The ROI Of Finance Automation, Quantified

Finance and accounting teams are already cashing in on automation — with faster closes, fewer errors, and more time for analysis.

Our new reports, The ROI Of Finance Automation and Total Economic Impact™ (TEI) Model For Finance Automation , kick off Forrester’s finance and accounting automation research series. It’s your blueprint for turning automation from a buzzword into a boardroom win. These two reports show you how to build a business case that gets funded fast.

Why Does This Matter?

Finance automation isn’t just about productivity improvements. It’s about:

- Freeing up finance talent for strategic work instead of invoice firefighting.

- Cutting costs by retiring outdated, high total-cost-of-ownership systems.

- Unlocking working capital through early payment discounts.

- Staying compliant across multiple countries around the world without breaking a sweat.

Why Now?

Advanced AI — including agentic AI and generative AI — is the game-changer. These technologies are powering next-gen automation capabilities such as intelligent invoice matching, predictive cash flow, and autonomous exception handling. The result? Faster ROI, smarter decisions, and a finance function that drives growth instead of just closing the books.

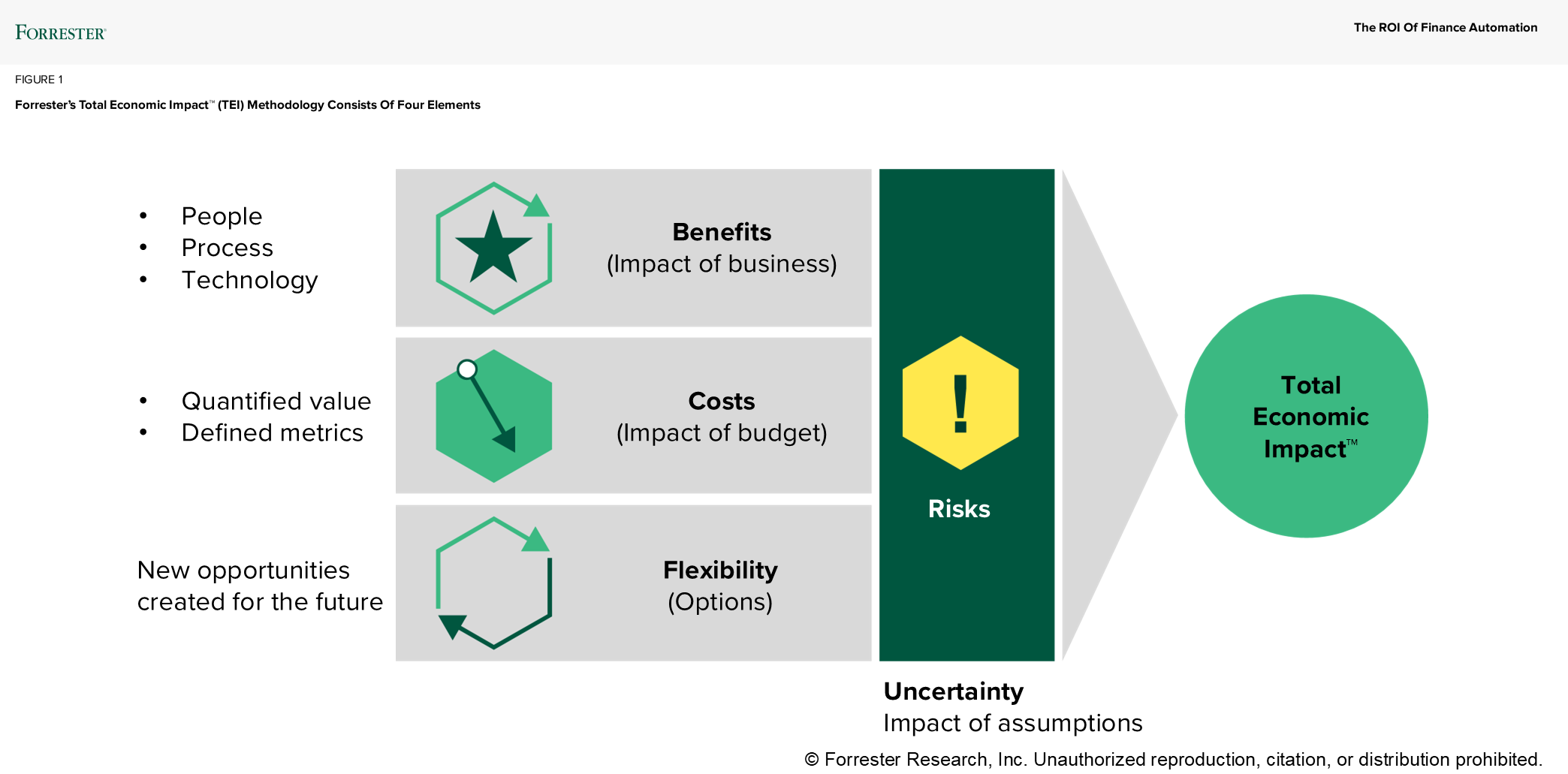

Use Our Total Economic Impact Framework To Calculate ROI

To make it real, we modeled a fictional global enterprise using Forrester’s Total Economic Impact™ (TEI) framework: After implementing modern accounts payable automation, the “company” achieved an ROI of 111% with payback in under 6 months. Forrester clients can use our TEI framework to calculate their own finance automation ROI.

What’s Next

This report is just the start. Coming soon, we will publish a series of finance automation reports covering the following:

- Gauging your finance automation program maturity

- Top agentic AI use cases for accounts payable automation

- Top agentic AI use cases for accounts receivable automation

- The state of e-invoicing and tax compliance

Forrester clients can read the full report and request a guidance session or inquiry with us.