The Future Of Health Insurance: Reinvention Is Mission-Critical

The US health insurance model is broken. The US spends more than any peer nation on healthcare. Yet Americans have shorter lives, uneven access to care, and a system most find confusing and unaffordable. Employer-sponsored family premiums jumped 6% in 2025 to $27,000, with workers contributing $6,850 on average — marking three years of increases. And that’s just for the privilege of having insurance. Nearly half of Americans are in high-deductible plans and pay thousands more for the healthcare services they do receive. These high costs create barriers to care, surprise bills, and unwelcome trade-offs in household budgets.

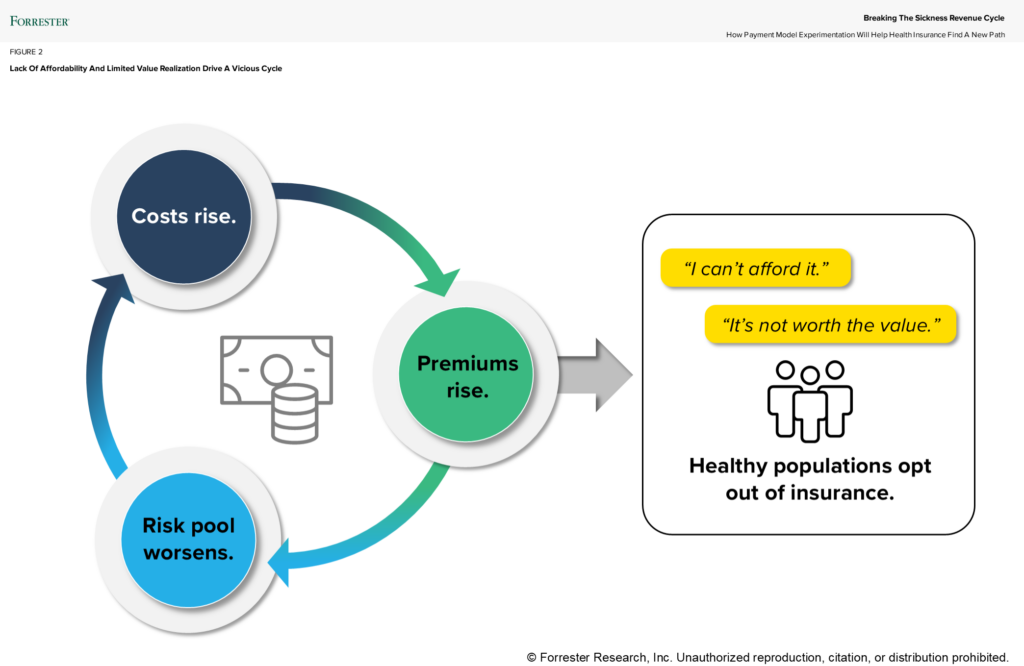

Many employers are changing benefits as policymakers debate the virtues of tax subsidies, leaving US households to navigate a maze that threatens both their health and finances. Affordability has become a core issue in healthcare, fraying even further trust in the system. Health insurers sticking with the status quo isn’t just risky; it’s untenable. As younger, healthier Americans opt not to pay for insurance, the risk pools will get riskier, and costs will rise for everyone. Provider organizations will struggle to bring people in for care, and financial strain will trigger more consolidation — further raising healthcare costs. As a result, the sickness cycle accelerates.

How do we fix it?

Failing to act will lead to catastrophe — for insurers, employers, consumers, and providers. A single solution won’t fill the hole we’ve dug. Instead, a dynamic mix of strategies and offerings can bridge gaps left by poor experiences and rising expectations. Over time, the most effective models give insurers a clear path to evolve by:

- Empowering consumers with more choice and transparency. Make coverage easier to understand. Provide consumers with tools to estimate costs and make informed decisions. This will reduce unnecessary care and prevent costly, avoidable treatments. Better-informed consumers ask fewer questions, reducing inbound calls and cutting operational costs.

- Expanding risk-sharing in specialty care. Specialists are currently 50% less likely to participate than primary-care physicians. Payers and providers can adopt value-based care arrangements in specialty-led services. These models could unlock up to $100 billion in annual savings from specialty spend, benefiting multiple stakeholders in the system.

- Breaking down barriers to routine care with virtual and AI-enabled models. Virtual care now delivers outcomes on par with in-person visits for conditions such as hypertension, diabetes, and behavioral health. It also reduces hospitalizations and readmissions. Gen Zers and Millennials are increasingly comfortable with using generative AI tools to assess their symptoms: Interest grew from 26% in 2024 to 39% in 2025. Offer trustworthy, convenient resources that empower pathways to lower-cost care and improve utilization for preventive and routine care.

Don’t walk — run.

It’s already broken, so now is the time to move fast. Health insurers must act to stay competitive and innovative. Read our new report, Breaking The Sickness Revenue Cycle, to learn how stakeholders are adopting new models to change the industry. Forrester clients can schedule a guidance session to discuss what the research means for their business and customers.

Clients can also join us for our 2026 Predictions healthcare webinar in January and another deep dive on the future of health insurance in February. Stay tuned for new research on digital experience optimization for health insurers, what consumers want to customize with their health insurer, and how health insurers can make trust a core brand principle.