Forrester’s 2014 Australian Mobile Banking Functionality Benchmark: It’s All Happening Down Under!

As part of this year’s Global Mobile Banking Functionality Benchmark we reviewed the mobile banking apps of the big four in Australia: Australia and New Zealand (ANZ), Commonwealth Bank of Australia, National Australia Bank (NAB) and Westpac. The dedicated Australian report, 2014 Australian Mobile Banking Functionality Benchmark, available here, provides the detail on where these banks do well, where they could improve, and what we think you could learn. We find that leading Australian banks are:

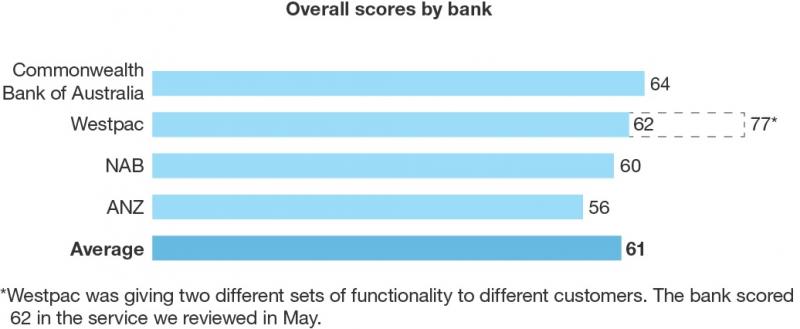

(1) Rapidly improving their mobile services. Yes, this is now true of many banks around the world, but it's especially true in Australia. Following our reviews, CommBank announced updates to its app that would move the bank from 64 out of 100 to 69 out of 100, and up from 10th place globally, based on our reviews of 32 banks across 11 countries, to joint 6th. Westpac has already migrated 1.2 million customers to its new web based platform, which would move the bank from 62 to 77 out of 100, and 2nd place overall in our global reviews, up from 12th. These are dramatic positional swings in a very short period of time.

(2) Combining the best of mobile web and mobile app. Part of the reason Westpac improved so quickly is because it’s taken a hybrid approach. Not because it can’t be bothered to build a native app, but because of the speed at which customers’ expectations are increasing. The bank is carefully combining the power of native interface rendering where it matters – for its branch locator, for example – with the maintenance ease of web-based elements where it doesn't. NAB is taking a similar approach. This goes against the grain globally, where most banks are either native, or aspiring to be native.

(3) Pioneering valuable self service features for fraud. Few banks worldwide offer basic self-service features, despite it being a clear win-win: the customer gets rapid issue resolution; the bank gets reduced servicing costs. Westpac now lets customers report a card lost or stolen entirely in-app, and notify the bank if they’re going abroad. CommBank’s new app lets customers instantly lock a credit card from overseas payments, block ATM cash advances and set transaction limits, all entirely in-app. Other banks should follow suit.

Forrester clients can view our full analysis here and see exactly how we arrive at each bank's overall score (shown below). Feel free to let us know what you think in the comments section. (Note: reviews for this report were conducted between May 5th and May 19th 2014).