to customers and prospects (see screenshot below).

- Banks are just starting to think strategically about mobile’s role in sales.Forrester has a separate methodology for and ranking of firms’ mobile banking efforts, but the importance of mobile touchpoints to sales of financial products is just starting to emerge. Now is the time for digital strategists at banks to determine their strategy for this evolving channel — or, at the very least, to start experimenting with and piloting mobile initiatives for marketing and sales. Digital teams must recognize that they may need a different strategy for the phone versus tablets.

- Merchandising and onboarding are the next big hurdles in digital sales.The breakthrough in real-time account opening is a big step forward for digital strategists at banks. To keep moving forward, banks that want to perfect digital sales should turn merchandising into a discipline and take the lead on multi- and cross-channel onboarding. These elements will affect banks’ talent acquisition and training strategies — eBusiness teams will need individuals schooled in the art of merchandising — as well as banks’ broader digital strategy, all the way down to the smallest details — real estate on mobile apps will be needed for contextual sales. Smaller banks are already demonstrating best practices in onboarding: Zions Bank in the US is at the forefront of onboarding, with a strategy that has improved not only customer retention but also the experience of new customers. Forrester has written a case study on Zions’ success here. We believe other banks will soon follow with their own merchandising and onboarding efforts.

Digital sales at banks have come a long way in the past three years, and we’re looking forward to continued improvement and innovation from digital strategists. Let us know what you think.