Evaluating Cisco’s Collaboration Strategy

Through a combination of analyst briefings and customer events, Cisco has ramped up outbound communication and marketing of its collaboration strategy in Asia Pacific over the past several months. The foundation remains video (TelePresence), webconferencing (WebEx), and IP telephony, areas where Cisco is a leader. But Cisco understands that to drive growth and expand its customer footprint within enterprise accounts, it must move further up the stack and increasingly compete with both traditional collaboration vendors like Microsoft and IBM and cloud-based alternatives like Google and salesforce.com.

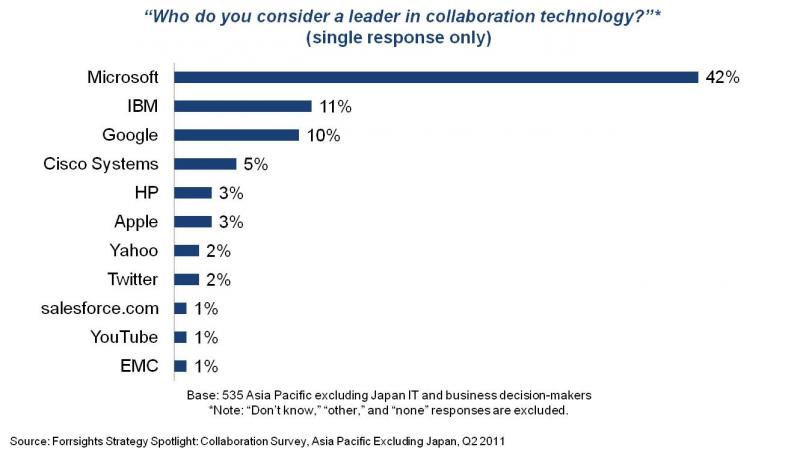

While the strategy still plays to the company’s core networking strength, I question whether Cisco can position itself as a “go-to” vendor in the traditional collaboration space. As our research shows, senior IT and business decision-makers in Asia Pacific don’t currently equate Cisco with collaboration.

To address this challenge, Cisco is pursuing multiple initiatives/approaches:

- Leveraging its core strengths. Cisco is focused on expanding from existing unified communications (UC) initiatives within customer accounts by leveraging the combination of networking and video to drive value. Cisco is pushing “control” via intelligent networking capabilities (e.g., security, identity management, authentication, access), all delivered through Cisco networking hardware. Simultaneously, Cisco is pushing “flexibility” via device- and platform-independent collaboration capabilities like content, video, instant messaging, and social computing.

- Redefining collaboration for enterprise customers. In contrast to traditional document-centric models to collaboration where file location is primary, Cisco is pushing a “people-centric” approach where network-centric user experience is the primary design point. In practice, this means helping organizations exploit the transition to the post-PC era as an opportunity to deliver better communication/collaboration capabilities for improved productivity.

- Driving widespread adoption of Jabber. Directly competing with Microsoft’s Lync, Cisco’s approach is to combine presence and video with Jabber’s instant messaging capabilities that cut across the entire portfolio, making Jabber the primary user interface for all Cisco UC capabilities. Additionally, Cisco released a Jabber SDK to enable integration with third-party applications like email and ERP. As the unifying layer for content sharing across the portfolio, Jabber uptake is fundamental to Cisco’s broader collaboration strategy, so it will bear very close scrutiny over the next six to 12 months.

- Enabling social computing within the enterprise. Cisco has positioned Quad as the foundation for integrating customers’ collaborative applications – essentially “Facebook for the enterprise.” Being furthest removed from Cisco’s traditional strengths, establishing a leadership position in this space will be a major challenge. Unlike Salesforce’s Chatter or IBM’s Connections (to cite two examples), I believe that Cisco will struggle to articulate a clear value proposition for Quad within its existing customer base — or to convince them that Cisco is the logical provider of an enterprise social platform.

Cisco has significantly improved its collaboration-related messaging and marketing over the last 12 months. The strategy is sound and the technology portfolio is extensive. However, despite clear benefits for driving richer communication, video is still not perceived as the primary collaboration interface for most organizations. Cisco’s primary challenge over the next 12 months is to change this perception and drive demand for a video-centric approach to collaboration via scenarios, use cases, and — most importantly — customer references.