Navigating The Economic Headwinds Of 2023

It seems that every other news headline is warning us of impending economic doom in 2023. The peculiar thing about sales is that there really are no acceptable excuses for nonperformance. I knew of sales leaders who were put on performance improvement plans during the pandemic. If a worldwide shutdown isn’t an acceptable excuse for nonperformance, I’m not sure what is. So as we look forward to 2023, and try to understand the landscape and how to navigate it, it’s instructive to look back at what we have learned over the past four years.

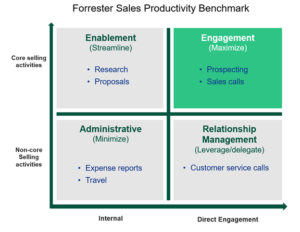

The sales research service at Forrester conducts sales activity studies annually for our clients. The purpose of these studies is to understand how B2B sales reps and their managers are spending their time. The study organizes those activities into four category quadrants (see below). We gather the data (as well as verbatim explanations from reps) and benchmark how time is spent versus a peer set. To date, we’ve surveyed more than 25,000 sales reps and managers.

Noteworthy findings from the sales activity studies to date are as follows:

- Sales productivity is down, and face-to-face interactions are up.

-

-

- Sales reps only spent 22.8% of their time on direct selling activities in 2022, compared to 25.1% pre-COVID.

- Post-COVID, face-to-face engagement continues to rise year over year.

-

-

- Time spent on internal selling activities can continue to be optimized.

-

-

- Lead identification and qualification peaked in 2021 and was cited in that year as the number two area to save time.

- Finding content or information was cited as the number two area for saving time in 2022.

- Time spent onboarding peaked in 2020, then lowered to half those levels in 2022.

-

-

- There are areas of opportunity to streamline activities.

-

-

- Internal communications and emails continue to take selling time away from reps. Pre-COVID, reps spent an average of 2.5 hours on emails/comms; this was cited as the number one time-saving area. In 2022, while the amount of time spent is the same, it dropped to the fourth position for time savings.

- Delivery management issues have continued to be a source of frustration for reps, as supply chain issues have continued to linger from the pandemic. Customer service issues peaked in 2021 and were cited as the number one area for saving time.

- The configuration and quote process was cited as the number one area to save time in 2022.

-

-

What’s Next In 2023?

- Automation is a continued focus. Sales organizations will continue to focus on understanding how buyers want to buy and create processes that mirror the buyer journey. Friction points within the sales process will continue to be resolved with technology-driven insights and automation. Sales organizations will continue to optimize the efficiencies gained over the past three years to increase direct selling time.

- Relationships still rule. While face-to-face selling is not yet back to pre-COVID levels, it is steadily increasing. As economic uncertainty continues to loom, a renewed focus on expansion, cross-sell, and upsell opportunities will create demand for deep relationship building through a customer-obsessed lens. Technology will provide data and insights that capture a more complete picture of overall lifetime value of an account, but selling is still a relationship business.

Almost a quarter into 2023, what trends are you seeing? Is your organization able to realize pandemic-focused efficiencies to facilitate more direct-selling activities? Connect with me, or let me know in the comments.